Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

What to buy and sell if inflation keeps rising

Economists and the Bank of England received a rude reminder last week that inflation has a nasty habit of confounding expectations.

According to the Office for National Statistics, consumer prices rose at an unexpectedly high 1.8% in January, compared with just a 1.3% increase in December and forecasts of a 1.6% increase.

The difference of 0.2% between consensus estimates and the actual inflation rate may not sound much, but the Bank of England’s target

rate is 2% which is only another 0.2% above the January figure.

WHAT’S BEHIND THE RISE?

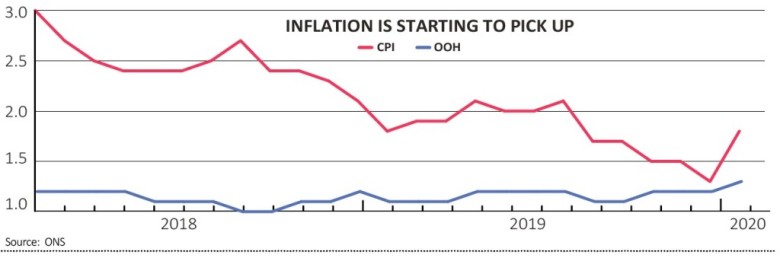

The Government’s official measure of inflation is the consumer price index (CPI), which it uses to target inflation in the 2% range.

However the most comprehensive measure of inflation is the CPIH. This includes a measure of the costs associated with owning, maintaining and living in your own home, known as owner occupier’s housing costs (OOH), as well as council tax.

Despite the fact that these are significant expenses for many of us, they aren’t included in the official CPI calculation but the OOH has been rising recently and has actually been one of the main drivers of underlying inflation.

As well as rising home ownership costs, gas and electricity prices contributed to the January inflation spike. In the same month a year earlier energy prices fell versus the previous month, thanks to the introduction of price caps. This January prices were flat on the previous month.

In January 2020 the price of petrol increased by 1.8% versus the previous month; a year earlier they declined by 1.7%. The price of women’s clothing increased and air fares fell by less than they did a year ago.

OTHER FACTORS TO CONSIDER

There are also a couple of longer-term factors which have been driving prices up over time, as we flagged in December.

Record low levels of unemployment and the introduction of the National Living Wage have increased labour costs for companies, which have been slowly raising the price of the goods they sell to protect their profits.

A second factor driving up prices has been the weakness of the pound against the dollar and the euro. The fall in the value of the currency since the referendum vote in 2016 has had the effect of making imported goods more expensive.

Crucially, this increase in prices isn’t just a UK phenomenon. US consumer prices rose 2.5% last month on an annual basis, up from 2.3% in December. Industrial prices jumped 2.1% in January against forecasts of a 1.6% increase and also in the context of a mere 1.3% advance in December.

COULD INTEREST RATES RISE INSTEAD OF FALL?

With the headline rate of inflation as measured by the CPI having fallen steadily since mid-2019, the Bank of England was under pressure to cut interest rates at its December meeting but wisely, as it turns out, it chose to hold fire.

Now, with inflation resurgent and everything from industrial confidence surveys to house prices pointing to a re-acceleration in the UK economy after several years of stagnation, the question is whether or not the increase is temporary and whether the central bank may eventually have to raise rates at some point.

Given the tightness of the labour market, the Government’s new work visa system due to come into effect next January is likely to force firms to increase pay levels if they want to keep their existing staff, let alone attract new talent.

Pressure on the Bank of England could also come from savers, many of whom are already struggling to earn enough of a return on their cash to maintain their standard of living.

WHAT DOES IT MEAN FOR STOCKS AND BONDS?

Rising inflation is every bond investor’s worst nightmare as inflation eats away at the yield on bonds. With a huge volume of fixed-income instruments trading on negative yields the potential for an unruly sell-off rises along with the CPI.

For equity investors rising inflation is good for firms with ‘pricing power’, i.e. those that can push through rising costs. Food producers, cigarette manufacturers and any firm which offers a subscription service should be able to increase prices to their customers.

UK supermarkets will also welcome higher inflation although constant pressure from the German discounters Aldi and Lidl to remain competitive on price will probably ‘keep them honest’ at least to begin with.

Value stocks are also likely to shine. When growth and inflation is scarce, investors typically pay up for growth stocks, and due to the weakness of the recovery from the financial crisis they have been paying an ever-increasing premium for ‘quality growth’.

Finally, rising inflation could spur further gains in gold, which is a traditional hedge against rising consumer prices. However before getting carried away, investors need to consider that the UK may be an outlier in terms of price trends and gold is a global commodity so gains may depend more on events beyond these shores than within them.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine