Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

TI Fluid has it all: growth, cheap shares and dividends

The ultimate goal for many investors is to find a mid or large cap stock offering earnings growth, decent dividends and trading on a cheap valuation.

Stocks with all of those attributes are rare in the current market. Fortunately we’ve spotted one which ticks all the boxes and hardly anyone has heard of it. This is your chance to buy the shares while the stock is under the radar and trades on a bargain rating.

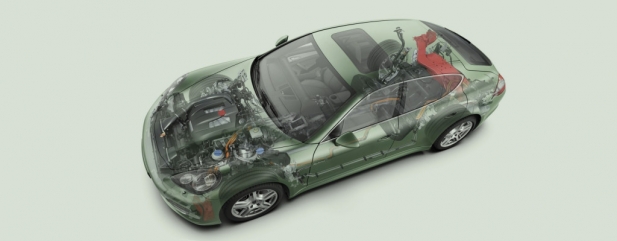

The company in question is TI Fluid Systems (TIFS), a £1bn auto specialist which has been around for more than 100 years and has a global footprint as a critical supplier to vehicle manufacturers.

The FTSE 250 member trades on a mere 6.5 times next year’s earnings and sports an attractive 5.1% dividend yield.

Peel Hunt analyst Harry Philips said on 20 March: ‘We accept that TI Fluid is a “newish” company to the market and Bain Capital has a 54% holding but a 2019 PE (price-to-earnings) ratio of just 6.6, an EBITDA multiple of 3.5 and a free cash flow yield of 13.3% for a proven business model is the wrong price.’ To put that in some context, the sector median EBITDA multiple is 6.6-times. The figures cited by Philips are slightly different to the table because the share price has subsequently changed.

WHAT’S THE CATCH?

You may ask why this stock is trading so cheaply. There are several factors; the shareholder list is dominated by the aforementioned private equity group Bain Capital and a few large institutions, limiting liquidity; Bain loaded the company with a lot of debt prior to floating it in October 2017; and the business is not well known outside a few fund managers and analysts.

Bain last year sold a bit of its stake and is likely to sell more shares in the future, such is the model of private equity firms.

Some investors are weary towards companies that have previously been owned by a private equity outfit in the belief that they’ve suffered from underinvestment. While that is a fair point, we don’t believe this applies to all private-equity backed companies.

NEGATIVE SENTIMENT

Another factor to consider is weak market sentiment towards anything related to the automotive sector. Reassuringly, TI Fluid’s most recent full year results, published in March, talk about 2018 being a ‘great year’ for the company. Pre-tax profit increased by 37% to €217.1m.

Chief executive William Kozyra says: ‘Despite a slight softening in global light vehicle production growth, we achieved strong organic growth, solid profit margins and free cash flow generation.’

The cash generation is important as it provides the power for TI Fluid to pay down borrowings – it currently has an €822.4m net debt position.

The benefits of deleveraging can super-charge investor returns. Interest charges currently swallow c43% of all the cash that TI Fluid generates from operations. As debts are paid off, the interest cost falls and therefore a greater proportion of the cash will be ‘owned’ by shareholders.

Investors, in theory, should be willing to pay a higher rating for companies with lower leverage as essentially there is reduced financial risk.

PROSPECTS BETTER THAN THE SHARE PRICE IMPLIES

Fuel efficiency and lower emissions are two megatrends here to stay for the long run and TI Fluid Systems is at the forefront of developing proprietary solutions to both these problems.

Its main line of business is fuel carrying systems where it has 35% market share and has developed strong relationships with all the global vehicle manufacturers. It has an untapped opportunity to leverage this strong market position to drive growth in the electric vehicle and hybrid electric vehicle markets.

Electric vehicles require a substantial increase in additional fluid content to thermally manage them effectively. In addition, by using lightweight nylon lines TI Fluid has reduced the weight of a vehicle by 30% to 60% compared to traditional aluminium and rubber.

The company has been awarded significant contracts for the design of thermal efficiency management systems. TI Fluid estimates it is currently seeing 50% share of these electric vehicle systems. They have a lifetime value of $700m and an eight to 10-year lifespan.

PLENTY OF FUEL IN THE TANK

Its second line of business is in fuel tank systems, where it has 15% market share. The company has developed a pressurised plastic fuel tank that utilises proprietary technology to meet the new increased fuel vapour pressure requirements of hybrid electric vehicles. Management estimates it is taking a 20% market share in this segment.

According to a report by consultant McKinsey, production of electric vehicles will quadruple by 2020 to 4.5m units. China has a dominant position in the production of electric vehicles; it currently has a larger market than the US and Europe combined. That’s fortunate as TI Fluid has a dominant market share in China.

The company has delivered above-average market growth historically. We believe it is well positioned to continue delivering above average-growth in the future.

There is an element of flexibility to the business. TI Fluid claims it can quickly adjust to market disruptions, such as the emissions scandal, and move its costs down in line with production, thus mitigating the impact on profitability.

Over time, particularly as it is a FTSE 250 name, TI Fluid should have better analyst coverage, and liquidity in its shares should improve.

The company is organising a capital markets day for analysts and investors in September, which will hopefully raise its profile and increase the general understanding of the business model. Get on board now before the wider market picks up on the story.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine