Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Reliable growth and income with Zytronic

Reliable growth at a reasonable price is not always easy to find among smaller companies but Zytronic (ZYT:AIM) is a UK technology business that offers just that. Paying dependable dividends on a 4%-plus yield, investors get a carefully run, attractive, income-paying stock with all the tax breaks that AIM offers.

The shares often look inexpensive relative to the wider sector; they currently trade on a forward price to earnings (PE) multiple of 14.2 for the full year to 30 September 2017. The rating dips to 13.5-times 2018 forecasts. This is largely due to the project nature of its contacts with limited forward visibility, a factor that upset trading briefly in early 2013.

But Zytronic is also a big exporter (95% of revenue goes overseas) that stands to leverage the weak pound through this year and beyond as previous hedging contracts unwind. It is also improving the quality of its profits through judicious investment in research and development, and has emerging growth market opportunities before it.

Bigger displays, higher profits

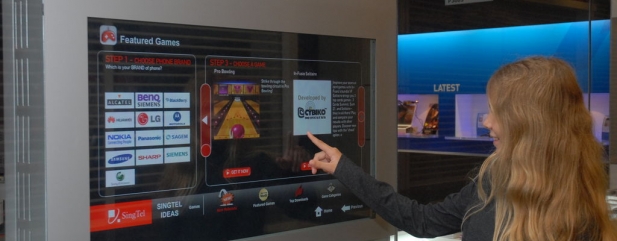

The Newcastle-based company designs and builds rugged, mainly touch-interactive displays. It built its reputation on outdoor applications, ATM machines in particular, but is increasingly tapping new markets. Interactive screens for gaming terminals are a significant market, plus vending machines, medical appliances, entertainment displays and other industrial applications where touch-screen controls tend to get bashed about. It supplies the displays for London’s ‘Boris Bikes’ terminals, for example.

For many of the company’s customers bigger is better. Much larger and curved touch displays are in demand, 30 inches or larger, used as they are to engage with consumers or boost productivity. This is a plus for Zytronic because it means more capacitive technology components are used per unit, boosting profit margins.

The company sold 14,000 display units of 30 inches or bigger last year, up from 9,000 in 2015, helping gross profit margins improve from 41.9% to 42.8% year-on-year.

Encouragingly, underlying trading continues to strengthen. Given management’s typically cautious guidance, this could see the company outperform current expectations. Further positive notes on trading would likely see forecasts raised, bolstering investor sentiment further and trigger a meaningful re-rating of the stock.

With net cash of £11.6m (19% of the market cap), there’s also a decent chance that some of that surplus money could be returned to shareholders as a special dividend. (SF)

Zytronic (ZYT:AIM) 405p

Stop loss: 324p

Market value: £61.7m

Important information:

These articles are provided by Shares magazine which is published by AJ Bell Media, a part of AJ Bell. Shares is not written by AJ Bell.

Shares is provided for your general information and use and is not a personal recommendation to invest. It is not intended to be relied upon by you in making or not making any investment decisions. The investments referred to in these articles will not be suitable for all investors. If in doubt please seek appropriate independent financial advice.

Investors acting on the information in these articles do so at their own risk and AJ Bell Media and its staff do not accept liability for losses suffered by investors as a result of their investment decisions.

Issue contents

Big News

Editor's View

Great Ideas Update

Investment Trusts

Larger Companies

Smaller Companies

Story In Numbers

- £24.3bn: Personal pension contributions break new record

- 15.7% jump in UK remortgage approvals in January

- Real Estate Investment Trusts

- FTSE All-Share Sectors

- 66%: Potential jump in IMI’s 2017 earnings per share

- 24%: US worst offender for cyber-attacks

- $6.47bn: Warren Buffett’s costly mistake

- 10 years: First dividend growth in a decade from Intu

magazine

magazine