Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

In a year when we have already seen the Swiss franc rocket, crude oil prices bounce and sovereign bond prices gyrate horribly investors could be forgiven for feeling exhausted as we approach the summer holiday season. Yet the ongoing Greek drama, an abrupt correction in Chinese stocks and debate over the timing and speed of interest rate rises in the USA and UK are making the headlines and obliging us all to focus on the big picture once again.

In this environment, a good multi-asset macro fund will be looking to add value and there is no shortage of choice of funds in this space, although they tend to be scattered across a number of categories, including Alt – Global Macro, Alt – Multistrategy, USD Flexible Allocation and USD Moderate Allocation. The table simply highlights the top five performers over five years from across all of those four segments.

Best performing multi-asset or macro OEICs over the last five years

| OEIC | ISIN | Fund size £ million | Annualised five-year performance | Dividend yield | Ongoing charge | Morningstar rating |

| Odey Absolute Return I GBP (Acc) | GB00B55NGS86 | 896.8 | 22.0% | n/a | 0.92% | n/a |

| FP Argonaut Absolute Return I (GBP hedged) Net (Acc) | GB00B79NKW03 | 258.3 | 14.0% | n/a | 1.06% | n/a |

| MFS Meridian Global Total Return I1 GBP (Inc) | LU0219434361 | 2,173 | 8.3% | n/a | 0.82% | ***** |

| Franklin Income Z (Acc) USD | LU0476945232 | 2,470 | 7.0% | n/a | 1.16% | ***** |

| Veritas Global Real Return A GBP | IE00B5W1LR97 | 80.3 | 6.5% | 2.0% | 1.29% | n/a |

Source: Morningstar, for Alt – Global Macro, Alt – Multistrategy, USD Flexible Allocation and USD Moderate Allocation categories. Clean funds only.

Where more than one class of fund features only the best performer is listed.

There are also certain investment trusts to consider as an option. Those listed in the table below come from the Hedge Fund category.

Some investment trusts also offer the macro or multi-strategy options

| Investment company | EPIC | Market cap (£ million) | Annualised five-year performance * | Dividend Yield | Ongoing charges ** | Discount to NAV | Gearing | Morningstar rating |

| BH Macro Limited GBP | BHMG | 764.1 | 3.3% | n/a | 1.94% | -5.3% | 0% | n/a |

| Bluecrest All Blue Fund | BABS | 740.9 | 2.7% | n/a | 0.10% | -4.6% | 0% | n/a |

| BH Global Limited GBP | BHGG | 366.1 | 2.6% | n/a | 1.18% | -5.0% | 0% | n/a |

Source: Morningstar, The Association of Investment Companies, drawn from the Hedge funds category

* Share price. ** Includes performance fee

There is even an Exchange-Traded Fund (ETF) to note. This is the db X-trackers SCM Multi-Asset UCITS ETF, which trades under the ticker XS7M and is designed to put money to work across a range of exchange-traded funds that are linked to equities, fixed income and commodities.

Given the prevailing volatility, multi-asset and macro funds will be looking to take advantage of any bumps in the road, to sell expensively and buy cheaply. Buy-and-hold investors are unlikely to be as interested and may prefer to stick and tried-and-tested specialist collectives, closed or open-ended, but adaptable, nimble and dynamic funds, may appeal to some whether they are run by fund managers, algorithms or a combination of the two.

Big picture, biggest issues

This column has attended several fund and wealth manager briefings to take the pulse of what the market is thinking and worrying about, where it sees danger and where it sees opportunities. To summarise the key themes of BlackRock's multi-asset team, Allianz Global Investors crack investment trust squad and wealth manager Plurimi, a specialist in global macro, they between them suggest investors need to think about the following:

The US economy and global growth. Doubts about global growth linger, with Allianz's Neil Dwane, Chief Investment Officer (CIO), Equities Europe, fearing moderate trend growth is the most likely outcome for some time to come. BlackRock's Pierre Sarrau, deputy CIO for Multi-Asset Strategy, sees recovery rather than secular stagnation ahead, citing International Monetary Fund (IMF) research which argues a lower oil price could add one to 1.5% to global GDP, even if he accepts global develeraging is a major headwind. Patrick Armstrong of Plurimi is more firmly in the recovery camp, at least for the USA, where he believes Q1's drop in ouput was a weather and port-strike inspired blip. Improved retail sales, consumer confidence and housing activity all point to a robust Q2 GDP growth number, in his view.

Interest rates. Divergent views on US economic growth colour the consensus outlook here. Plurimi expects an American rate rise in September, albeit one of perhaps 0.1% or 0.125% rather than the usual 0.25% increment, with another move by December. He only expects rates of 3% to 4% by 2018. Allianz also expects rates to remain highly accommodative and lower for longer, owing to the global ongoing need to pay down debt. No-one seems to expect the UK to move before the US, with a 2016 rate hike expected from the Bank of England.

Markets still await first shift in US and US base rates

Source: Thomson Reuters Datastream

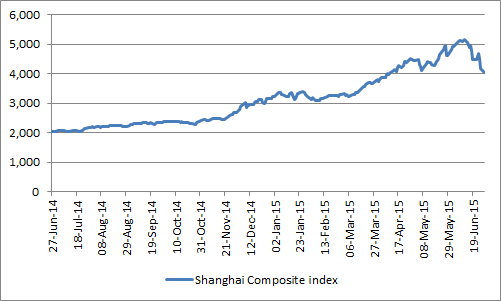

The Eurozone. Allianz does not believe the Eurozone is broken and there was an expectation that some compromise would be found, to keep Greece in the fold. This may still prove to be the case, especially if Syriza loses the Greek referendum vote on Sunday, but even in the event this proves wrong the consensus seems to be the broader economic fall-out will be limited. Europe has had fiveyears to prepare for this, after all, and Plurimi even argues a major financial market shake-out could see the European Central Bank (ECB) increase its Quantitative Easing (QE) scheme. No-one expects Mario Draghi to halt the programme before his September 2016 deadline.China. The absence of strong growth in the West means China's long-run structural potential catches Allianz's eye, even as China remodels and tries to shift from construction and exports to consumption. Plurimi does not expect a hard landing either and argues the authorities have lots of fiscal and monetary levers to help them manage both the economy and markets alike. Last weekend interest rate cut, the fourth since November, supports this view, even as Chinese equities stumble following a stunning run.

China has cut rates again as its equity market continues to correct

Source: Thomson Reuters Datastream

In terms of positioning, Plurimi feels Europe, Japan and China offered the most potential from an equity perspective, not least because of loose monetary policy from central banks, while he fears the US may be overvalued. By currency, Armstrong accepts a strong dollar is a consensus call, but feels a US rate rise in September will give more bang to the buck.

BlackRock's team is wary of froth in China and also the dollar, while it is on the look-out for signs Japan and European bonds may also be crowded trades. Its proprietary dashboard of indicators suggest energy stocks and soft commodities may be unloved and represent potential pockets of value.

Allianz Global Investor's Dwane shares Armstrong's cautious view on US equities, citing concerns over valuation, the low quality of corporate earnings (a reliance on buybacks) and rampant management selling of stock. He flags a preference for Europe, where company profit margins are still below peak and dividend yields relatively attractive on a historic basis, as well a focus on stocks that can offer secular profit growth or dividend increases or both – in other words, just the sort of stocks targeted by the Merchants Trust and Brunner Investment Trust teams.

Referendum riddle

It may surprise some not to see Greece at the top of the list, though events in Athens and Brussels continue to move at speed. It is also worth noting a post on the ever-intriguing website Wolf Street which flags a FactSet survey of American corporate trading statements and the countries US management teams have talked about the most in June. Greece doesn't get a mention, perhaps because it represents barely 2% of Eurozone GDP and less than 0.5% of global output.

Top five countries mentioned by US corporations in June earnings calls

For the moment, European stocks and bonds simply look to be losing the ground gained in the week running up to the 20 June negotiations deadline. Whether the malaise runs deeper will depend on the results of the Greek referendum on 5 July. It seems possible that the European Central Bank has managed to limit any economic contagion, given the European banking sector now has limited exposure to Greece's debtpile. The ECB, IMF and the European Financial Stability Facility (EFSF) are now on the hook for around 60% of Athens' €323 billion in Government debt, so the risk has been transferred from banks in no small part to European taxpayers.

Bulk of Greek debt is now held by the ECB, IMF and EU

Source: IMF, EU Commission

However, as Mark Tinker, Asian Equity Strategist at AXA Investment Management shrewdly points out, what we still can't gauge is the full possible impact upon financial markets. A story in the International New York Times suggested hedge funds have shovelled € 10 billion in to Greek bonds and stocks in the view a compromise deal to keep Athens in the Eurozone and the euro would be found. If this proves to be wrong, someone, somewhere could lose heavily, especially if they are using leverage – and as advisers and clients with long memories will remember from financial crises and bear markets such as those of 1997-98, 2000-03 and 2007-09, it is leverage and a lack of liquidity that cause meltdowns, even if it is unexpected events that trigger them.

An island apart

The one topic which hardly seems to crop up at all during these macro briefings was the UK, which in some ways may be apposite given our island status. Concerns over the General Election result have faded away, amid the apparent perception that the unexpected Conservative majority was a market-friendly development, although we now await the Budget on 8 July to see exactly what the Cameron-Osborne team has in mind.

Nevertheless, the rally in the FTSE All-Share the day after the ballot (8 May) now seems like a distant memory, as the benchmark index has since lost 5% of its value. The issue of a referendum on EU membership and a possible departure from the economic bloc - or ‘Brexit’ – is not going away, even if the prospect of a more immediate Greek dash for the outdoor is dominating markets’ attentions right now. Moreover, the UK’s heavy market cap weighting toward banks, miners and energy stocks is hardly helpful, as these sectors continue to lag. The graphic below shows these three areas' performance on a week-to-week basis in 2015, ranking them from one (the best) to 39 (the worst) among all of the industrial groupings which make up the FTSE All-Share. For UK equities to kick on these three need to make fresh ground.

Banks, miners and oils are holding back the UK's broader equity indices

Source: AJ Bell Research, [ITAL] Shares Magazine. Shows performance ranking, from one to 39, relative to other sectors in FTSE All-Share.

The 10-year gilt yield continues to creep higher, confounding those (including this column) who thought the 2% threshold might prove a floor. Government debt is teetering on bear market territory and for the moment bond investors appear to be thinking inflation, a rate rise or both are coming soon and not just here. Inflation figures remain subdued but wages do seem to be creeping higher on both sides of the Atlantic, giving central bankers pause for thought, even if the debate remains fierce. No sooner had Bank of England Monetary Policy Committee member Martyn Weale made a strong case for an early rate rise in an interview with the Financial Times (23 June) than the central bank's Chief Economist Andy Haldane used a speech to argue against a pre-emptive increase in borrowing costs (30 June)

Only sterling is really holding its own at the moment, perhaps encouraged by Chancellor Osborne’s steely talk of fresh austerity and possibly helped by the Eurozone’s woes, which continue to harm sentiment toward the euro, as well as Japan’s ongoing Quantitative Easing (QE) programme).

The final word

For the moment Greece is the word and events in Athens and Brussels are key. While neither Allianz’s investment trusts nor Plurimi gave any indication they had gone down this path, there is plenty of anecdotal evidence to suggest some money managers have let cash levels creep higher, in anticipation of a chance to buy on any Greek-inspired dips.

After all, the old market saying has it that you can have good news and cheap stocks, just not both at the same time, so it will be interesting to see how far any correction does go before someone steps in looking for potential bargains. From an equity perspective, Allianz’s work suggests the markets which look most expensive on a cyclically-adjusted earnings basis include the USA and Japan. The UK and MSCI Europe, which continue to look respectable on a relative basis, although, while the list of cheapest markets include a rogues gallery of Greece, Russia and Argentina.

There can be little better way of illustrating the old market saying that you can have good news and cheap stocks, just not both at the same time.

Cyclically-adjusted valuations for major global equity markets

Source: Allianz Global Investors Economics & Strategy, Thomson Reuters Datastream.

The Shiller price/earnings (PE) ratio reflects the average profits of the last 10 years and attempts to eliminate cyclical fluctuations.

Past performance is no guarantee of future returns.

Data as of January 2015.

Russ Mould

AJ Bell Investment Director