Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

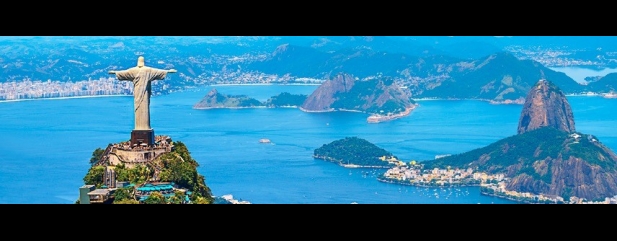

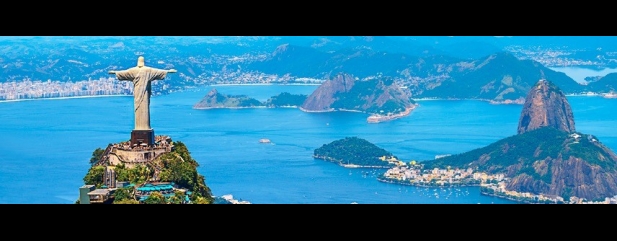

Why Brazil’s Bovespa index is buoyant

AJ Bell is an easy to use, award-winning platform Open an account

We've accounts to suit every investing need, and free guides and special offers to help you get the most from them.

You can get a few handy suggestions, or even get our experts to do the hard work for you – by picking one of our simple investment ideas.

All the resources you need to choose your shares, from market data to the latest investment news and analysis.

Funds offer an easier way to build your portfolio – we’ve got everything you need to choose the right one.

Starting to save for a pension, approaching retirement, or after an explainer on pension jargon? We can help.

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The election of the perceived market-friendly Jair Bolsonaro as president in October 2018 has proved a strong catalyst for Brazilian equities in 2019.

The flagship Bovespa index is up a healthy 13.2% so far this year, compared with an 11.1% advance for the FTSE All-World, according to data from SharePad.

The Bolsonaro administration, which has attracted criticism for authoritarian tendencies and socially conservative policies, has nonetheless pleased foreign investors by announcing pension reforms and is beginning to look at the tax system.

It has not all been smooth sailing though with the government slashing its own GDP growth forecast for the year in half to 0.8% in July and unemployment still at elevated levels. In response finance minister Paolo Guedes announced plans to inject $11.2bn worth of stimulus to get the economy moving.

The MSCI Brazil index is designed to measure the performance of the large and mid-cap segments of the Brazilian market. With 55 constituents, the index covers about 85% of the Brazilian equity universe and therefore offers a good overview of the Brazilian stock market.

Although the country is rich in natural resources, financials is the sector with the heaviest weighting on the index and accounts for six out of the 10 largest constituents.

Brazilian banks have historically benefited from the dominant position of just a few operators, strong interest rates and the growth potential from operating in an inherently less mature market.

It is not unusual for banks in Brazil to deliver returns on equity upwards of 20%. At best UK banks operate at around half that level.

This outlook is part of a series being sponsored by Templeton Emerging Markets Investment Trust. For more information on the trust, visit here

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

The value of your investments can go down as well as up and you may get back less than you originally invested. We don't offer advice, so it's important you understand the risks, if you're unsure please consult a suitably qualified financial adviser. Tax treatment depends on your individual circumstances and rules may change. Past performance is not a guide to future performance and some investments need to be held for the long term.

magazine

magazine