Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

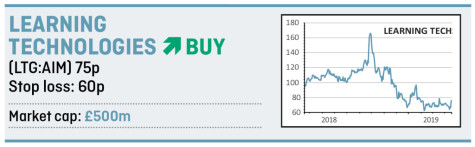

Learning Technologies eyes cross-sell growth spree

Increasing bureaucracy and red tape can be a challenge for medium and larger organisations trying to retain their best staff in the face of more exciting opportunities at start-up enterprises. One way of preventing this brain drain is to provide the workforce with ongoing training such as services offered by Learning Technologies (LTG:AIM).

The company provides a range of e-learning applications and technologies to more than 2,000 corporate clients and international government departments.

Since joining the stock market in 2013 it has actively pursued a buy-and-build strategy that has seen eight businesses acquired. The aim was to rapidly extend the product set and geographic reach, particularly into the large US market where more than half of revenue will be generated in the future.

The overall corporate e-learning market is growing at 11% a year. Sadly concerns about the pace of organic growth have previously capped investor enthusiasm with Learning Technologies in the past, where one analyst calculates it achieved underlying revenue growth in the mid-single digits in the second half of 2018.

This situation, plus previous lumpy and unpredictable new business, explains why the share price was sold down so heavily late last year, although the entire UK market suffered a big sell-off during October.

Learning Technologies now appears to have the scale to pull significant cross-selling levers in the future.

The company believes it has been averaging just 1.2 products or services across its customer base compared to an average closer to four for its top 10 clients. This suggests that even modest improvements could have a big impact on growth in revenue and profitability and it is a major priority for management. Consensus forecasts already anticipate last year’s £93.9m revenue expanding to £126.4m in 2019.

Earnings quality is also starting to improve thanks to a greater proportion of recurring sales contracts – about 50% according to Canaccord’s conservative estimates.

This underscores Learning Technologies’ ambition to hit an annual revenue run-rate of £200m by the end of 2021 on which it believes £55m of operating profit is possible. Last year’s operating profit came in at £27.3m, after one-off charges were stripped out.

Such potential upside is, we believe, not sensibly factored in to the share price on a 2019 price-to-earnings multiple of 9.5, even accounting for the accompanying risks.

Some analysts believe the stock could double in value to 150p over the next 12 to 18 months.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine