Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“I am convinced that if it [the price system of a free market] were the result of deliberate human design, and if the people guided by the price changes understood that their decisions have significance far beyond their immediate aim, this mechanism would have been acclaimed as one of the greatest triumphs of the human mind.”

Thus wrote the Austrian economist Friedrich Hayek in 1945's The Use of Knowledge in Society as he espoused the view the market's ability to turn freely available information into an agreed price was a “marvel”.

Markets cannot be entirely efficient, or always right, for it would be impossible to make money if it were, but Hayek's words do mean that investors should always respect what the market is telling them. Portfolio builders may not agree with what is happening but they have to be aware of it, respect it and stress test their own views against it, since someone, somewhere is happy to pay the prevailing price for an asset or security and for what they feel to be a good reason.

One method here is to follow boardroom purchases or sales of company stock, especially if a gaggle of directors are acting at once, as in theory no-one knows more about a firm than the people who are running it. But investors can take this one step further and look at what proven money-makers are thinking about not just their company but a whole industry.

The question then is who to follow. Warren Buffett’s record at Berkshire Hathaway makes his views always worthy of consideration, while the activities of the shrewdies in the private equity business are another – after all it is their job to buy assets cheaply and then sell them on.

It is therefore worth investors putting their ear to the ground right now. The noise created by Quantitative Easing (QE) programmes in Japan the Eurozone and Sweden, as well as interest rate cuts by over 20 central banks this year, is currently drowning out everything – and may well do so for a while yet – but this should not excuse everyone from paying attention to what the smart money is doing.

The smart money

Property magnate Raymond Mould (no relation) has a good reputation for calling the top and bottom of the commercial real estate cycle with some aplomb. It is unlikely that he just got lucky selling Arlington at the height of the 1980s property boom, setting up Pillar Properties in 1991 only to sell that in 2005 before the recession hit and then set up London & Stamford, what is now FTSE 250-listed Londonmetric Property in 2007 to take advantage of a major retreat in valuations. Any client thinking of an investment in the commercial property asset class should potentially look at what Mould is doing.

Raymond Mould's track record as a seller and buyer of commercial property assets is hard to beat

Source: Thomson Reuters Datastream

There are other examples of where a leading figure has made a call on an entire industry. In November 2011, the Oppenheimer family announced the sale of its 40% stake in De Beers for $5.1 billion to Anglo American (AAL), a deal which concluded in August 2012. The timing looked odd at first. Luxury goods stocks were doing well and mining stocks were still a long way from clients' doghouse. The official word from the Oppenheimers cited the lack of an obvious successor to the 65-year old family head, Nicky Oppenheimer. Market chatter at the time surrounded how a growing flow of unregulated 'blood' and 'conflict' diamonds had started to become problematic for the industry.

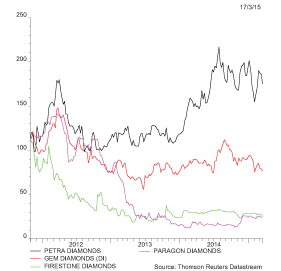

Whatever the reason for the sale, Anglo American has hardly thrived since, even if its biggest challenges are not diamond-related, and other London-listed diamond stocks have struggled to make headway.

Diamond stocks have not shone since the Oppenheimer sale of De Beers

Source: Thomson Reuters Datastream, AJ Bell Research. Share prices rebased to first (Petra Diamonds).

The nature of their trade means private equity firms have to be canny buyers and shrewd sellers. Some savvy investors may have therefore taken the hint when private equity giant Blackstone took itself public and floated in summer 2007. No sooner had the stock started trading than the credit crisis hit and global equities collapsed.

Blackstone exit helped to call the top in 2007

Source: Thomson Reuters Datastream, AJ Bell Research.

It is therefore interesting to see statistics published this week by the Financial Times newspaper. It cites data from Dealogic which show private equity sales have risen by one third year-on-year so far in 2015, to $63.5 billion. This comes after 2014's industry-wide disposals worth $428 billion, the highest figure since 2006's $308 billion of sales.

Big private equity purchases are still going through, helped by the availability of cheap debt, but it will be interesting to see how the net balance of trade develops this year and if inferences can be drawn on whether private equity firms feel public company valuations mean they are a buy or a sell.

One man who continues to deploy cash selectively is Warren Buffett of Berkshire Hathaway. The latest annual report and accounts show how the investment vehicle's cashpile continues to grow as the Sage of Omaha sticks to his value-driven disciplines. The chart below clearly shows how Berkshire appears to invest most aggressively when the markets are falling – and stocks are cheaper – and with greater caution the higher markets go.

Berkshire Hathaway's net cashpile continues to grow

Source: Berkshire Hathaway accounts, Thomson Reuters Datastream, AJ Bell Research

The contrarian indicator

Just as it is worth tracking the flow of proven smart money, investors might need to be wary of potential contrarian indicators. Every cycle features events which strike a discordant note that unwittingly call the top or the bottom, even if this regrettably only becomes apparent with the benefit of some degree of hindsight. For example:

- The flotation of Pets.com in February 2000, and attendant froth in the initial public offering (IPO) market helped call the top in the tech bubble and the NASDAQ. The loss-making concern raised $76 million at $11 a share but buyers came unstuck as the stock went to $0.19 before its suspension just nine months later.

Pets.com flotation helped call the top of the tech bubble

Source: Thomson Reuters Datastream, AJ Bell Research

- The Bank of England’s decision to sell gold between 1999 and 2002 at an average price of $275 an ounce looks less good for the seller and very good for the buyers, as the precious metal bottomed at $250 an ounce.

Bank of England's gold sales helped called the bottom

Source: Thomson Reuters Datastream, AJ Bell Research

This column has pointed out before how companies have a bad habit of buying back stock near the top of the market cycle, when their shares are generally more expensive, and ceasing to do so when their shares are cheaper (see Cash Returns Are Still King, 14 November 2014 here ). Should anyone doubt this, please direct them to a September posting on the ever-interesting www.aswathdamodaran.blogspot.co.uk site. The opening chart looks at dividends and buybacks in the US going back to 1980 and shows how buybacks peaked in 2007 and collapsed in 2008 and 2009 only to accelerate again in 2011 and 2012.

Companies do not always buy back their shares as part of a rigorous capital allocation policy. Executives sanction these purchases to goose their share price so stock options are worth more, respond to shareholder pressure or simply as a gesture of faith.

As such, buybacks can be an investor relations tool rather than a valuable signal for advisers and clients. It is therefore interesting that the European Central Bank is not buying bonds as an investment but rather as a mechanism of monetary policy. Everyone must therefore tread carefully at times such as these. As Tim Price of wealth manager PFP Group argues in his constantly thought-provoking weekly missive The Price of Everything: “Investors have historically bought bonds for two main reasons: capital preservation and yield. At current prices and interest rates, many sovereign bond markets now offer neither”.

Anyone taking a hugely bearish stance in front of the tidal wave of central bank liquidity created by QE and rate cuts has found themselves swept away over the past five or six years as equity and bond prices have soared.

Yet this flood of cash is now failing to support commodity prices or currencies and securities in the emerging markets so no-one should become complacent, especially if markets ever have to go ‘cold turkey’ and make their own way without the help of central bank largesse.

Commodities and emerging market equities are still under pressure despite market's 'risk-on' mode

Source: Thomson Reuters Datastream

Nor does the Bank of England's gold-selling strategy of 1999 to 2002 inspire maximum faith in any strategy to blindly follow a central bank into the markets. After all, no-one at the European Central Bank, US Federal Reserve, Bank of England or Bank of Japan saw the great financial crisis of 2007 coming either.

Russ Mould, AJ Bell Investment Director

Related content

- Wed, 17/04/2024 - 09:52

- Tue, 30/01/2024 - 15:38

- Thu, 11/01/2024 - 14:26

- Thu, 04/01/2024 - 15:13

- Fri, 17/11/2023 - 08:59