Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

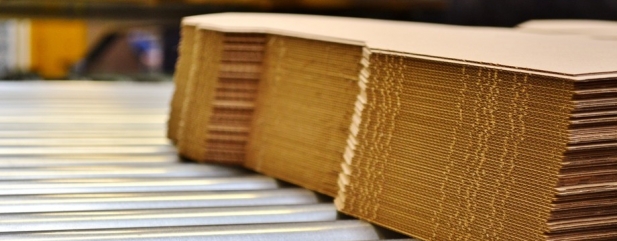

The packaging firm on the cusp of the FTSE 100

It’s been around since 1940, listed on the London stock market since 1986 and just narrowly missed out on FTSE 100 promotion in March. You’d think we were talking about a household name, but £4bn packaging group DS Smith (SMDS) is unfamiliar to most people. That may soon change.

If you’ve bought a new TV or PC, had a parcel delivered after buying something online or seen food products sitting in cardboard display units on a supermarket shelf, then you’ll be familiar with the type of robust packaging produced by DS Smith.

Its customers include Unilever (ULVR), Nestle and Procter & Gamble. These are giants of the consumer goods industry.

DS Smith now also collects and recycles packaging, lowering its own costs while helping customers make progress in achieving their own green targets.

Packaging is a steady industry that tends to grow roughly in line with GDP. That’s about 2% annually at the moment across its key European markets. The rise of internet shopping is one of the levers helping the company expand at a faster rate than 2%.

HEAVY SPENDING

DS Smith has spent about £500m on acquisitions over the past few years, mainly in Europe but also in the US through Indianapolis-based Parish Manufacturing.

It’s been able to do big deals by leveraging its own scale and borrowing capacity in the knowledge that debt can be rapidly paid down from its own reliably large cash flow.

The company threw off £237m of cash from operations in the six months to 31 October 2016; and it is on track to beat the £363m generated in the last full year.

Hand-in-hand with expansion comes production streamlining. This led to the 2015 closure of its 250-year-old paper mill in Wansbrough, Somerset. Updating its creaking production lines was deemed too expensive.

That was bad news for the local community and not great for shareholders given the £79m associated cost of shutting down Wansbrough (although this headline figure also included other closures, restructuring and acquisition expenses).

Pre-tax profit for the year to 30 April 2016 grew by 3% at constant currencies to £201m. Perhaps a better indication of performance is adjusted pre-tax profit (before amortisation and associate charges) which rose 15% to £332m.

Stockbroker Stifel forecasts pre-tax profit will grow to £378.4m in the year to 30 April 2017 and then hit £416.2m a year later. Those are very decent levels of growth for a company the size of DS Smith, in our opinion.

Stifel has a 515p price target, which implies about 23% upside from the current 418.5p share price. DS Smith is also forecast to pay 14.9p dividend over the next financial year. That would equate to a 3.5% prospective dividend yield.

Adding the 23% implied share price upside to the 3.5% potential yield gives you an indicated 26.5% potential total return over the next year – which is very attractive. We’d caveat that statement by saying such a return is not guaranteed.

TELL ME MORE ABOUT THE INVESTMENT CASE

Arguably, the criticism levelled at DS Smith most is its implied cyclicality. By that, we mean the company’s fortunes could rise and fall in line with global economic strength or weakness.

Analysts, including JP Morgan’s Alexander Mees, increasingly argue that earnings volatility is being reduced by concentrating on the FMCG (fast moving consumer goods) space.

That debate is likely to keep running although the group’s growth record during the past few years is fairly unblemished.

Input costs remain important factors to monitor. For example, you should look at the raw fibre materials used to make paper and cardboard, and energy prices given a paper mill’s heavy use of electricity.

Both of these costs can be partly offset by the use of energy efficient technology, while some of any extra expense has often been successfully passed on to customers.

‘It is the proof of DS Smith’s business model that, in general, market input changes cause variation in earnings expectations of no greater than the range of forecast error,’ says Hector Forsythe, analyst at investment bank Stifel.

A CLOSER LOOK AT IMPORTANT NUMBERS

Net debt at the half year stage on 31 October 2016 stood at £1.16bn. First half interest payments of £31m are comfortably covered by earnings and cash flow.

Return on average capital employed stood at 15.1%, which is a healthy figure and at the upper end of its 12% to 15% target range. This ratio reveals the profitability against investments made in the company.

DS Smith has adapted an old economy business to the digital age well. We see more incremental upside to the share price and believe it stands a good chance of getting in the FTSE 100 in the near future. (SF)

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

- Energy in a spin over plans for power price cap

- Wincanton joins list of potential takeover targets

- Virgin Money shrugs off unsecured debt concerns

- Sportech easier to swallow after pools sale

- Tritax investors offered cheap shares

- Spanking for Sports Direct

- Robotics stocks could get boost from Trump policies

- Whitbread burnt by Costa sales decline

Editor's View

Feature

Great Ideas Update

Investment Trusts

Larger Companies

Money Matters

Smaller Companies

Story In Numbers

- ZPG could tap £3bn revenue opportunity

- £1,470: Moneysupermarket saves you money but is it a good investment?

- 71 month high: French business activity

- FTSE 350 sectors, best performers

- Commodity prices this year selection

- £150m: Debenhams’ costly to-do list

- $5.4trn: Record ETF flows boost world’s largest asset manager

- £100bn: Search advertising market is booming

magazine

magazine