Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

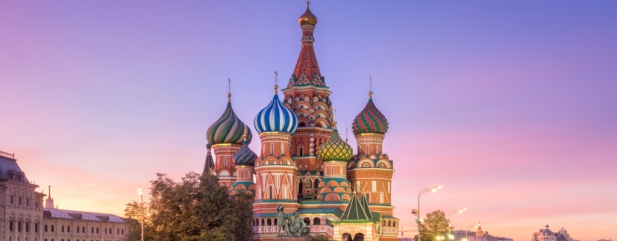

Adventurous trusts to Putin your portfolio

A deteriorating relationship with the US and weak oil prices have weighed on the Russian market for some time. Yet Russia is adjusting to the environment it finds itself in and earnings growth is beginning to materialise.

We believe now is a good time for investors with a higher appetite for risk to consider exposure to Russia via investment trusts or funds.

As Chris Colunga, co-manager of BlackRock Emerging Europe (BEEP), recently commented: ‘In Russia, with the economy in good shape, improving consumer sentiment and record low inflation, there is room for interest rates to be cut, further aiding the economic recovery.

‘Valuations are low, dividend yields are high and the potential remains for the market to re-rate on lower interest rates.’

How do I get exposure?

There are various investment trusts with exposure to Russia trading on material discounts to their net asset value (NAV). The sole country specialist is JPMorgan Russian Securities (JRS), currently trading on 15.1% below its NAV.

Managed by Oleg Biryulyov since 2002, the trust’s objective is to provide capital growth from a diversified portfolio of investments primarily in quoted Russian companies or others which operate mainly in Russia.

It can invest up to 10% of its assets in companies operating in former Soviet Republics.

According to research group QuotedData, the JPMorgan investment trust offers investors a more balanced portfolio than an equivalent exchange-traded fund which tracks an index of Russian companies.

‘With the comfort of a closed-end structure, the freedom to invest outside Russia and to hold stocks that are not constituents of the main Russian indices, the manager has the ability to make long-term stock selection decisions (turnover is typically 25%-35% per annum) and produce returns that are differentiated from index benchmarks,’ says QuotedData.

With leading exposures to the energy, financials and materials sectors, the portfolio is fairly concentrated, typically boasting 25 to 50 positions. Holdings range from steel producer Severstal and agricultural commodity and food business Ros Agro to gold miner Polyus. The trust also has exposure to energy giants Gazprom, Lukoil and Rosneft.

Fund manager Oleg Biryulyov says: ‘In Russia, we believe the macro trend remains in favour of gradual recovery, and the central bank has capacity to cut rates further.

‘On the micro side, we believe corporate behaviour in Russia will continue to become increasingly shareholder friendly and dividend payouts will surprise on the upside.

‘August saw significant dividend payments, much of which appears to have been reinvested—an encouraging sign for the market. The broadening of sanctions has been a disappointment, but we see limited impact on the companies in our portfolio.’

Preferred themes

The investment trust has a long-standing thematic preference for private sector, non-cyclical stocks including healthcare company MD Medical and Ros Agro in the consumer staples sector.

MD Medical is a private healthcare provider for women and children while Ros Agro is a diversified, vertically integrated agricultural products producer which has a focus on sustainable long-term growth with emphasis on increasing production in Russia’s Far East to serve the Asian markets. ‘Today, the trust has material exposure to consumer related sectors including financials and consumer staples, whilst having little or no exposure to industrials, telecoms and utilities.’

Russia and beyond

BlackRock Emerging Europe, managed by Sam Vecht and Christopher Colunga, seeks to achieve long term growth of capital by putting money to work with companies operating in Eastern Europe, Russia, Central Asia and Turkey.

The fund’s biggest position is Sberbank, Russia’s largest bank. It has branches throughout the country and a 46% share in the retail deposit market.

‘We have been adding to our position in the stock since March 2017 on the basis of its strong fundamentals, attractive valuation, low cost of risk and ability to continue optimising the costs,’ say the co-managers.

‘Furthermore, as the Russian economy and consumer sector continue to recover and the central bank cuts the key policy rate, we expect the bank to see increased loan growth, in particular in mortgages.’

Baring Emerging Europe (BEE) has exposure to the Russian banking sector via such stakes as Sberbank and online financial services group Tinkoff.

It also invests in Russian freight operator Globaltrans, which has been performing strongly following an increase in freight rates and an environment of strong commodity prices, as well as oil producer Lukoil, retailer Magnit and social network Mail.ru.

Other relevant products

Other investment trusts with exposure to Russia (alongside other countries) include JPMorgan Emerging Markets (JMG) and JPMorgan Global Emerging Markets Income Trust (JEMI). (JC)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine