Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Is a potential shift to electric cars bad for Johnson Matthey?

There have been growing concerns about the impact of consumers shifting from diesel to electric cars on Johnson Matthey’s (JMAT) sales.

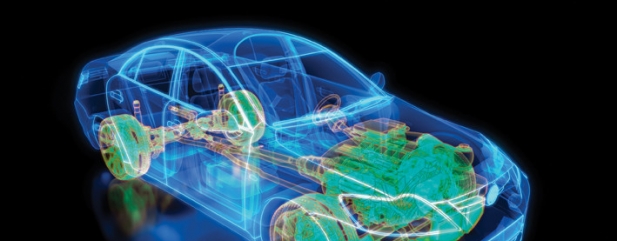

Johnson Matthey manufactures emission control catalysts to control the amount of harmful pollutants emitted from diesel or petrol cars. These catalysts aren’t required in electric cars.

Around 20% of Johnson Matthey’s group sales came from the European diesel market in its financial year ending 31 March 2017, according to Morgan Stanley. Therefore the rise of electric cars is important to the FTSE 100 firm’s investment case.

IS THE MARKET OVERLOOKING JOHNSON MATTHEY’S POTENTIAL?

Morgan Stanley analyst Charles Webb thinks the market is overlooking value in Johnson Matthey’s automotive arm which includes a battery business.

He has an ‘overweight’ rating on the shares which is essentially a ‘buy’ rating.

Webb says investors ‘look past’ competitor Umicore’s catalyst exposure in favour of its battery materials division. Unfortunately for Johnson Matthey, investors appear to only focus on its catalysis products.

Through Morgan Stanley’s analysis, Webb argues the market is valuing Umicore’s automotive battery business at approximately €3bn on an enterprise value basis (market cap plus debt), while Johnson Matthey’s business is being ascribed ‘virtually zero’ value.

HOW IS JOHNSON MATTHEY PREPARING FOR FUTURE TRENDS?

Johnson Matthey is developing its technology in nickel-manganese-cobalt (NMC) cathode materials which can be used in electric car batteries.

‘In less than a year, the company has accelerated its technological competence in NMC cathode materials to a level it believes is comparable with leading market peers,’ says Webb.

The analyst has raised his Johnson Matthey pre-tax profit forecast for each of the next four years including roughly 8% improvement for the years to March 2019 and 2020 (to £555m and £589m respectively). The biggest upgrade goes to 2021 figures, up 9.7% to £640m.

Johnson Matthey’s emission control technologies division is expected to grow thanks to more gasoline use, further regulations on emissions in Asia and an improved outlook for US Class 8 trucks.

In the best case scenario, Morgan Stanley has a target price of £40 if earnings growth and returns from the firm accelerate and diesel penetration falls slower than expected. Johnson Matthey currently trades at £28.83.

The bullish performance would require other catalysts including a recovery in Class 8 truck volumes, which would drive diesel demand, and emission work particularly in Asia in order to boost growth.

Johnson Matthey has unappreciated growth potential. Buy at £28.83 as a long-term holding.

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

- 21 investment trusts now considered ‘dividend heroes’

- Fire safety expert Marlowe reports surge in interest

- FTSE 100 stocks with superior dividend growth

- AA refinances debt to cut annual charges

- Takeover bid for FTSE 100 stock Worldpay

- Significant development in US sports betting market

- Inmarsat sweats on satellites battle

- Three UK stocks grab place on ‘high quality dividend’ list

magazine

magazine