Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The world’s biggest companies: are they still a buy?

The world’s biggest companies enjoyed a rip-roaring 2017 as investors went mad for internet and technology stocks. The $64,000 question now is whether they can continue to make big gains in the market during 2018, and beyond.

The oft dubbed FANG stocks tend to nab the headlines. These are Facebook, Amazon, Netflix and Google parent Alphabet.

Each is a dominant force in their respective fields. Facebook, in social networking and online advertising; Amazon, in online shopping and cloud computing, while Netflix is number one when it comes to subscription-based streaming video on demand. Google is the world’s undisputed king of online search and advertising.

Throw in Apple – the world’s largest company by virtue of its $895bn market value – and Microsoft, also strong in cloud computing, gaming and enterprise software, (let’s call them FANG+AM) and these half dozen companies demand the attention of investors, even those that typically shun the technology space.

MASSIVE MARKET LEVERAGE

This is because of the huge influence they exert over wider stock markets. If we strip out the much smaller Netflix (worth a comparatively piddling $92bn) we are left with the world’s five biggest companies by market cap, worth a combined $3.58trn, or $3,583bn if that’s easier to digest.

Put another way, FANG+AM represent 14% of the entire value of the S&P 500, the index that best benchmarks the US stock market. Considering the S&P 500 makes up something like 70% to 80% of the value of all US stocks, it means these five companies alone are worth something in the region of 10% or more of the entire US stock market.

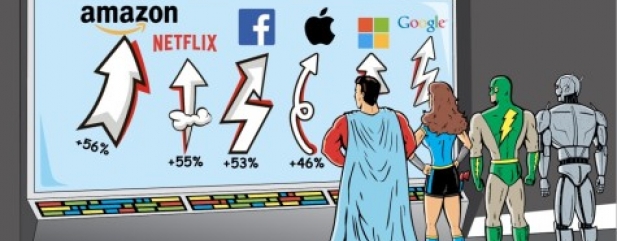

Through 2017, Amazon’s 56% share price gain lead the pack. It was followed closely by Netflix (55%), Facebook (53%), Apple (46%) and Microsoft (38%). Alphabet/Google brought up the rear, and even it chalked-up an impressive 33% jump last year.

Little wonder that the S&P 500 rallied last year, breaking new records on the way. Last year the index soared 19.4%, ending the year just a fraction off its all-time high at 2,673.61.

WILL THE BEARS SHOW THEIR BITE?

This had led to inevitable talk of a technology bubble and a steep market correction to come. Investor concerns are wide-ranging. What happens, for example, if the US plunges into recession? Is government intervention likely as these names become increasingly dominant online? There are tax complaints and antitrust threats.

For example, in June 2017, the European Union (EU) slapped Google with a record $2.7bn antitrust fine for giving preference to its online shopping platform over competitors.

Then there are deeper issues to sort out. Who, for example, should take responsibility for things like fake news and internet obscenity? Phone networks don’t carry the can for obscene calls but regulators are taking increasingly tough stands against online content, even user generated stuff.

This is something that Facebook founder Mark Zuckerberg is now grappling with, after his site was accused last year of spreading fake news during the 2016 US presidential election race. It has also faced criticism for changes made to its newsfeed algorithms. Last week Zuckerberg announced newsfeed changes clearly aimed at placating lawmakers, although the impact to ad revenues remains to be seen.

There’s also the US repeal of net neutrality. This will effectively allow broadband suppliers to slow networks speeds of heavy data users, or charge extra not to do so. How this may impact costs for Netflix’ streaming services only time will tell. Amazon, Microsoft and Google, among the world’s biggest public cloud providers, may also be impacted if business users wind up being charged more by their communications networks providers.

ARE VALUATIONS REALLY STRETCHED?

But the biggest concern for investors is, arguably, one of valuation. After such strong share price runs in 2017, how much upside is left on the table for the coming years? What’s the downside in a market correction? What if past growth rates simply cannot be match in the future?

These are all very fair questions for investors to ponder.

Investors typically look back to the dotcom crash in the early 2000s, yet fund managers in the main have consistently called into question such comparisons. The major difference between current ambitious investment multiples versus those of the late 1990s is real earnings.

‘This time round technology share prices are rising with earnings upgrades that are outstripping an otherwise low growth environment,’ is the view of Walter Price, the highly experienced manager of the Allianz Technology Trust (ATT).

Between them FANG+AM stand on an average price to earnings (PE) multiple of 60.7 for the next 12 months, according to Reuters data. Yet this is hugely influenced by the relatively poor profits performance of Amazon and Netflix, both of which have clearly communicated plans to sacrifice near-term profits as they chase land grabs in existing and new markets.

Amazon stands on a next 12 months PE of 159, Netflix 92.6.

It’s worth mentioning that shareholders have often been willing to overlook this kind of valuation for big technology with potentially enormous future cash flows.

PEs among the rest of the FANG+AM group look anything but stretched when you consider the respective growth, both real and potential, averaging out at 23.

MOST RECENT TRADING

Against such PE multiples investors must compare trading. Most of the FANG+AM’s financial years tally with the calendar year, which means 2017 results are still to come (probably towards late February/early March).

Apple stands apart in that regard, but its recent trading has been similarly impressive. Full year figures to 30 September 2017 showed a return to growth after declining for the first time in years during 2016. It also seems to be seeing strong demand for its latest iPhone X, arguably the first new iPhone makeover to make a big difference since iPhone 6 back in 2014.

Elsewhere, in November Facebook reported third quarter earnings that beat earnings and revenue estimates by a wide margin. Late last year Amazon scored two price target hikes on expectations of a strong holiday sales season. Increasing optimism over its online retail leadership also helped. The consensus target price is currently pitched at $1,330.

Alphabet/Google has also impressed. In late October its third quarter results smashed estimates, sending shares in the internet giant to a new high.

MARKET EXPERTS REMAIN UPBEAT

Many analysts do expect FANG+AM stocks to continue to rally in 2018, driven by what have been called ‘network effects,’ or in other words, using their powerful business platforms to win new business at increasingly lower cost. This also creates deeper and wider moats, or barriers to entry.

It implies that revenue and earnings growth, not to mention potential windfall from repatriated cash thanks to US tax reforms, will continue through 2018. Ongoing fans include billionaire entrepreneur Mark Cuban and Ken Fisher, the founder of Fisher Investments, plus scores of fund managers and investment analysts.

Of course, we cannot predict the future with accuracy but we do believe that the real value of these businesses is most likely to come over several years rather than on a time-frame limited to the coming 12 months.

Part of the reason is new developments and emerging technologies. Themes like automotive technology (among the major markets next up for significant disruption, say experts), artificial intelligence, machine learning, robotics and others are gathering pace. Importantly, it is the FANG+AM companies that are leading the way in terms of investment dollars.

Excluding Netflix, Facebook, Amazon, Alphabet/Google, Apple and Microsoft have applied for more than 52,000 patent applications and grants since 2009, according to venture capital researcher CB Insights.

How any of these companies might look years down the line is beyond any of us to predict, but investment in today’s and tomorrow’s technologies perhaps gives a hint to the direction of travel.

As one analyst has said, the US technology sector is still the easiest place for UK investors to get access to major investment themes and mega-trends. Don’t write it off just yet, there are still plenty of investors eager to own Apple, Amazon and Netflix et al, and sell-offs are regularly treated as a buying opportunity. Our preferred picks are Amazon, Alphabet/Google, Apple and Facebook. (SF)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

- Dollar hits three-year low

- Premier plays down Batchelors sale chatter

- Melrose launches GKN charm offensive

- The winners and losers from Carillion’s demise

- JD says profit will be better than expected

- Savills CEO steps down after nearly 40 years at firm

- Sting in the tail for BP on Deepwater Horizon oil spill

- Dividend downgrades for Card Factory

magazine

magazine