magazine 7 Nov 2019

Download PDF Page flip version

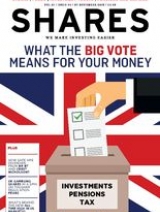

Shares looks at what could happen to your money depending on different outcomes from December’s general election. The team debate potential changes to certain share prices, markets, the pound, tax and pensions.

Also this week: why gambling stocks have been sold off, what’s leading the US market to record highs, and why investors are starting to worry about dividends at BP, BT and Crest Nicholson.

Learn more about consensus earnings forecasts and where to find them. Discover the long-term laggards in the investment trust space.

Read about McDonald’s investment case and find out which stock is up by more than 50% since Shares highlighted its attractions in February.

We examine what could happen to investments, the pound, taxes and pensions

It is not enough just to look at the best performers, it’s the largest stocks which make the difference

We explain the growing concerns over cash payouts from three FTSE 100 companies

The company’s UK demise is further sad news for the struggling retail sector

Gambling is set to become a key battleground in the general election

Directors investing their own money aligns their interests with shareholders but it doesn’t guarantee a profit

Doyen of high street quick eats, this is a powerful growth and income story

We reveals the laggards over the past one, three and five years

We explain where to find them and their pros and cons

We explain the rules, why they might change and look at the cost of some unusual tax breaks

The Government wants to improve the way pension information is sent to the public

Why central bank policies are hurting the sector

The FTSE 250 firm is getting its act together which could help to drive earnings and the share price

Ambitious expansion plans should result in healthy returns for investors

Digital disruption trends are accelerating and plays right into the FTSE 250 member’s hands

Trading update provides latest catalyst for a star performer

Strategic review could lead to the sale of its asset management business

We remain optimistic about the company's prospects despite short-term blip

Pensions expert Tom Selby explains the tax rules when you take money out of your retirement pot