Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Investment trusts for every stage of life

Good financial planning can make a big difference between a happy life and one that is more stressful due to worries about money. We all have big events in our lives that require a cash outflow and so it really helps to be financially prepared.

Growing concern in the UK about rising consumer debt is particularly relevant. Too many people rely on credit to fund their lifestyles and too few people are saving for the future; and those who are saving may not be putting enough away.

It’s time to make a change. Putting aside some money on a regular basis is paramount to funding the big events in your life such as helping your children, paying university fees and enjoying a fantastic retirement. We will now explain the ideal places in which to invest your hard-earned cash and hopefully get a decent return.

The ideal destination for your money

We’ve decided to focus purely on investment trusts for this article as they offer diversification and have various advantages over more traditional funds as we explain later on.

Investment trusts invest in companies, bonds, property or other assets with the aim of delivering capital returns and/or dividends. You buy them in the same way as individual company shares. They trade on a stock exchange and their price moves up and down depending on market demand and other factors such as events affecting the assets within their portfolio.

These types of investment products can invest in almost anything, but many focus on a region, sector or investment style. You can find investment trusts offering exposure to everything from big and small companies to higher risk emerging markets.

If you’re already familiar with investment trusts, just skip the following section and jump to the different age group discussions where will highlight 11 of our favourite investment trusts and in which situations they might be suitable to buy. Otherwise keep reading and we’ll explain five reasons to buy these types of funds.

1. Potential to bag a bargain

You will often hear investment trusts referred to as closed-end funds. A closed-end fund has a fixed number of shares. Unlike open-end funds such as Oeics and unit trusts, new units are not created or deleted when investors buy or sell an investment trust.

Investment trusts have a fixed number of shares in issue, so when you invest in them you are buying shares from someone else on the market who is selling.

The situation means investment trusts can trade at a discount or premium to the value of their underlying assets. Although this arguably makes an investment trust a slightly more complex investment, it potentially offers you the opportunity to bag a bargain by buying a trust for less than the value of its investments.

2. Closed-end benefits

As discussed, unlike an open-end fund an investment trust does not expand or contract based on investor demand.

It does not have to sell its best investments to meet redemptions when markets are falling. Neither does it have the pressure of investing substantial flows of money when the market is enjoying a bull run.

When investors put cash into a unit trust or Oeic this money must be invested even if the manager is struggling to find attractive opportunities.

3. Wide range of information

Investment trusts are more transparent than open-end funds and can have superior corporate governance as the fund manager reports to a board of directors. The board sets and monitors the investment strategy and reviews the investment performance.

Unlike unit trusts and Oeics, which tend to jealously guard information about their holdings beyond the top 10 list, many investment trusts will publish their full portfolio at least once a year and often more frequently.

4. Easy to buy and sell

You can buy and sell investment trusts in the same way as an individual company and their prices can change throughout the day. Mutual funds (such as Oeics and unit trusts) are only priced once a day at a level which you only learn after confirmation that your trade has completed

5. Dividend benefits

The ability to provide a regular, reliable income is a key appeal of investment trusts.

These types of funds can retain a portion of their cash generated from underlying assets each year to help smooth out dividend payments. It means they can store away some money so that dividends can still be paid in tougher market or economic conditions.

Many investment trusts have increased their dividends every single year for at least two decades. Four investment trusts have even reached the impressive milestone of 50 years or more of consecutive dividend growth. They are City of London Investment Trust (CTY), Bankers Investment Trust (BNKR), Alliance Trust (ATST) and Caledonia Investments (CLDN).

35 YEAR OLD INVESTING FOR THEIR CHILDREN OR RETIREMENT

SCENARIO A: HELPING YOUR CHILD IN LATER LIFE

A big motivation for investing is to provide a financial head-start for your children. If you’ve recently celebrated your child’s birth, the following investment trust could be an ideal candidate to place into a Junior ISA.

The investment could accumulate tax-free gains over an 18-year period and potentially provide your offspring with a tidy sum of money when they become an adult that could be put towards their first home or help them avoid racking up large debts while at university, for example.

WE SUGGEST: Monks Investment Trust (MNKS)

The Baillie Gifford-run investment trust has an emphasis is on global growth companies. Among the key metrics the team analyse is earnings growth which in their view is the biggest driver of share prices.

‘Our approach is to focus on a range of the world’s best businesses and to hold them for several years, often through political and economic cycles and uncertainties,’ says the team behind the trust.

‘The long-term revenue and profit growth potential of our investments dominates our analysis, as opposed to guesswork surrounding variations in global GDP, interest rates or politics.’

The trust is invested in super-sized companies like online retailer Amazon, insurance firm Prudential (PRU) and cruise operator Royal Caribbean. It has a diversified portfolio, typically containing more than 100 stocks from across the globe.

35 YEAR OLD INVESTING FOR THEIR CHILDREN OR RETIREMENT

SCENARIO B: TAKING ADVANTAGE OF FREE MONEY VIA THE LIFETIME ISA TO INVEST FOR RETIREMENT.

The Lifetime ISA was launched earlier this year allowing you to receive up to £32,000 of free cash from the Government.

Adults under the age of 40 can open an account and pay in up to £4,000 in each tax year. The Government pays 25% bonus (i.e. up to £1,000) on those contributions annually.

The bonus is paid up to the age of 50. You can withdraw money without a penalty to help buy your first home worth up to £450,000 or if you are terminally ill. Otherwise the money is locked in the account until you reach age 60.

Withdrawals at this stage will be tax-free, making the Lifetime ISA a potentially useful vehicle for boosting your retirement funds. Someone investing with a timeframe of up to 25 years can afford to take greater risks as they have more time to ride out market volatility.

Alongside the previously-discussed Monks Investment Trust, which would also be a good fit here, we now discuss two other investment trusts which would be appropriate for someone in these circumstances.

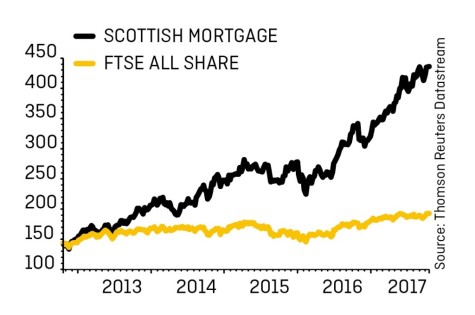

WE SUGGEST: Scottish Mortgage (SMT)

Another Baillie Gifford-run trust, Scottish Mortgage is towards the higher end of the risk spectrum with investments in some of the world’s biggest and best performing technology stocks.

It provides exposure to such companies as retail giant Amazon, electric vehicle manufacturer Tesla, social media giant Facebook, streaming service Netflix as well as Chinese tech firms Alibaba and Baidu.

Scottish Mortgage adopts a patient approach to investment, typically holding stocks for at least five years.

The focus is on trying to find the great companies of the future which will drive the global economy. This focus on growth does sometimes lead to volatility in returns. For example, in the April 2016 financial year the share price total return was -2.1% whereas in the March 2017 financial year the return was nearly 50%.

Entering the FTSE 100 in March 2017, the trust has since cut its annual management charge from 0.3% on the first £4bn of assets under management, falling to 0.25% thereafter.

WE SUGGEST: Finsbury Growth & Income (FGT)

Investing predominately in UK-listed companies and managed by high profile investor Nick Train, this trust focuses on undervalued quality companies which he believes can deliver positive returns thanks to their ability to grow earnings and dividends over time.

Among the largest constituents of the portfolio is consumer goods giant Unilever (ULVR) which Train reckons is only just beginning to tap the potential for its brands in emerging markets.

Other holdings with strong brands and emerging markets-driven growth prospects include spirits maker Diageo (DGE) and Burberry (BRBY). Beyond the UK market it is also invested in Dutch brewer Heineken and confectionery group Mondelez whose brands include Cadbury.

In four of the last five years the trust has delivered a double-digit return. This is a concentrated portfolio with around 30 holdings and limited churn. Train typically holds on to investments for the long-term. The shares currently trade at a 9.8% premium to NAV as investors seem happy to pay a higher price to take advantage of the fund manager’s superior track record.

45 YEAR OLD INVESTING FOR THEIR CHILDREN OR RETIREMENT

SCENARIO A: SAVING FOR UNIVERSITY FEES

The cost of a university education is significant but if you want your children to prosper in the jobs market a degree can be invaluable.

Based on the maximum annual tuition fee of £9,000 per year, a three-year degree course would set you back £27,000 and that’s before you consider living costs and the price of any additional study.

Some of this cost can be covered by student loans but many parents will aim to help their kids as much as possible with the costs of studying.

The earlier you start saving, the better. Someone with an eight-year-old child in theory has just 10 years to build up a sufficiently large pot to help them through university.

We believe the following two investment trusts are good places to park your savings. They are at the lower end of the risk spectrum to reduce the risk of you suffering a serious dent in the university fund and not have enough money by the time you need to pay the bills. It is important to stress that no investment trust is guaranteed to produce a positive return.

WE SUGGEST: Henderson International Income (HINT)

Investing exclusively outside of the UK, this trust is managed by Ben Lofthouse with a remit of providing a high and rising level of dividends as well as capital appreciation over the long-term.

This will be delivered by an internationally diversified portfolio of around 60 shares – most of which yield 2% or more.

The investment criteria include a focus on firms with strong barriers to entry and robust cash flow.

With roughly an even split between the Americas, continental Europe and Asia Pacific, the trust can in theory still perform even if certain geographies are in the doldrums. No more than 50% of the portfolio can sit in any one of these three regions. The trust pays dividends quarterly and has an ongoing charge of just over 1%. We recommend you reinvest all dividends, if possible, to enjoy compounding benefits.

WE SUGGEST: Seneca Global Income & Growth (SIGT)

This investment trust is one of a handful which adopts a multi-asset approach rather than focusing purely on equities.

Its strategy is to deliver a combination of income and capital growth while keeping volatility to a minimum.

Specifically, it looks to deliver a total return at least equivalent to the rate of inflation plus 6%.

Its UK share selections are principally focused in the mid cap space; its exposure to overseas stocks and shares is achieved through funds managed by third parties.

The trust also takes interests in so-called specialist assets, such as infrastructure, and property which in its view offer more reliable income than shares and better capital growth than bonds.

Managed by a five-strong team, the trust has been steadily reducing its equity exposure in anticipation of a bear market.

45 YEAR OLD INVESTING FOR THEIR CHILDREN OR RETIREMENT

SCENARIO B: BROADENING A PORTFOLIO AHEAD OF RETIREMENT

A 45 year old might be around the halfway point of their working life and thinking more seriously about how to fund a comfortable retirement.

We assume they have already built a core investment portfolio, perhaps using low-cost exchange-traded funds to gain exposure to UK, US and European markets.

Now might therefore be the point at which such an investor considers adding some more niche elements to their portfolio. One way is to increase exposure to small or medium-sized companies which might grow at a faster pace than the large global firms likely to already feature in someone’s core portfolio.

WE SUGGEST: Mercantile Investment Trust (MRC)

Managed by JP Morgan, quarterly-dividend paying Mercantile trades at a 10% discount to net asset value despite a pretty decent track record.

The trust is steered by Martin Hudson, who has been at the helm since 1994, alongside Anthony Lynch and Guy Anderson who joined in 2009 and 2012 respectively.

In the last five years it has delivered a cumulative return of 123.5% and this is not just thanks to the fluke of one year of exceptional performance. Only one of those years saw the trust deliver a negative return and three of the years saw returns upwards of 25%.

The focus is on UK companies outside the FTSE 100 with established track records and significant scope for growth. Among its largest holdings are industrials firm DS Smith (SMDS), housebuilder Bellway (BWAY) and health and safety kit maker Halma (HLMA).

‘We continue to believe that UK mid and small cap companies offer good prospects for long-term capital growth and income,’ says Mercantile in its most recent monthly commentary.

WE SUGGEST: Impax Environmental Markets (IEM)

Many people have historically assumed that environmental, social or governance-style funds cannot generate a sufficient investment return.

However, a research note published in March 2015 based on several academic studies saw analysts at Morgan Stanley’s Institute for Sustainable Investing conclude that sustainable equity mutual funds had equal or higher median returns, and equal or lower volatility, than traditional funds for 64% of the periods examined.

Impact Environmental Markets sits firmly in the sustainability theme by investing in global companies which provide environmental solutions through their products and services. Morningstar calculates the investment trust has delivered 7.5% annualised returns over the past 10 years. On a five year basis that annualised return figure jumps to 21.2%.

The top holding in the trust is EDP Renovaveis, a Spanish renewable energy provider which is the world’s fourth-largest wind energy producer. Other names in the portfolio include US waste management firm Clean Harbors and Dutch environmental consultant Arcadis.

55 YEAR OLD PREPARING FOR AN ACTIVE RETIREMENT

SCENARIO A: HOLIDAY OF A LIFETIME

Thanks to improvements in healthcare and greater awareness of looking after ourselves, more people may be fortunate enough to reach retirement in good physical health.

Assuming you are already putting plenty away in a pension to take care of everyday living expenses in retirement, you might want to consider supplementing this future income with a fund for holidays and other activities you could enjoy in the early stages of your retirement.

An ISA is a logical vehicle for this strategy. The following investment trusts are examples which could help you achieve this goal without taking on undue risk. They feature a value-style approach and exposure to smaller companies, a part of the market that has historically outperformed large caps on a longer-term basis.

Both these styles can dip in and out of favour, hence why we suggest you hold them for at least eight years or more.

WE SUGGEST: Miton Global Opportunities (MIGO)

This investment trust invests in other closed-ended funds with the hope of bagging a bargain. Manager Nick Greenwood looks for trusts which are undervalued because they are poorly understood or sit in sectors which are out of favour.

The approach is based on Greenwood’s knowledge base built up over a near 40-year career, proprietary research and frequent meetings with trusts.

The portfolio typically includes between 30 and 50 funds covering a range of global markets and asset classes. Top holdings include Taliesin Property (TPF), which invests in Berlin residential property, and India Capital Growth (IGC) which has a patchy track record but is under new management and offers exposure to one of the world’s fastest growing markets.

WE SUGGEST: Standard Life UK Smaller Companies (SLS)

Smaller companies specialist Harry Nimmo has been running this fund since 2003. He focuses on sustainable dividend and earnings growth and financial strength to narrow the focus to the very best names in the small cap universe.

Once he has identified a potential winner he tends to run with it for the long-term so some of the constituents of the portfolio are no longer that small.

They include premium mixer company and current stock market darling Fevertree Drinks (FEVR:AIM), one of AIM’s largest companies, and FTSE 100 healthcare provider NMC Health (NMC).

The trust trades at a discount despite Nimmo’s strong track record and downside risk is limited by a commitment to buy back shares if the discount stretches beyond 8%.

65 YEAR OLD SEEKING A COMFORTABLE RETIREMENT

SCENARIO A: GENERATING AN INCOME THAT BEATS INFLATION

You are lucky enough to retire at 65 and have reached the point when you will likely begin drawing on the savings you have accrued through the course of your career.

Therefore, you might want to consider switching your investments into products which ideally deliver a nice stream of income, with dividends growing faster than inflation, rather than those which focus heavily on capital gains.

Investment trusts are ideal for income investors thanks to their ability to smooth dividend payments and the next two examples both have enviable dividend track records. They should also provide some element of capital growth which could be handy if you are fortunate enough to live for a long time in old age.

WE SUGGEST: Brunner Investment Trust (BUT)

The Allianz-managed trust delivers income from a concentrated portfolio of global equities. It has increased its annual dividend for 45 consecutive years.

Manager Lucy Macdonald, who has run the fund since 2005, has shifted the focus from UK income stocks to look further afield.

She has noted a growing emphasis on dividends from the technology sector and the recovering income profile of the financial sector as it moves out of crisis mode. Just over 20% of the trust is invested in financials and a little over 10% in tech firms.

Macdonald looks for ‘truly quality stocks’ whose value does not reflect their longer-term prospects. Among the companies she holds are Royal Dutch Shell (RDSB), payments firm Visa and cosmetics giant Estee Lauder. The trust yields 2.2%.

WE SUGGEST: City of London Investment Trust (CTY)

This Janus Henderson product has an exceptional track record of dividend growth which has been maintained by Job Curtis since he took over management of the trust more than 25 years ago.

In 2017 the company increased its annual dividend for the 51st consecutive year and currently yields 3.9% with dividends paid every quarter.

A focus on firms with strong balance sheets is aimed at dodging any disasters in the event of a market downturn.

Nearly 90% of the fund is invested in the UK and more than 70% in the FTSE 100. The portfolio is stacked with familiar names like British American Tobacco (BATS), Vodafone (VOD) and GlaxoSmithKline (GSK). (TS)

DISCLAIMER: Editor Daniel Coatsworth owns shares in Scottish Mortgage mentioned in this article

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine