Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

"The big US banks have, to some degree at least, set the tone for the Big Five FTSE 100 firms, with a return to taking loan loss provisions (rather than writing back 2020’s provisions in 2021), increased investment in digital services and lower levels of income from investment banking operations weighing on earnings, but with higher interest rates offering the prospect of increased net interest margins and interest income going forward," says AJ Bell Investment Director Russ Mould.

"Most of the major US banks’ shares are down in 2022 to date, with Citigroup, Bank of America and JP Morgan Chase down by 11% t17%, and the big investment banks have fared little better, with Morgan Stanley down 8% and Goldman Sachs stock 11% lower.

"In the UK, the Asian-exposed banks, HSBC and Standard Chartered, are up, Lloyds and NatWest broadly flat and Barclays down by almost one fifth, so expectations do not seem to be unduly high as we head into the first-quarter reporting season.

"For the first quarter, the consensus analysts’ forecasts for Barclays are as follows:

- Total income of £5.7 billion, down slightly from £5.9 billion in Q1 2021

- Pre-tax profit of £1.3 billion, down from £2.4 billion a year ago

- Earnings per share of 2.8p, down from 9.9p a year ago

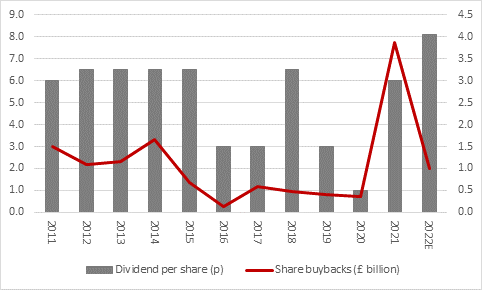

- No dividend, as is usual for the first-quarter stage, and nor do analysts expect any additional comments on share buybacks, although Barclays did announce a £1 billion buyback for this year alongside its results for 2021 back in February. For 2022 analysts are looking for a total dividend of 8.1p a share, compared to 6p in 2021.

Source: Company accounts, analysts’ consensus forecasts

Source: Company accounts, analysts’ consensus forecasts

"The key figures that will help to shape those headline numbers are as follows

- A £947 million profit from Barclays International, which includes the investment bank, compared t£2.0 billion in Q1 2021

- Barclays UK is seen making £531 million compared t£460 million in the same period a year ago

- A cost/income ratio of 61.9% against 61.0% in Q1 2021

- Barclays is seen taking £299 million in loan loss provisions in Q1, compared to just £55 million in Q1 2021.

Source: Company accounts, analysts’ consensus forecasts

Analysts will also home in on the net interest margin figure, which has been under steady pressure thanks to zero interest rate policies and quantitative easing from central banks, which have flattened the yield curve. In Q1 2021 the net interest margin for Barclays UK was 2.54% and in Q4 2021 it was 2.49%.

Source: Company accounts

"Any change in trend in loan or deposit growth will also be of interest. Loan growth began to improve throughout 2021, reaching 5.5% year-on-year in the fourth quarter, although deposit growth was consistently better, to suggest customers (or risk managers) were still fairly cautious in their outlook.

Source: Company accounts

"Finally, analysts and investors will look for any change in guidance from chief executive C.S. Venkatakrishnan, who now has a new chief financial officer in Anna Cross, who took the role on 23 April after Tushar Morzaria’s retirement, especially in light of the greater uncertainty in the macroeconomic outlook. At the full-year stage, Mr Venkatakrishnan guided to

- A full-year impairment charge below pre-pandemic levels (the 2019 figure was £1.9 billion) – analysts have pencilled in £1.2 billion

- A modest increase in total costs to £12 billion, excluding restructuring and performance costs, thanks in the main to inflation and increased IT spend."

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05