Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“A firm hand is required by George Osborne in tomorrow’s autumn statement as history shows that GDP growth fuelled by high public borrowing is unsustainable.

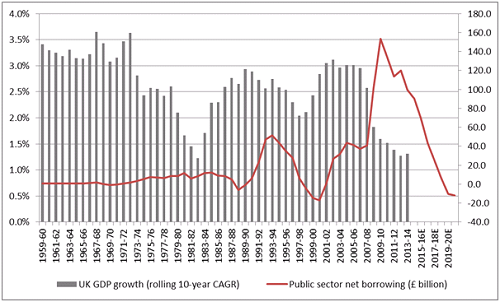

“The explosion in debt in the late 2000s has hammered growth in the 2010s (see chart 1) and similar periods of falling growth followed periods of increased public borrowing in the early 80s and late 90s.

“The overwhelming narrative of this Government is its determination to wipe out the annual deficit by 2019, but this was dealt a blow in October when the deficit ballooned 16% from a year earlier to £8.2bn.

“The chances of Mr Osborne relaxing his austerity drive look unlikely, particularly if the OBR raises its forecast for the deficit for this year.

“That means growth is likely to remain modest and interest rates lower for longer, as a sudden leap in borrowing costs would only increase the Government’s debt burden. Only time will tell whether lower borrowing will lead to a period of more sustainable economic growth.

“From an investment perspective, in the immediate term this is likely to place a continued premium on income and reliable sources of either dividends or coupons, and also on firms which enjoy pricing power and can grow their earnings almost whatever the economic conditions.”

Source: ONS / AJ Bell research

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30