Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

How and when to pick a financial adviser

Getting financial advice can be a rewarding experience that may even save you money over the long run, but to get the most out of it you need to do your homework.

The fees and type of service can vary considerably so it’s a good idea to attend your initial meeting armed with information and a list of questions.

Why should I consider getting advice?

An adviser who specialises in investments will likely have a wealth of information, expertise and products at their disposal.

Nowadays advisers have to undergo rigorous exams and continuous professional development. They are therefore well placed to determine which investment strategy suits your individual circumstances.

Many advisers can help with other areas of your finances too, including pensions, tax, mortgages and life insurance.

Most people who get financial advice usually do so after a specific life event such as receiving an inheritance or windfall, divorce, buying a home or approaching retirement.

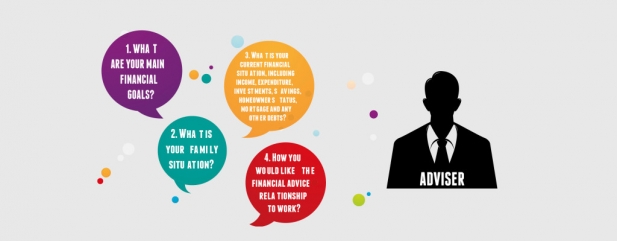

What questions will the adviser ask me?

A financial adviser’s main objective at the first meeting is to understand more about your financial situation and ascertain whether they can help.

VouchedFor.co.uk, a financial adviser comparison site, says typical questions would include:

1. What are your main financial goals?

2. What is your family situation?

3. What is your current financial situation, including income, expenditure, investments, savings, homeowner status, mortgage and any other debts?

4. How you would like the financial advice relationship to work? The adviser will want to ensure their style works for you and that they can help.

Being honest and open when answering the adviser’s questions will ensure they have all the information necessary to draw up a financial plan.

What should I ask the adviser?

Ask as many questions as you need in order to feel comfortable with the adviser and confident they are a good fit for you.

The following questions are a good place to start:

1. How, and how much, do you charge? An adviser is legally obligated to tell you how much they charge before you are taken on as a client. It could be a percentage of your investments or a flat fee.

2. Do you have experience of a situation similar to my own? Some advisers deal only with clients that have a certain level of wealth.

3. What services do you provide? Some advisers can assist with all areas of financial planning while others may specialise in certain areas. Most are not stock-pickers; instead, they focus on the strategy of investing.

4. Are you ‘independent’ and able to give advice on the whole of the Market, or restricted to products from a limited range of providers?

5. Will I work solely with you or with a team?

6. How often, and via what medium, will you communicate?

7. What is your approach to investment? It’s worth discussing the adviser’s methods to understand the process, risks involved and potential outcomes.

8. How regularly will you assess my financial situation?

9. Can I see an example of a financial plan? VouchedFor.co.uk says some advisers may provide a brief overview for clients, whereas others produce an extensive piece of work complete with graphs, charts and all manner of technical lingo.

10. How can I keep track of my money? It could be via an app, phone calls or face-to-face meetings.

12. What is your performance record?

13. What professional qualifications do you have?

If the adviser acts shirty or doesn’t provide decent answers it’s probably a signal to look elsewhere.

‘Do not have any hesitation about asking questions and always reserve the option to step away and give yourself some thinking time if necessary,’ says Keith Richards, chief executive of the Personal Finance Society. ‘A reputable professional adviser will welcome and respect your right to do so. You should never feel under any pressure to do something or take a particular course of action.’

How do I find a good adviser who doesn’t overcharge?

Fees can vary considerably so it’s a good idea to shop around and get several quotes before choosing your adviser.

Fees typically involve three elements: an initial consultation, which ranges from being free up to £2,000; determining the right investment strategy and setting up investments, which costs approximately 2% of your investment or an hourly charge of £100 to £300; and ongoing monitoring and reviews, costing around 0.7% a year.

Cheapest isn’t always best. Check the Financial Conduct Authority’s register to ensure the firm is legitimate and isn’t involved in any scams.

PIMFA, a financial advice association, recommends reading promotional material and terms and conditions carefully to ensure you understand your commitments and aren’t being blinded by something that’s too good to be true.

Sites like VouchedFor.co.uk and Unbiased.co.uk list thousands of advisers around the UK. The former also contains 60,000 verified client reviews.

Karen Barrett, chief executive and founder of Unbiased, suggests trying to find an adviser with whom you ‘click’ personally.

‘If they understand what makes you tick, you’re far more likely to get advice that genuinely improves your life, not just your finances,’ she says. (EP)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

magazine

magazine