Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

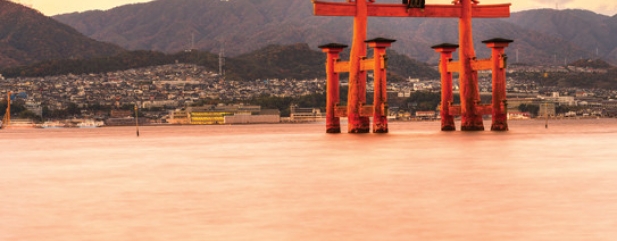

Funds to help portfolios blossom

The Japanese economy appears to be finally cranking back into growth mode after as ‘Abenomics’ and financial stimulus by the country’s central bank take effect.

Reforms, introduced by prime minister Shinzo Abe, are matched by improving corporate governance and are broadly supportive of Japanese shares.

Companies are also flush with cash, meaning there’s scope for material dividend growth and the market is cheap relative to other international markets. UK investors can gain Japanese exposure through a variety of funds.

In the Association of Investment Companies’ (AIC) Japan sector, investors can choose from JPMorgan Japanese (JFJ), Aberdeen Japan (AJIT) and the Andrew Rose-managed Schroder Japan Growth (SJG), a trio of trusts trading at a discount to net asset value (NAV).

JPMorgan Japanese manager Nicholas Weindling summarises the bull case concisely: ‘The long-term outlook is positive: government policy is supportive, steady global demand is a tailwind for the Japanese equity market, and companies are starting to emphasise increasing returns to shareholders. We continue to focus on structural growth areas such as factory automation, growing e-commerce, an ageing population, Japanese companies expanding in Asia and companies prioritising improving shareholder returns.’

Also standing at a discount to NAV within the AIC Japanese Smaller Companies sector is Atlantis Japan Growth (AJG), offering exposure to Japanese small and mid-caps and whose long-term performance record under Taeko Setaishi makes it an interesting vehicle for investors, according to Stockdale Securities.

Trading at a 4.1% premium to NAV at the time of writing is Baillie Gifford Japan (BGFD), the star performer steered since 1991 by Sarah Whitley. The trust pursues long-term capital growth through investments in medium to smaller sized Japanese companies which Whitley views as having above average growth prospects.

Active share of 86% versus the benchmark TOPIX index shows Whitley is prepared to go against the grain. Top 10 holdings include telecom operator-to-tech investor SoftBank, steered by billionaire Masayoshi Son, robotics and factory automation play Yaskawa Electric, internet advertising concern CyberAgent and baby care products play Pigeon.

Within the AIC Japanese Smaller Companies sector, Baillie Gifford Shin Nippon (BGS) has the stand-out 10 year share price total return at 14.3% on an annualised basis, according to Morningstar. Under manager Praveen Kumar, the trust invests in 40 to 75 attractively valued smaller companies offering good growth opportunities.

Kumar is excited about online fashion retailer Start Today, which has successfully fended off competition from the likes of Amazon and a host of smaller players to become Japan’s leading multi-brand mall style website, a one-stop online shop for hundreds of fashion brands. ‘We first bought the shares for Shin Nippon in early 2009. Since then, the share price has increased, but this does not mean that the growth story has run its course.’

Kumar argues Start Today’s long-term growth opportunity remains underappreciated by the market. ‘For one, we believe five years from now the number of people shopping for clothes online will be a lot higher than the market is currently envisaging. This means there is still a significant untapped growth opportunity that other investors are not factoring into their valuations.’

On the widest discount across both Japan sectors is Fidelity Japanese Values (FJV), whose performance has picked up strongly since the appointment of GARP (growth at on a reasonable price) investor Nicholas Price as manager in September 2015.

Japan is increasingly of interest as a dividend income market. Management behaviour and regulation has changed, supported by Abe, the Bank of Japan and the Japan Pension Association. Japan’s excess cash flow is being returned to shareholders through dividends and share buybacks, while dividend cover is stronger overall than in major Western markets.

A great way to capture Japan’s dividend opportunity is via the only dedicated Japanese equity income investment trust, namely CC Japan Income & Growth (CCJI), a concentrated portfolio of 38 stocks managed by Coupland Cardiff Asset Management’s Richard Aston.

‘Our focus is on the shareholder return capabilities of the companies,’ explains Aston, who says it is a high quality portfolio. ‘We don’t focus on value for value’s sake and we don’t want to get involved with value traps. The dividend culture in Japan is very much in its infancy but is gaining attention. There are a lot of companies with net cash on their balance sheets in Japan and dividend payers have outperformed over the last fifteen years.’

CC Japan income & Growth’s top 10 holdings include Nippon Telegraph & Telephone, Japan’s leading fixed line telephone operator offering stable and sustainable returns, tyre maker Bridgestone and semiconductor production equipment play Tokyo Electron. A small company position is Gakkyusha, an operator of cram schools in the Tokyo metropolitan area with the highest admission rates to secondary schools.

Structural gearing of 20% boosts the income generating capacity of the trust and Aston feels this is ‘justified by the long term capital appreciation of the stocks which have demonstrated the characteristics of shareholder return we consider to be important.’ (JC)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

Editor's View

Great Ideas Update

Investment Trusts

Larger Companies

Main Feature

Money Matters

Smaller Companies

Story In Numbers

- Petropavlovsk co-founder kicked off the board after 23 years’ service

- Which FTSE 350 Shares have Lost Shareholders Money

- Which FTSE 350 Shares Rewarded Shareholders

- $390bn wiped off global drug sales forecasts

- 98.6% vote in favour of Standard Life/Aberdeen merger

- London’s shrinking bank industry

- 150M Hurricane blows Crystal Amber down

magazine

magazine