Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“An increase in the first-half dividend, improved profit guidance for the year and very modest loan losses and litigation costs are all giving shares in Lloyds a boost, especially as a much gloomier outlook was already priced in,” says AJ Bell Investment Director Russ Mould.

“The shares trade at a one-fifth discount to the 54.2p tangible book value per share figure, offer a 5% yield and come on a single-digit earnings multiple. Yes, the economic outlook is difficult, but the stock may be pricing in a lot of the potential bad news already.

“Lloyds’ shares are down by nearly 20% from this year’s peak in January and trade no higher now than they did in late 2012, even though the bank has paid out £11.8 billion in dividends and returned another £2.1 billion in cash to shareholders via buybacks over the past decade.

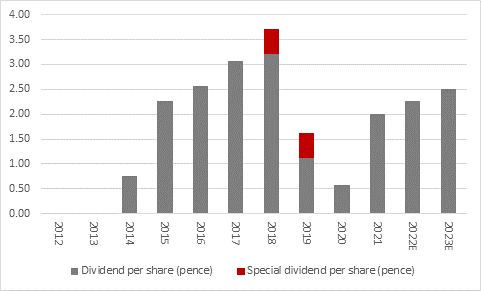

“That equates to 38% of the bank’s current market capitalisation and there are further cash returns to come. Lloyds is increasing its first-half dividend by more than expected, to 0.80p a share from 0.67p a year ago. Analysts had pencilled in a cash distribution of 0.75p.

Source: Company accounts, management guidance, Marketscreener, consensus analysts’ forecasts

“Despite concerns over the fragile state of the UK economy, the risk of a housing market slowdown and concomitant increases in bad loan losses, Lloyds has also beaten expectations for first-half profits.

“The lender generated pre-tax income of £3.7 billion, compared to consensus forecasts of £3.2 billion.

“Granted, that comes in below the £3.9 billion earned in the equivalent period in 2021 but that figure had been flattered by £734 million in loan loss provision reversals, as it turned out Lloyds was too conservative with its assessment of how covid-19 could affect its business in 2020. This time around the bank took a relatively modest £377 million loan loss charge.

“The first-half earnings look to underpin full-year 2022 pre-tax profit forecasts of £6.6 billion, compared to £6.9 billion in 2021, and even suggest there is some upside to those estimates.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

“After all, chief executive officer Charlie Nunn is raising guidance for two key swing factors for the bank’s operations.

“He now expects a net interest margin in excess of 2.80%, compared to a prior forecast of 2.70% and last year’s outcome of 2.54%. Meanwhile, the asset quality ratio is expected to come in below the prior expectation of 0.20%, so that means fewer loan losses than expected.

“Add those two together, and put them alongside an unchanged forecast for operating costs of £8.8 billion, and Lloyds is now looking for a return on tangible equity of around 13% versus 13.8% last year, when Mr. Nunn had initially steered the market to expect something around 11% for 2022.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

“Any profit forecast upgrades will bolster confidence in Lloyds’s ability to keep returning surplus capital to shareholders via dividends and buybacks. Ahead of the first-half figures, analysts were looking for a dividend of 2.33p a share (£1.6 billion) compared to 2.00p (£1.4 billion) in 2021. Lloyds is also running a £2 billion share buyback programme.

Source: Company accounts, Marketscreener, consensus analysts’ forecasts

“The dividend alone equates to a 5% yield, which is a premium to the wider FTSE 100, and the 7.5 times forward earnings multiple represents a substantial discount versus the UK’s premier equity index. A discount to book, or net asset, value may catch value-hunters’ eyes too.

“Granted, times could get a lot tougher and loan loss impairments could start to pile up again, but it feels like net interest margins have bottomed, at least for now, and analysts are already forecasting no growth in pre-tax profit out to 2025. The valuation factors in a lot of potential pain already and it might not take a lot to surprise on the upside, given the lowly expectations.”

| 2022E P/E |

Historic* Price/book |

2022E Dividend yield |

2022E Dividend cover |

|

|---|---|---|---|---|

| NatWest Group | 10.3 x | 0.88 x | 5.3% | 1.84 x |

| HBSC | 14.9 x | 0.86 x | 4.2% | 1.61 x |

| Lloyds | 7.5 x | 0.82 x | 5.0% | 2.67 x |

| Barclays | 6.1 x | 0.54 x | 5.1% | 3.25 x |

| Standard Chartered | 8.2 x | 0.51 x | 2.3% | 5.29 x |

Source: Refinitiv data, Marketscreener, consensus analysts’ forecasts for earnings and dividends. *Book value per share is last published figure (Q1 for NatWest, HSBC, Barclays and Standard Chartered and Q2 for Lloyds).

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05