Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The importance of having an open mind in investing

It can be hard to change your opinion of a stock or a fund manager if you have an established view of something or someone. Having an open mind can, however, lead to better investment decisions if there is information that warrants rethinking your view.

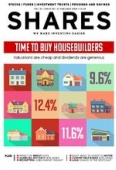

This theme is central to our article on housebuilders in this week’s edition of Shares. We correctly said to sell last summer and now we’re saying to buy back in on a selective basis.

You may think we are crazy given all the headlines about slowing house price growth, the troubles people are having in selling homes, profit margins being squeezed across the industry, and the negative impact Brexit could have on the property market.

We agree, it does look gloomy. Yet we’ve weighed up the facts and looked at the financial situation of housebuilders, together with valuations, and concluded that the risk/reward balance swings in favour of owning the shares.

You’re likely to make most of your money through dividends rather than share price gains as it is hard to see what would spark a massive

rally in the sector, apart from a smooth Brexit agreement pushing up the pound or a sudden property market recovery.

On the flipside, if the Brexit process gets even more complicated the housebuilding sector could fall in value as its shares are heavily influenced by market sentiment towards the UK and its currency.

Our change in stance provides a good reminder that you should challenge your thinking and ask if something successful is now a ‘sell’ or something unsuccessful is now a ‘buy’.

Don’t get emotionally attached when you buy a share. If someone has backed a winner, many investors stay committed when times get harder and are blinkered to problems when they emerge.

Many fund managers don’t think twice about selling a great business if the shares have gone into excessive valuation territory, or they consider a purchase if valuations have slumped into bargain territory. They follow a process and don’t let emotions get in the way of their decision-making.

Financial analysts can also change their mind on stocks if there is enough evidence to warrant a reappraisal. For example, Shore Capital analyst Robin Speakman has been cautious on outsourcing group Serco (SRP) for some time, but his research notes have been quite balanced, flagging both positives and negatives.

Quite often analysts with a neutral or negative stance on a stock can be too dismissive of a business and one-sided in their commentary.

After careful consideration and more than two years of having a ‘hold’ rating, Speakman finally switched his rating to ‘buy’ on 9 January following a material contract win. ‘This bring greater visibility of profit improvement and the return to positive cash generation. This allows us to consider fundamental valuation criteria for the first time since the group entered its major restructuring programme in 2014,’ he says.

Many investors wouldn’t dream of touching Serco given a history of setbacks, yet having an open mind can mean you pick up on ideas which, if successful, are often missed by the market until months later.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine