Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

One of the tracks for which singer-songwriter Ian Dury was best known was Sex and Drugs and Rock and Roll and when it comes to testing the market's appetite for a little excitement, advisers and clients just need to substitute for the first word for the Philadelphia Semiconductor index – or SOXX – to get a fair gauge of the market mood.

Technology is often a popular sector with advisers and clients alike, given the tempting prospect of strong organic growth, almost regardless of the macroeconomic backdrop. Any firm with a new, disruptive innovation, which offers ease of use, productivity gains, life enhancement, amusement or all four at a keen price can quickly seize control of a very profitable new market or gobble up the profits of dominant player in an already well-established one.

Whatever the product or service, it is a pretty fair bet that it will there will be silicon chips somewhere in the foodchain, be it within a server, smart meter or handheld device. Concepts such as Apple's iWatch, the Internet of Things, Big Data, Self-Driving Cars and the Connected Home will not function without semiconductors.

Enthusiasm for these ideas, and the growth potential they offer may explain why the technology-laden NASDAQ Composite index is again flirting with the 5,000 mark last seen in 1999 (even if biotechnology's renaissance has a big say here, too). In the UK, the Technology Hardware & Equipment sector has outperformed nicely, racking up a 16.5% gain year-to-date against a 7.5% rise in the FTSE All—Share, even as Software & Computer Services has lagged a little.

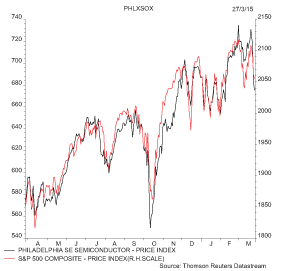

The SOXX has also got in on the act, regaining the 700 mark it lost as the technology, media and telecoms bubble began to burst 15 year ago.

The SOXX has surged this year

Source: Thomson Reuters Datastream

However, late March's string of mixed economic data and some patchy trading statements have helped to push the SOXX back below that 700 threshold. The upcoming first-quarter corporate reporting season from America's leading chip and chipmaking equipment stocks could therefore provide a useful readthrough on both the global economy and also broad equity market sentiment. The chart below shows how the S&P 500 and the SOXX are pretty closely correlated.

How the SOXX smells tends to influence the broader US market

Source: Thomson Reuters Datastream

Killer apps

The SOXX can be easily followed on free information sources such as Yahoo! Finance and even accessed via a number of US-listed exchange-trade funds. It is formed of 30 leading silicon chip and chip-making equipment specialists. Most are American, including microprocessor giant Intel, Analog Devices and Texas Instruments, but Taiwan Semiconductor Manufacturing Company (TSMC) and the UK's ARM are also featured.

The share price of ARM, the UK's largest quoted technology firm by market cap, and the SOXX also appear correlate to a degree, even if the Cambridge firm's model is very different from those of the mainstream chipmakers. It neither makes chips, nor designs them, instead licensing out microprocessor architectures upon which other chip firms can then base their own individual products. ARM also banks a royalty, on average in the region of four to five cents a time, whenever an electronic device containing a chip based on its intellectual property is shipped.

THE UK's ARM is a member of the SOXX

Source: Thomson Reuters Datastream

ARM is therefore a play on both the power of its IP but also device end volumes. In the fourth quarter of 2014, nearly half of royalties were related to mobile and smartphone unit shipments.

Global chip volumes are driven by global GDP growth, rising silicon content per device as tech gadgets offer greater functionality and also the appearance of new killer applications, which drive product cycles. Prior killer apps include the colour TV in the mid-1960s, the pocket calculator in the 1970s, the video cassette recorder in the 1980s, the Windows PC in the 1990s and the smartphone in the 2000s.

Last year was a good one for the silicon chipmakers, as global wide sales rose 9.9% to $336 billion, according to trade body World Semiconductor Trade Statistics (WSTS). That was the best year since 2011.

The global chip industry is looking to build on a strong 2014

Source: WSTS, SIA, Gartner

However, it was only the third that came in above the industry's long-run compound annual growth rate (CAGR) in sales of 9.3%. Moreover, WSTS forecasts for sales growth of 4.9% for 2015 and 3.1% for 2016 hardly set the pulse racing, especially after a XX% run in the SOXX since XXXX.

Crunchtime for Apple suppliers

According to IC Insights, the computing and communications segments each generated just over one-third of worldwide integrated circuit demand in 2014. Consumer electronics represented a further 12%, cars around 8% and industrial, medical and other applications the rest.

Product penetration levels are high, economic growth is tepid and the timing of the Windows 10 launch and hardware upgrade cycle has yet to be confirmed. PC-related names like Intel and Hewlett-Packard had a good 2014 as Microsoft's decision to withdraw the 13-year-old XP operating system boosted demand for new machines but this effect has begun to wear off. Microsoft also needs to make sure Windows 10, codenamed Threshold, is a lot more popular than the stink bomb that was Windows 8, back in 2012.

Intel and Microsoft share price weakness smacks of weakness in the PC market

Source: Thomson Reuters Datastream

Microprocessor giant Intel got the first-quarter updates off to a bad start with a stinker of a profit warning (3 March). Bulls were quick to blame this on stock specific issues, related to softer-than-expected PC demand. It is to be hoped they are correct even if several big chipmakers should still be able to bask in the warm glow cast by last autumn's launch of iPhone 6 launch.

Apple continues to thrive on the back of the iPhone 6

Source: Thomson Reuters Datastream

Apple remains a source of good news for chipmakers, although SanDisk flash memory maker SanDisk would disagree after a second profit warning this year (27 March) crushed the stock. Analysts were quick to blame the Californian firm's loss of key contracts with Apple to Korean rival Samsung Electronics. Hopefully this is not the beginning of a classic cycle, where analysts cite company specific issues, then retreat to championing the “higher quality” names of a sector as more disappointments follow and then circle the wagons around the few names yet to warn. Only when the final few cough up bad news and the whole sector has collapsed do the scribes finally acknowledge there is an industry-wide problem, even if by then it is too late to help clients preserve their wealth.

Apple's second-quarter numbers are due towards the end of April. Microsoft's Q3s are slated for 23 April and Intel's Q1s. In the case of Intel, March's warning should have taken care of those and greater interest will lie with the outlook statement for the second quarter.

Between them these three could set the tone for the SOXX and its constituents such as ARM but also the S&P 500 and thus equities globally, given the apparent correlation between the chip and broader US equity benchmarks.

Russ Mould, AJ Bell Investment Director

Related content

- Wed, 17/04/2024 - 09:52

- Tue, 30/01/2024 - 15:38

- Thu, 11/01/2024 - 14:26

- Thu, 04/01/2024 - 15:13

- Fri, 17/11/2023 - 08:59