Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

TI Fluid Systems has the qualities to bounce back

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

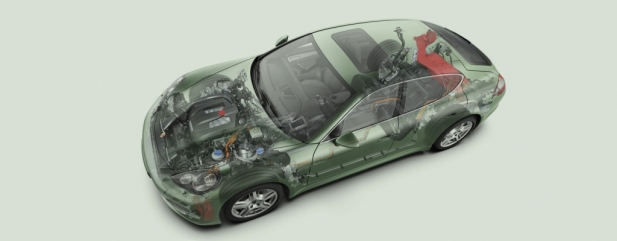

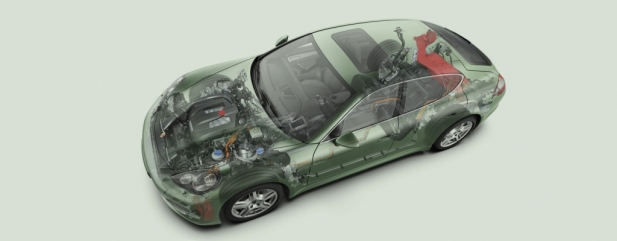

The long-term drivers of increasing globalisation, tighter regulations and electrification remain in place for TI Fluid Systems (TIFS).

Against that positive backdrop, slowing growth exhibited by China and fears of a global slowdown has weighed on the shares. Analysts have recently downgraded their revenue and profit projections by around 5% to 7%.

TI Fluid Systems is able to mitigate softer markets due to its flexible cost base, where fixed costs only representing 15% of revenue.

The company’s leading market positions in performance and safety critical products mean that it can grow faster than the underlying market and achieve higher operating margins and substantial free cash flow.

The total addressable market will rise from €1.3bn in 2018 to between €13.6bn to €19.5bn in 2026 according to IHS Markit and the company’s estimates.

Although this sounds dramatic, it will only take the market share of hybrid to 38% and electric to 11% of the total market.

SHARES SAYS: The company’s global footprint, with leading market positions, puts it on the front of the grid in the race to deliver a greener future. The shares remain too cheap and don’t reflect the quality of the business. According to broker Peel Hunt the shares offer a free cash flow yield of 11.1%. Keep buying.

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine