Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Has diversification saved your portfolio?

Asset diversification should have been one of the few saving graces for investors in recent weeks, potentially reducing the losses.

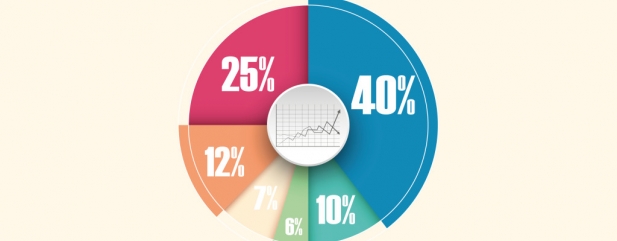

Having a mixture of stocks, bonds and property means you spread your risks across different assets – each of which behave somewhat differently in terms of market dynamics and price trends.

Anyone fully invested in equities – another term for stocks and shares – at present will rue the day they didn’t bother to create a well-diversified portfolio. Equities have plummeted in value this year including an approximate 18% decline in UK stocks, as measured by the FTSE 100 index.

In comparison if you’d had a good proportion of assets in bonds, your performance may well have been much better on a relative basis. For example, Vanguard LifeStrategy 60% Equity (B3TYHH9) is split 60% in stocks and 40% in bonds – so far this year it has delivered a 7% negative return, so significantly outperforming the FTSE 100.

Having such a high weighting to bonds may not suit someone seeking large capital gains as equities have delivered significantly better growth over the long term. It is also important to stress that bond prices can fall when interest rates go up, so if you sell a bond before maturity in that environment, you may end up doing so at a loss.

Yet in volatile market conditions such as now, diversification is the ticket to a better night’s sleep.

SPREADING THE RISKS

Even though equities have been badly hit this year, diversification can still help even in an equities-only portfolio as there is a lot to be gained from spreading risks around different industries and geographies.

Investment trust Alliance Trust (ATST) only invests in equities and last week said it had achieved 23.1% net asset value total return versus 21.7% for its benchmark, the MSCI All Country World index, over its past financial year.

While that period doesn’t include the current global markets sell-off, diversification is certainly a key reason why some of its mistakes haven’t hurt badly.

Its stake in TV-based shopping specialist Qurate Retail delivered a 58% negative total return. It also suffered double-digital losses on stocks such as nutrition group Glanbia (GLB) and tech firm Baidu.

Fortunately these losing trades only had a small impact on its portfolio as they were just a handful of stocks among a broad portfolio of approximately 160 names. In contrast, a portfolio with only a small number of holdings, such as 10 or 20, would have really felt the pain if two or three of its stocks did very badly.

WHAT TO DO NOW

Anyone now seeking to restructure their portfolio to be more diversified must consider that selling any equities now in favour of buying bonds could mean crystallising losses just at the wrong time.

We aren’t trying to call the bottom of the market sell-off, yet it does feel as if so much pain has been inflicted that some sort of market recovery could happen fairly rapidly.

We suggest sitting tight and thinking about diversification once markets have stabilised as history suggests corrections will happen time and time again in the future. Rejigging your portfolio would make you better positioned next time we have a difficult patch for investments.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine