Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Making sense of the latest market movements

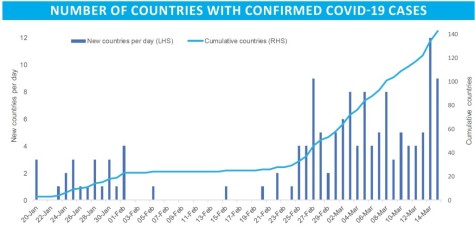

There is a scramble to work out the extent of the coronavirus impact and how much of it has been priced in by markets as investors react to a rapidly increasing number of global infections.

The US market really fell over on 16 March, giving back all of the gains from a big rally on 13 March and then some as it posted its biggest fall since 1987.

This rout reflects the escalating coronavirus crisis and the measures being taken across the world to combat it. There is growing uncertainty over how long the world will be dealing with the crisis and how long the curbs on everyday life taken to contain it will persist.

QUANTIFYING THE HIT

Recent economic figures from China offered some insight into the scale of the hit to an economy in lockdown mode.

Consensus forecasts were for a 3% fall in industrial production, a 2% drop in fixed asset investment and a 4% contraction in retail sales. The actual readings were several magnitudes worse than that, at -13.5%, -24.5% and -20.5% respectively.

Equities have continued to fall in value despite the US Federal Reserve cutting rates to near zero and pumping trillions of dollars of liquidity into the financial system, other central banks in the world also taking action, and governments stepping in with fiscal measures.

Kerstin Braun, president of Stenn Group, an international provider of trade finance, thinks the Fed may have acted too hastily. She said: ‘The US Federal Reserve’s decision to cut interest rates to 0% is premature and makes almost zero sense. We are currently in the midst of the peak of coronavirus panic, so this move only serves to further undermine investor confidence.’

WHICH SECTORS AND COMPANIES HAVE BEEN MOST AFFECTED?

The airlines continue to suffer as we discuss in a separate article. The following table shows the best and worst performing sectors since selling began in earnest on 20 February. We also look at some of the areas which might be better positioned in the current environment in this article.

An update from catering giant Compass (CPG) provided an insight into the impact of coronavirus. It is expects half-year operating profit to be up to £225m lower than expected due to containment measures, and these only began to have an impact from the end of February onwards as major events were cancelled and schools began to be shut down.

Some companies are responding to current events by suspending dividend payments. The bookmakers are being hit by lack of almost any sporting events for punters to bet on, so William Hill (WMH) has put its payout on hold. In the retail sector Shoe Zone (SHOE:AIM) has also deferred its dividend.

WHAT WILL HAPPEN NEXT?

Investors will be looking for signs that actions taken on social distancing are proving effective, and they may be hoping that the summer months will provide some relief.

Morgan Stanley strategist Andrew Sheets believes it is worth watching market volatility closely as in previous sell-offs over the last decade the market bottomed a little while after expected volatility came down.

He says: ‘The first thing markets need is to become comfortable with the level of uncertainty (volatility), and only then can they become comfortable with the level of prices. Keep an eye on volatility – it may need to peak first.’

The VIX index continues to spiral for now, hitting 83.56 on 16 March, not far short of its intra-day high of 89.53 reached on 24 October 2008 at the height of the financial crisis.

SIGNS OF HOPE FROM CHINA?

An interesting feature of the latest trading update from Primark owner Associated British Foods (ABF) was that the Chinese supply chain issues which had dominated a 24 February announcement had flipped.

Supply shortages are now expected to be minimal as most of its factory suppliers reopen. The problem now is in Europe where stores are being shuttered.

Likewise consumer electronics firm Apple, which is closing all its shops outside China, is reopening those it has inside the country.

That is because Chinese authorities appear to have put a lid on the coronavirus outbreak for now. On 16 March the country reported just one new domestic case (although it is seeing an increasing number of cases imported from abroad).

The gradual resumption of operations in China could help ease supply chain issues for businesses which source goods from the country but also as a sign of what might be possible once the outbreak is under control in Europe and the US.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine