Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

Property investment trusts currently offer annual dividend yields of 5% and discounts to net asset value of 9% on average (see Table 1 below). Russ Mould, AJ Bell Investment Director, looks at whether now could be the time for long-term investors to consider investing in commercial property:

“The recent suspensions of a number of the most popular commercial property funds has understandably spooked retail investors, However, a number of recent announcements suggest that the current downturn in commercial property may not be as severe as that triggered by the 2008 financial crisis:

- British Land, the UK’s second largest property group, announced a series of lettings and sales deals following the referendum, including the £400m sale of the flagship Debenham’s store on Oxford Street

- FTSE 250 Real Estate Investment Trust (REIT) Derwent London announced it has pre-let 46% of the first phase development of its White Chapel Building in London, E1. Encouragingly, the firm noted that three of the four new tenants signed their ten-year leases after the EU referendum result became known on 23 June.

- Legal & General reduced the downward fair value adjustment of its UK Property Fund from 15% to 10%, noting that valuations had begun to stabilise after 6 July.

“The recent suspensions of open ended funds may have tarnished commercial property as an investment and questioned whether an open-ended fund is the ideal structure for what is an illiquid asset. However, commercial property remains an important asset class within a diversified investment portfolio and there are alternative options available to retail investors.

“Investment trusts have not been forced to suspend withdrawals because their shares are traded on the open market and their access to permanent capital means they are not obliged to sell the underlying property investments if investors want to cash out. That is what caused open ended funds to close, as they are subject to the ebb and flow of customers’ money.

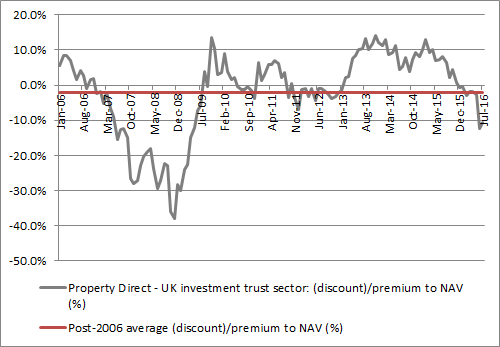

“During the 2007-09 crisis, the overall investment trust property sector briefly traded at a 38% discount to net asset value (NAV) at its low. This compares to a 10-year average discount of just 2%:

Source: The Association of Investment Companies, with particular thanks to Jemma Jackson

NOTE: Past performance is not a guide to future performance and some investments need to be held for the long term.

“Following an average fall in share price of 4.7% since the Brexit vote, the current average discount to NAV for UK property investment trusts is 9.4%, some way off the lows of 2008 and potentially offering value compared to the long term trend over the past three years.

“With some trusts offering dividend yields well north of 5%, income-focussed investors may decide that now is a good time to add these investments to their portfolio, particularly if they have a long term time horizon of 10 years or more.”

Table 1: UK property investment trusts

| Investment company | Share price since Brexit vote* | Dividend Yield | Discount to NAV |

| Drum Income Plus REIT | 0.00% | n/a | 13.60% |

| AEW UK REIT | -4.50% | 5.80% | -1.70% |

| Standard Life Investments Property Income | -7.40% | 6.10% | -6.10% |

| Ediston Property | -8.20% | 5.50% | -7.60% |

| Regional REIT | -9.80% | 7.10% | -9.30% |

| F&C Commercial Property | -2.40% | 4.90% | -9.50% |

| UK Commercial Property | -2.60% | 4.80% | -10.60% |

| Picton Property Income | -2.50% | 4.80% | -10.90% |

| Schroder Real Estate | -4.10% | 4.70% | -11.20% |

| F&C UK Real Estate | -5.90% | 5.70% | -11.50% |

| AVERAGE | -4.7 | 5.10% | -9.40% |

Source: The Association of Investment Companies, Morningstar for the Property Direct – UK category and Thomson Reuters Datastream

* From the close on 23 June to the close on 20 July

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05