Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The stocks and indices which matter when investing in Europe

This is the third of a multi part series. Part one covered the FTSE 100 and FTSE 250. Part two covered the S&P 500 and Nasdaq Composite indices.

For investors looking to invest directly in European markets, the Euro Stoxx 50 is the leading index of blue-chip stocks from across the Eurozone, used by financial institutions both as a benchmark and as the underlying index for exchange-traded funds (ETFs) and hedging tools such as futures and options.

Over the last year the index has gained a respectable 21% compared with a gain of just over 5% for the FTSE 100 and a 23% rise in the S&P 500 in the US.

WHAT’S IN THE INDEX?

As its name suggests the index comprises 50 of the largest stocks from across the euro currency area, weighted by market capitalisation, and excludes stocks listed in the UK, Scandinavia and Switzerland.

The index is dominated by French and German companies, which make up over two thirds of the constituents by number, with smaller representations from Spain, Italy and the Netherlands. Belgium, Finland and Ireland are each represented by a single stock.

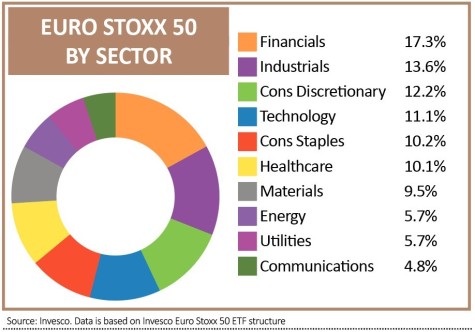

Unlike the FTSE, the Euro Stoxx 50 contains no mining or tobacco companies. The two sectors with the biggest number of stocks are consumer discretionary – personal goods, media, retail and automobiles – and financials, followed by healthcare and industrial goods and services. The sectors with the smallest number of stocks are chemicals, oil and gas, telecoms and utilities.

The biggest constituent of the Euro Stoxx 50 index is SAP at 5%. This is a European software business founded in 1972 in Germany and now with offices around the world. SAP stands for ‘systems, applications and products in data processing’.

One way of getting exposure to the index is via exchange-traded fund Invesco Euro Stoxx 50 ETF (SX5S).

WHY THE DAX INDEX IS IMPORTANT

For investors specifically interested in the shares of German companies, the benchmark index is the DAX 30 which tracks the 30 largest companies traded on the Frankfurt Stock Exchange.

While the DAX is a capitalisation-weighted index like the FTSE and the S&P 500, unusually it is a ‘total return’ index which means that returns include reinvested dividends.

Over the past year the index has gone up 23.9%, including dividends, and unlike the FTSE it contains no mining, oil, gas or tobacco stocks as there are no large German companies which qualify for inclusion.

By number of stocks the DAX is heavily skewed towards consumer companies, such as Adidas, BMW, Daimler, Lufthansa and Volkswagen. Financial stocks used to be a big part of the index and they now have a much smaller weighting than in the past, which is a similar story to the FTSE.

Other sectors with notable weightings are chemicals, thanks to BASF and Linde; healthcare, which is predominantly represented by Bayer and Merck; and technology, where SAP is joined by chipmaker Infineon and payments firm Wirecard.

There are various tracker funds providing exposure to the DAX 30 index including exchange-traded fund iShares Core DAX ETF (0MLH).

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine