Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Grab a 6.2% yield with touchscreen engineer Zytronic

With many investors becoming increasingly worried about perceived sky-high ratings of UK equities we believe little technology engineering business Zytronic (ZYT:AIM) is a firm value opportunity.

The stock is currently trading on 13.9 times forecast earnings for the year to 30 September 2019 and offers a prospective dividend yield of 6.2%.

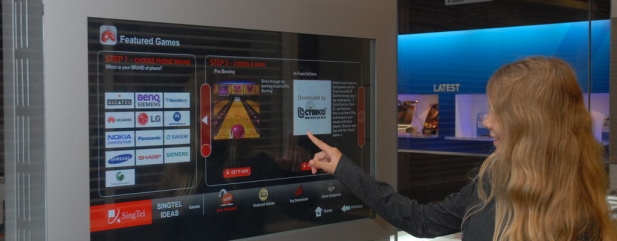

The Newcastle-based company designs and builds rugged touch interactive displays. It built its reputation on outdoor applications such as cash machines and is increasingly tapping new markets.

Gaming is the really exciting opportunity and last year was the first time revenues from this market segment overtook financial industry sales as its number one contributor. Gaming revenue jumped 30% last year to £7.7m and up 17% in the first half this year.

Other growth markets include vending machines, medical appliances, entertainment displays and other industrial applications where touch-screen controls tend to get used heavily and bashed about a fair bit.

This is a largely project-based business and forward visibility on contacts can be limited. This was evidenced at half year results published in May when a large financial sector customer put the brakes on orders after seeing its own end demand weaken.

That explains the hefty share price sell-off on 15 May from 457p to 402p. Encouragingly, the company did say at the time that financial industry prospects had since started to pick up.

These issues have happened several times over the years but Zytronic always manages to bounce back. This is because of the effort the company puts into technology and product development and the investment it makes in protecting intellectual property.

This can be seen in the larger, and sometimes curved, 30 inch-plus touchscreens it is making in increased numbers. This is a plus for Zytronic because it means more capacitive technology components are used per unit, boosting profit margins that should offset lower volumes from smaller devices.

The business has been run by the same cautious management team for years. Chief executive Mark Cambridge has been with the firm since 2000 while finance head Clare Smith has more than 10 years under her belt.

Further reassurance comes from Zytronic’s bullet-proof balance sheet backed by £13.7m of net cash (that’s 19% of the firm’s market value). The company has also been paying generous and steadily growing dividends for years.

Stockbroker N+1 Singer forecasts a slight dip in pre-tax profit to £5.2m in the current financial year (2017: £5.4m) before surging next year to £6m. (SF)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine