Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

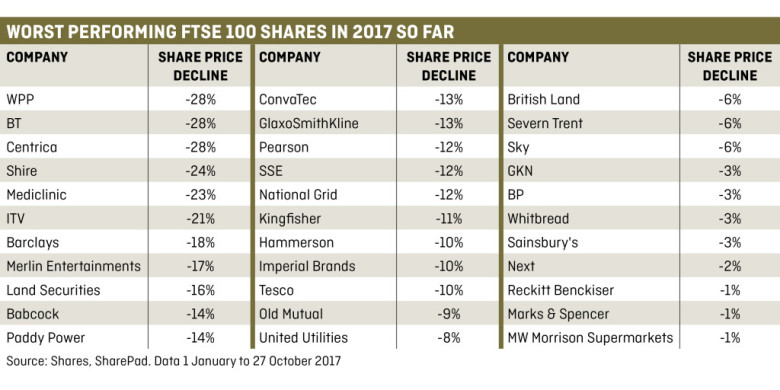

33 Stocks in the FTSE 100 are down this year

Stock markets are rallying around the world including a good performance from the main indices in the UK. While this bull-run is exciting for investors, not everyone will be toasting big returns from their portfolio.

One third of the stocks in the FTSE 100 are now trading at a lower price than at the start of 2017. That’s despite the FTSE 100 index having risen by 5% year to date. Does that shock you?

Many household names including broadcaster Sky (SKY), telecoms provider BT (BT.A) and banking group Barclays (BARC) have declined in value for a number of reasons.

The fact that 33 of the UK’s largest listed companies have dropped in value during a boom time for stock markets may leave investors scratching their heads. Yet it does provide a valuable lesson that not all stocks are able to catch a ride when markets are racing ahead.

The key question now is whether some of these large cap stocks have been oversold, thereby creating an opportunity to buy some on lower than normal valuations.

This article looks at many of the beaten-up stocks from the FTSE 100 to analyse why they’ve had such a bad year. We provide our thoughts on a number of companies which look like good buying opportunities as well as pointing out some that should continue to be avoided.

We also talk to some analysts to get their views on the best investment opportunities from the pack.

What's driving the FTSE 100 higher?

The international nature of the FTSE 100 means global factors have imposed a greater influence on the index than compared to the rest of the UK stock market.

Some confidence remains that spending plans in the US and China will drive world economic growth while greater political stability in Europe has been encouraging.

In the US, the S&P 500 has risen more than 14% so far this year, setting new records. The same applies to the Nasdaq index which has increased by nearly 22% in 2017.

Those rallies have helped lift investor sentiment in many parts of the world and will have certainly contributed to people in the UK buying London-listed stocks.

Currency movements have also played a very important role in terms of influencing the direction of the FTSE 100. A drop in sterling last year made British goods and services look cheap to overseas buyers, hence why UK takeover activity has been very strong over the past year or so.

The large number of overseas earners on the FTSE 100 benefited from weaker sterling, particularly dollar earners like miners, as international earnings are more lucrative when translated into pounds.

Sterling this year has started to regain strength against the dollar, hence why the overseas earners’ momentum has started to fade a little. Construction firms, miners and other dollar trades have in general still delivered positive returns for investors, yet not as much as in 2016.

The top performers in the FTSE 100 this year have been industrial companies – a broad term including service providers – as well as housebuilders thanks to a robust property market and high levels of dividends attracting investors.

Other companies enjoying a good run include ones that were simply priced too cheaply last year for various reasons. Those having re-rated in 2017 include airline International Consolidated Airlines (IAG) and engineer Rolls Royce (RR.).

As for those stocks focused on the UK, the country’s economic data has been reasonably robust with unemployment at multi-decade lows which should translate into wage growth at some point. That said, there remain many headwinds including rising costs, regulatory change, a questionable consumer outlook and Brexit.

Why some companies have flopped

As for the losers on the FTSE 100 this year, we note the market has given a harsh reaction to many bits of negative corporate news.

Single day share price movements to the tune of 15% to 20% have historically been rare among larger companies; not this year.

A mixture of profit warnings, economic concerns, political threats and balance sheet worries has resulted in severe share price declines for many FTSE 100 stocks.

We now discuss some of the worst affected, starting with five stocks rated as ‘buys’ at their current price, either by ourselves or by analysts.

FIVE TO BUY

Babcock International (BAB) 815.75p

Shares in Babcock have fallen by 14% this year as investors fear it will suffer the same fate as its London-listed outsourcing peers Interserve (IRV), Capita (CPI) and Mitie (MTO), all of whom have issued profit warnings in 2017 or late 2016.

Several analysts are now saying the shares look really good value and we agree. Even fund managers are getting excited including Seneca Investment Managers which has recently added the stock to a number of its portfolios, saying the market shouldn’t associate Babcock with the aforementioned support services firms.

‘We believe the company is fundamentally different to others in its sector. It has a very skilled workforce, and these workers are increasingly in short supply.

‘The company operates in complex, highly regulated and often secretive industries, so the barriers to entry are high.

‘Contracts are long term in nature and allow gains and pains to be shared with customers. Unlike many peers, Babcock doesn’t depend on cost-plus contracts that often rely on add-on work at high margins to earn a decent overall return.’

Examples of work undertaken by Babcock including refitting UK nuclear submarines and naval ships, maintenance of the London Fire Brigade’s fire engine fleet and operating air ambulance fleet.

Nine analysts now have ‘buy’ ratings on Babcock versus four ‘holds’ and two ‘sells’, according to Reuters data. The median target price is £10.20, implying potential to make nearly 25% return in a year.

GKN (GKN) 321p

Market dynamics suggest there is a fair price even for companies struggling; and UBS analysts reckon British aerospace and automotive engineer GKN is trading below it.

The investment bank’s equity experts base their claims (and a bullish ‘buy’ recommendation) on valuation grounds. They say the shares are trading at too large a discount to peers, suggesting that 360p is a more reasonable price at which the shares should trade.

The shares have been weak following a profit warning and news of external claims against the company potentially costing it £40m.

However, a more recent modest bounce is down to speculation the group could split itself in two. Reports suggest it may separate the automotive arm (which is facing challenges from the rise of the electric vehicle industry) from aerospace, itself up against industry pricing pressure.

ITV (ITV) 164.35p

Investors could essentially double their money buying shares in media group ITV at current levels, claims investment bank Liberum.

That’s quite a bold statement given the shares have fallen 21% so far this year amid concerns about a decline in advertising and the impact of internet streaming on traditional TV broadcasters.

Liberum analyst Ian Whittaker says there is a misconception about ITV and other broadcasters in that they are seen merely as linear TV providers. He says that’s wrong as ITV and other broadcasters ‘can increasingly monetise’ content across other platforms.

He sees more than 40% of ITV’s profit growth coming from digital sources. Whittaker also believes ITV has an opportunity to capture more of the fast growing £1.1bn online video display advertising market.

‘The advertising weakness at ITV is down to temporary, not permanent factors,’ adds the analyst who has a 330p price target on the stock. He says advertising weakness has come from consumer goods and retail companies; noting there are signs the former group is spending again.

Shire (SHP) £35.47p

One of the key headwinds facing rare diseases specialist Shire this year is competition in its haemophilia franchise from Roche.

Shire also faced a mixed reception over its $32bn acquisition of Baxalta last year despite its strong position in the plasma products market.

Despite these drawbacks, the company’s dry eye disease treatment XIIDRA is proving to be a hit in the US.

Canaccord Genuity analyst Brian White believes Shire is trading on an undeserved discount to its peers, highlighting good cash generation and the performance of its legacy business as reasons to stay positive.

White forecasts a significant erosion of the inhibitor market and a more modest impact on the broader haemophilia market. However, he still anticipates 12% compound annual earnings growth between 2017 and 2022.

Tesco (TSCO) 185.55p

Groceries titan Tesco’s positive half year results on 4 October confirmed continued positive trading momentum and a hotly-anticipated return to the dividend list after a three-year hiatus.

Its shares having been rising since the summer but still remain 10% down on the start of the year. They were particularly weak earlier in 2017 as rising inflation has pushed up food prices, causing investors to worry about consumer spending going forward.

We rate Tesco as a ‘buy’, seeing more to come from chief executive Dave Lewis’ turnaround, although we acknowledge concerns over competition from hard discounters Aldi and Lidl and the planned £3.7bn takeover of wholesaler Booker (BOK).

Half year results proved a milestone with

pre-tax profit surging from £71m to £562m. Operating margins rose to 2.7% and are on track to hit the 3.5-4% target range by 2019/20. Net debt was reduced by 25.1% to below £3.3bn.

In Tesco’s core UK and Republic of Ireland business, like-for-like sales grew 2.1% for a seventh consecutive quarter of positive performance with shoppers returning in droves. We’re hoping to see continued progress when Tesco reports on Christmas trading (11 Jan 2018).

TWO STOCKS TO AVOID

Kingfisher (KGF) 310.5p

Home improvement powerhouse Kingfisher’s soggy share price reflects a cautious outlook for the UK and France and a lack of belief in its ‘One Kingfisher’ transformation plan. We think the shares have further to fall.

Better than expected half year results (20 Sep) revealed underlying pre-tax profit up 0.9% to £440m versus a consensus estimate of £426m thanks to solid growth at its UK chain Screwfix and in Polish operations.

Stockbroker Davy believes the shares are cheap and argues they are worth up to 390p.

We don’t share its positive view, believing there could be further downside given the squeeze on UK consumer incomes.

We have lingering doubts about the ‘One Kingfisher’ strategy, given it is the latest in a long line of failed attempts to unify the group’s supplier base and global sourcing teams.

Furthermore, we also believe competition will intensify in the UK thanks to rival firm Homebase having a new owner (Wesfarmers) actively reinvigorating that brand. Furthermore, we’re conscious that DIY appears to be dwindling as a national pastime with people increasingly opting for the ‘do it for me’ route. (JC)

ConvaTec (CTEC) 202.95p

Woundcare specialist ConvaTec cut its anticipated full year sales growth in October from 4% to a new range of 1% to 2% after being hit with supply issues in its advanced wound and ostomy care divisions.

That triggered a massive share price sell-off, wiping out all its gains made year-to-date and more.

We’re not confident in the company’s ability to bounce back as this guidance depends on resolving supply issues, fulfilling back orders and recovering new orders with progress not expected until at least the end of 2017.

The shares are currently trading below its original IPO (initial public offering) price when ConvaTec floated just over a year ago so the woundcare business will need significant and positive updates to regain its footing.

Numis analyst Paul Cuddon says the company’s key products face intense competition and pricing pressures.

He also flags under-investment compared to ConvaTec’s rivals which are aiming to take market share in the US and Europe. This is a stock to avoid for now.

SOME OF THE REST

WPP (WPP) £13.03

The worst FTSE 100 performer this year, media agency WPP has downgraded its sales growth guidance three times in 2017 amid concerns about client spending and economic uncertainty in various parts of the world.

Analysts believe 2018 could be better for WPP, particularly as there are several major sports events stimulating the advertising and marketing industry.

Centrica (CNA) 169.75p

We have been negative on the British Gas-owner for more than three years because of the weight of regulatory millstones and weak upstream dynamics. The government’s energy price cap plans are another likely drag on future earnings.

A turn in investor sentiment anytime soon looks unlikely, and the shares may well fall further.

SSE (SSE) £13.69

Another of the energy supply big six to feel the tightening grip of watchdog Ofgem. SSE’s share price has dropped 12% this year, most of it in the wake of price cap talk first emerging in the summer.

Regulatory uncertainty is running high and, for many investors, even a 6%-plus income yield is not enough to justify owning the shares at present.

National Grid (NG.) 914.85p

A 12% share price decline since May isn’t as bad as it looks. The infrastructure specialist paid out £3.2bn to investors as a special dividend, so the market value of the shares was automatically reduced to account for the cash outflow.

It’s roughly stayed at the same level since the payment. Recent energy price caps will barely touch the group.

Imperial Brands (IMB) £31.78

Sentiment towards tobacco multinational Imperial Brands is currently poor. Investors are concerned over regulatory changes in the US and a relative lack of presence in certain Next Generation Product (NGP) segments.

Some analysts think the market is wrong including Investec which has a £43.60 price target for Imperial, excited by planned new NGP launches ahead.

Merlin Entertainments (MERL) 373.95p

Terrorism attacks discouraging people from taking outings and deteriorating consumer confidence have dragged on Alton Towers and Legoland operator Merlin Entertainments, which recently reported a slowdown in trading in the 40 weeks to 7 October.

Overseas, Merlin delivered a 12.4% jump in sales, partially driven by favourable currency movements. Approximately 70% of its profit is generated overseas.

Land Securities (LAND) 956.25p

The property group has done some high profile deals this year, including the sale of its 50% stake in 20 Fenchurch Street (the Walkie Talkie building) for £634m.

However, Brexit may make it harder for Land Securities to find enough tenants to fill its vast amount of commercial property, hence why the shares have been weak amid growing investor concerns.

Barclays (BARC) 183.83p

Barclays has two well-regarded businesses, its retail banking division and Barclaycard. However, poor performance from its investment banking arm has weighed heavily on Barclays’ share price this year.

The company has lost more than a fifth of its value since a February high of 239.75p.

Hammerson (HMSO) 513.25p

Shopping centre owner and developer Hammerson is exposed to any decline in consumer spending, hence why its shares have been weak this year amid rising inflation and growing concerns about the high levels of consumer debt.

The company has investments in around 20 retail parks in the UK and has been impacted heavily by a drop in both footfall and physical retail sales.

Pearson (PSON) 721.25p

The academic publisher kicked off the year with a profit warning and subsequently slashed its dividend; causing investors to panic about the potential need for a large fundraise to shore up its balance sheet.

Its main problem is that US students are no longer buying expensive academic textbooks. That’s prompted Pearson to try and create a leaner business with a focus on digital education, a strategy that will take some time to execute.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine