Two very different high-profile IPOs (initial public offerings) in London have experienced similar teething problems after making their stock market debuts.

Peer-to-peer (P2P) platform Funding Circle (FCH) saw nearly of a fifth of its value wiped off in conditional trading on 2 October.

‘This is highly unusual, as typically the banks which bring a company to market are able to at least stabilise a share price during this period,’ says AJ Bell investment director Russ Mould.

The shares remained under pressure on 3 October as unconditional trading got underway, down a further 2.7% at 360p.

Luxury car manufacturer Aston Martin (AML) fell 4.7% to £18.12 on its market debut (3 Oct).

Both companies saw their issue prices come in at the lower end of the guided range, in Funding Circle’s case at 440p.

WHY ARE THEY STRUGGLING?

The market reaction suggests there are serious concerns over the valuation of both companies. Funding Circle generated revenue of £94.5m in 2017 and chalked up a pre-tax loss of £36.3m, incurring heavy marketing costs of £38.7m.

With marketing costs expected to rise and a tarnished reputation for the P2P sector, it is perhaps little surprise investors are giving Funding Circle the cold shoulder.

Aston Martin made a profit last year and does have a strong brand, synonymous with the James Bond films, but it has endured seven bankruptcies since its inception in 1913 and even at current levels trades at a significant premium to Italian sports car giant Ferrari.

At the current market cap of £4.13bn and using last year’s net profit figure of £77m the shares are on a trailing price-to-earnings multiple of 53.6 times compared with Ferrari at just over 40 times.

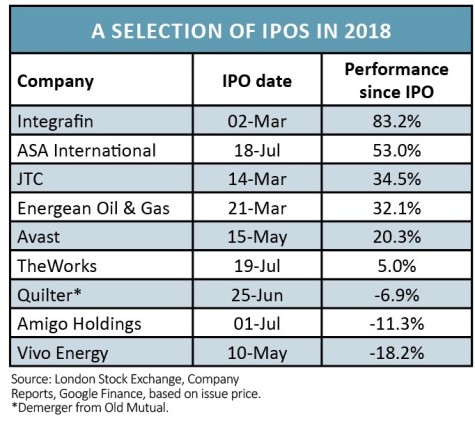

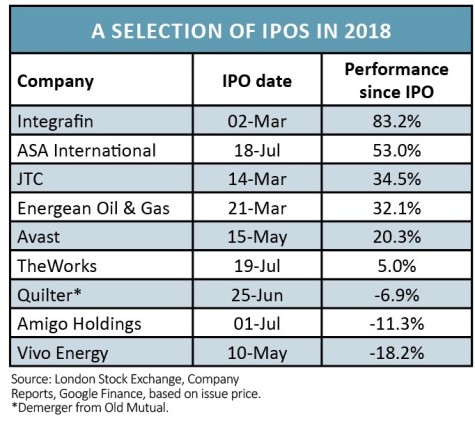

A look at the performance of other IPOs in 2018 show the right stories are still attracting interest from investors. For example JTC (JTC), a provider of services to asset managers, has increased by 34.5% in value since March, while microfinance specialist ASA International (ASAI) has also done very well. (TS)

‹ Previous2018-10-04Next ›

magazine

magazine