Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

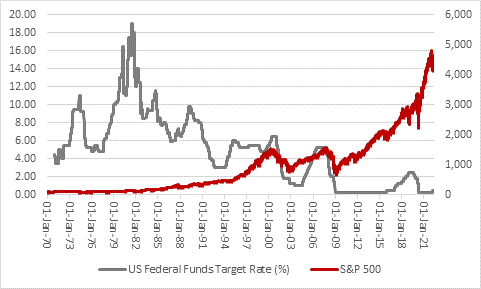

“The US Federal Reserve’s determination to continue tightening monetary policy, via both higher interest rates and sterilisation of Quantitative Easing, is likely to make life more difficult for investors, if history is any guide,” says AJ Bell Investment Director Russ Mould.

“Given that benchmark 10-year US Treasury yields are still running well below the prevailing rate of inflation, at 3.0% plays 8.5%, the bond market seems to be that the US economy is strong enough to withstand a gradual tightening of policy – and that even if it isn’t, the Fed will chicken out and quickly ease again. Yet wobbles in headline indices – and routs in previously hot areas of the market like new floats, SPAC deals and technology shares – suggest that stock market investors area not quite so sure for two reasons.

“First, the tune from the Powell-led Fed appears to be changing dramatically, with inflation the key issues and little apparent heed being paid to employment, financial market conditions or the soaring US dollar.

“Second, history suggests that even if the US economy can withstand a higher cost of money, financial markets may not, as improved returns on risk-free cash (at least in nominal, pre-inflation terms) dampen the relative appeal of financial assets such as bonds and shares, where the risks are higher, especially if a bull run leaves valuations looking extended relative to historic norms.

“The current scenario of lofty valuations using metrics such as market cap-to-GDP and cyclically-adjusted earnings, recent frantic activity in new listings and speculation in meme stocks, and rising interest rates looks like the perfect set-up for a market stumble, based on the experiences of 2007 and 2000, as well as other historical share price upsets.

Source: Refinitiv data

“Just consider this tale of market woe, across the Fed’s last eight rate-hike cycles.

| Rate hike cycle | Event |

|---|---|

| 1971-1974 | 1973-74 stock and bond bear market |

| 1977-1981 | Latin American debt crisis (and double-dip US recession) |

| 1983-1984 | Biggest US banking failure to date (Commercial & Illinois) |

| 1986-1989 | 1987 Black Monday Crash, US Savings & Loan crisis (c. 750 banks closed or resolved) |

| 1994-1995 | Bond market rout, Mexican Tequila sunset crisis and China devalues |

| 1999-2000 | Tech bubble collapses |

| 2004-2006 | US housing market collapses and Global Financial crisis begins |

| 2015-2018 | US economy slows, repo market rout hints at stress in inter-bank markets in 2019 |

Source: Refinitiv data

“Higher US interest rates may already be affecting some riskier areas of the markets. New float activity has cooled, SPAC deals have gone badly or failed to make it to market, highly-valued tech stocks have been cut down, meme stocks have failed to recapture their peaks and even cryptocurrencies have lost ground.

“None of this is to say that stock or bond markets are about to suddenly keel over but investors may be facing their next big tests. The last eight peaks in the S&P 500 were preceded by an average interest rate increase of 2.18 percentage points – and it has needed more than that on just two occasions to bring a bull market to a halt.

“Financial markets are putting a 75% chance on a Fed funds rate of at least 3.00% by the end of 2022. That implies a 2.75 percentage point increase in 2022 alone with the possibility of more to come in 2023, when markets are putting a two-thirds chance on US headline rates reaching 3.50% by summer.

“Even if that 3.50% figure is below the 7.59% average which has called the top for US stocks after the last eight bull markets, you do have to wonder whether the US economy will prove more susceptible to even a modest tightening in policy this time around, given that there is so much more debt in the system, at the Government, corporate and consumer level.

Changes in US interest rates before the last eight peaks in the S&P 500

| Date | S&P 500 peak level | Fed funds rate at S&P peak | Change in Fed Funds before peak |

|---|---|---|---|

| 11-Jan-73 | 120 | 5.5% | 2.00% |

| 21-Sep-76 | 1,008 | 5.5% | 0.75% |

| 28-Nov-80 | 141 | 15.0% | 10.25% |

| 10-Oct-83 | 173 | 9.4% | 0.88% |

| 25-Aug-87 | 337 | 6.6% | 0.88% |

| 16-Jul-90 | 369 | 8.0% | (1.81%) |

| 24-Mar-00 | 1,527 | 6.0% | 1.25% |

| 09-Oct-07 | 1,565 | 4.75% | 3.25% |

| Average | 7.59% | 2.18% |

Source: Refinitiv data

“Investors also need to consider the role played by Quantitative Easing in the bull market that began in the USA in late 2008. QE helped to keep interest rates and bond yields low and encouraged risk-taking as investors sought a return on their capital – and this was an explicit Fed policy, one described by former chair Ben Bernanke as an effort to create a wealth effect by driving share and bond prices higher.

“That is all well and good, but it does beg the question of what happens to consumer confidence and spending patterns should share and bond prices start to fall, and wealth dissipate, at least on paper. The Fed ran out of ammo so far as interest rate cuts were concerned and it then hit the print button with the result that share prices went into orbit.

| Fed interest rate cycle | Change in rates | Change in S&P 500 | |

|---|---|---|---|

| Lower | 1971 | (1.00%) | 6.0% |

| Higher | 1971-1974 | 7.5% | (9.7%) |

| Lower | 1974-1976 | (6.25%) | 30.1% |

| Higher | 1977-1981 | 14.25% | 33.7% |

| Lower | 1981-1982 | (10.5) | 7.1% |

| Higher | 1983-1984 | 3.06% | 8.2% |

| Lower | 1984-1986 | (5.69%) | 49.9% |

| Higher | 1986-1989 | 3.94% | 21.6% |

| Lower | 1989-1992 | (6.81%) | 28.6% |

| Higher | 1994-1995 | 3.0% | 0.1% |

| Lower | 1995-1998 | (1.25%) | 105.7% |

| Higher | 1999-2000 | 1.75% | 6.8% |

| Lower | 2001-2003 | (5.5%) | (27.6%) |

| Higher | 2004-2006 | 4.25% | 11.6% |

| Lower | 2007-2008 | (5.0%) | (40.5%) |

| Lower * | 2007-2014 | (5.0%) | 30.4% |

| Higher | 2015-2018 | 2.25% | 19.0% |

| Lower | 2019-2020 | (2.25%) | (18.4%) |

| Lower * | 2019-2022 | (2.25%) | 47.5% |

| Higher | 2022- ? | ||

Source: Refinitiv data. *Elongates cutting cycle to point whereby the Fed stopped adding to QE

“So did speculation, at least if margin debt is any guide and it is margin debt – money borrowed to put into the markets – that could once more prove to be the downfall of a bull run in stocks, if rates rise, losses on stocks bought with borrowed money pile up and investors find themselves as forced sellers so they can repay their loans on time. Margin debt has already started to decline, and the S&P 500 has lost momentum, which may not be entirely a coincidence.”

Source: FINRA, Refinitiv data

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05