Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

We are big fans of Volution which is trading on a bargain rating

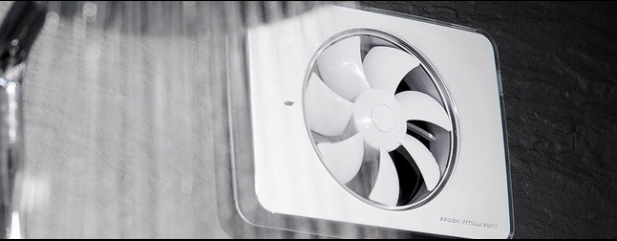

Regulatory-driven growth at ventilation products firm Volution (FAN) is not reflected in the current valuation as the company completes the largest acquisition in its history.

The £38m purchase of New Zealand peer Simx increases its exposure beyond UK markets from around 43% to more than 48%, and is expected to be immediately earnings enhancing.

Volution’s ventilation business represents nearly 90% of group sales. It designs, assembles and markets ventilation fans, systems and ducting for domestic and commercial buildings. It has leading market positions in the UK, Scandinavia, Germany and now New Zealand.

The remainder of group sales come from the Torin-Sifan business which supplies motors and fans for the global heating, ventilation and air conditioning industries.

Demand for ventilation products is being driven by tighter regulations on air quality. Principally operating as a designer, supplier and assembler rather than an asset-intensive manufacturer of products, Volution generates strong margins and cash flow.

It has a good track record of reinvesting cash into bolt-on acquisitions in what remains a highly fragmented market. Volution has previously estimated the seven acquisitions made between 2012 and 2016 generated average returns on capital of 24%.

M&A HELPS BOOST GROWTH

Acquisitions have helped supplement organic growth of between 3% and 5%. The company aims to enhance the margin performance of acquired businesses by boosting selling prices, redesigning products to reduce the cost of assembly, improving procurement and switching to in-house components.

This latest deal is not cheap at an enterprise value to earnings before interest, tax, depreciation and amortisation (EV/EBITDA) ratio of more than 10-times. Yet it provides exposure to a relatively strong economy and its integration should be smoothed by Simx’s status as a long-standing customer of Volution.

The group as a whole trades on a price-to-earnings (PE) ratio of 12.2-times for the financial year to 31 July 2019, compared with an average forward PE of 18.3-times for a Liberum-compiled list of its peer group.

So why is Volution trading at a discount? Margins are under a bit of pressure, falling from 19.4% to 18.5% in the six months to 31 January 2018, thanks to the loss of some higher return work in the UK and the initially more modest profitability of acquired businesses.

First half cash flow performance was disappointing. This reflects increased working capital demands as the company looks to maintain customer service in the UK during the completion of a consolidation of its facilities in Slough and Reading.

These factors look short-term in nature to us and do not justify the current gap between Volution’s valuation and that of its peers. (TS)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

- Impressive earnings ‘beats’ from service companies and engineers

- Barclays now in Edward Bramson’s cross-hairs

- What does Putin’s win mean for Russia-focused investments?

- FTSE 100 in a spin amid takeovers, restructures and spin-offs

- Is there more to come from Burford Capital?

- Pound see-saws on Brexit progress and softer price growth

magazine

magazine