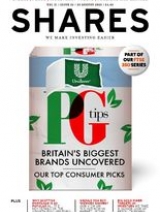

magazine 22 Aug 2019

Download PDF Page flip version

In the second part of its multi-part series on the FTSE 350, Shares looks at Britain’s favourite brands and identifies its top consumer picks.

Find out about why a newly listed gold miner is shining, discover why the bid for pubs group Greene King might be too low, and learn why there is scepticism ahead of the IPO of office provider WeWork.

Also in this week’s issue: a discussion of top growth fund Scottish Mortgage, high yield bond ETFs, what an inverted yield curve means for investors and what might make markets more cheerful.

Elsewhere, the digital magazine looks at an investment trust on a quest for growth and value.

Defence technology firm’s deal will see it supply US military with life-saving protection kit

And why investors have been hit hard by Argentina, including one who lost $1.8bn in a single day

Investors should sit tight and see if a better offer comes along

Leaked government paper on no deal Brexit and retail pressure add to woes for the sector

Despite the appealing narrative, the risks are too many and too great

Led by a former rugby international, shares in Resolute Mining have jumped by a third since it listed in June

Baillie Gifford-run investment trust has a brilliant record for low-cost, long-run returns

Strategy is paying dividends for this trust’s long-term shareholders

We look at the steps which could put equities back on the front foot

What is a cockroach portfolio and could it be a useful option?

Shares in the quirky and quintessentially British fashion brand have fallen too far

Copper is weak now, but long term it should rebound and Antofagasta is best placed to capitalise

Stick with the insurer ahead of demerger

All-important dividend looks safe for now, based on market’s recent reaction

We look at how to track these fixed-income instruments through ETFs

AJ Bell pensions expert answers query relating to lifetime allowance