Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Our Great Ideas portfolio outperforms in choppy waters

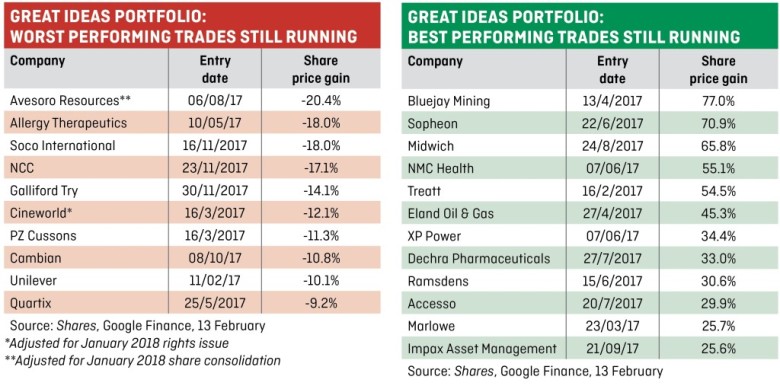

Our Great Ideas portfolio was hit by the recent bout of volatility, but we are still in positive territory overall and handsomely beating the wider market.

We run our list of stocks on a 12-month rolling basis and track the performance of the portfolio against the FTSE All-Share. The latest figures show our portfolio is up by 5.1% on average against a 2.7% decline for our measure of the FTSE All-Share, all excluding dividends (see ‘How our portfolio works’).

The only name to go through its stop loss, a mechanism which sells a stock at a specified level, is Wey Education (WEY:AIM).

The online education provider had been on a stellar share price trajectory heading into the sell-off. We still think the business has significant growth potential, but investors should watch from the side lines for now rather than seeking to take advantage of the recent weakness.

We feel the market may lose its appetite for stocks trading on very high ratings, which includes Wey trading on nearly 100 times forecast earnings.

Other small cap growth stocks in our portfolio, such as ad tech firm Taptica (TAP:AIM), music products outfit Focusrite (TUNE:AIM) and telecoms solutions business Gamma Communications (GAMA:AIM), have performed poorly in February. We retain our positive view on these names.

The two life insurance names in our list of picks, Aviva (AV.) and Legal & General (LGEN), have also struggled as they are exposed to the performance of asset classes like stocks and bonds through their pension funds.

The fall in the oil price which accompanied the stock market sell-off proved damaging to oil producer Soco International (SIA). (TS)

How our portfolio works

Our hypothetical portfolio runs on a 12-month rolling basis.

We add the two featured Great Ideas selections each week to the list and remove the two oldest picks (unless we’ve already taken profit on them or the trades have hit their stop loss).

For each article we record the entry price and the index value of the FTSE All-Share at that time. We compare the performance of the FTSE All Share for the same length as which the Great Ideas trade is running.

Our Great Ideas are investment ideas for you to research further – we do not provide advice. Past performance is also no guide to future performance..

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

- Sterling slides as Brexit fears resurface

- Which are the best and worst performing stocks following the market sell-off?

- Analysts get behind cyber security firm Sophos

- Tesco could go head-to-head with Aldi and Lidl on price, claims media report

- Shock as highly respected small cap fund manager is pushed out

magazine

magazine