Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

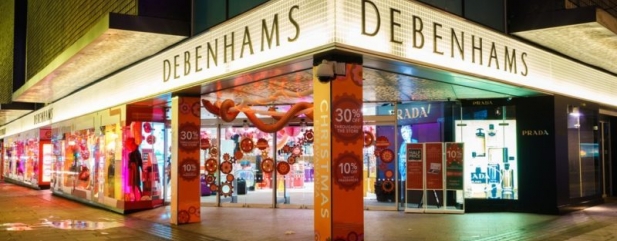

Share price decline implies Debenhams is at death’s door

Ailing department store Debenhams’ (DEB) shares plunged to fresh lows on media reports it had called in accountant KPMG to consider its options, as the chill wind blowing through the high street threatens to claim another victim.

The fear is the decision to bring in KPMG is a prelude to a company voluntary arrangement (CVA) or perhaps worse.

Debenhams’ response (10 Sep) failed to address investors’ key concern.

Chairman Ian Cheshire says: ‘The board continues to work with its advisers on longer term options, which include strengthening our balance sheet and reviewing non-core assets. This activity is in order to maximise value for shareholders and protect other stakeholders, including our employees.’

Structurally-challenged Debenhams has issued a series of profit warnings amid rising costs, squeezed disposable incomes, heavy discounting and changing shopping habits, while rival House of Fraser lurched into administration over the summer.

The latter was acquired by Mike Ashley’s Sports Direct (SPD), whose near-30% Debenhams stake implies the possibility of a corporate tie-up; combining House of Fraser and Debenhams would cut costs and create the opportunity to rethink the merged entity’s strategic direction.

Debenhams now expects to report pre-tax profit before one-off items for full year 2018 of around £33m, within the range of the £31m-to-£36.5m company-compiled consensus, yet in fact a downgrade on the £35m-to-£40m guidance provided by the retailer in June.

With the early weeks of the new season having shown more positive trends, Debenhams believes ‘any sustained upturn would result in a rebound in our profit performance’ and CEO Sergio Bucher insists ‘the product and format improvements we have tested are gaining traction and we are ready to scale up some of our strategic activity.’

Yet Patrick O’Brien, UK retail research director at GlobalData, is scathing: ‘While it would seem too early to try to foist a CVA on landlords who are already seething at what they deem to be an inherently unfair process being abused by retailers, Debenhams appears to be softening them up for some form of negotiation.

‘Debenhams may still be profitable and has the possibility of bringing in £200m-plus from the sale of Magasin du Nord, but its long term performance is still going to be under huge pressure, and with it carrying £4.6bn of lease commitments, both it and its landlords know that these will need to be addressed soon unless there is a marked upturn in the fortunes of the UK high street.’ (JC)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

- Investors braced for potential dilutive equity fundraise from Sirius Minerals

- Will Unilever exit the FTSE 100?

- Second worst September start for US tech stocks in 10 years

- Are UK markets finally ready to shed their Brexit discount?

- Share price decline implies Debenhams is at death’s door

- Is this the beginning of the end for Whitbread?

magazine

magazine