Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“June’s flurry of statements and counter-statements from Cobham and Ultra Electronics left investors none the wiser as to whether the firms had come close to combining two business units or not. But what is clear after its latest trading statement that Ultra feels it is thriving as a stand-alone business,” says AJ Bell investment director Russ Mould.

“Chief executive Simon Pryce gets firmly on the front foot by flagging how first-half trading is better than expected, thanks to the benefits of cost and efficiency programmes, strong business flow in certain key divisions and a decrease in expenses related to covid-19.

“The irony of all of this, though, is that such positive commentary may only increase the ardour of any potential suitor for Ultra, which is a leader in several niche technologies, including cyber-security systems, radar software management platforms and anti-submarine systems. They are likely to remain an area of priority for Government spending and bolster the £1 billion order book upon which the Board’s ‘Focus, Fix, Grow’ initiative is aiming to build.

“Ultra’s order book, sales and profits went nowhere fast for most of the last decade, but the new programme seems to have given the company fresh momentum. That may catch the eye of potential buyers.

Ultra Electronics Order book (£ million):

Source: Company accounts

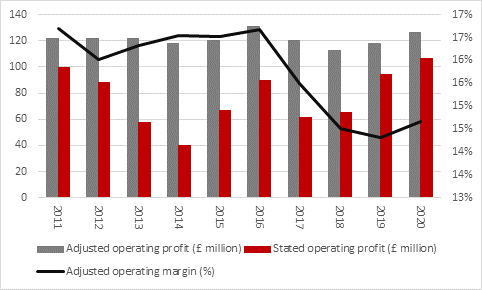

“In addition, falling debt and decreasing pension liabilities could also make Ultra easier to swallow and its profile as a cash-generative business which generates double-digit operating margins and returns on capital also means it could pop up on a predator’s list, in an industry that remains a hotbed of merger and acquisition activity.

Source: Company accounts

“Senior has just this year seen off no fewer than five approaches from private equity firm Lone Star. Cobham was acquired by Advent in 2019 and deals have not been confined to financial buyers. US giants UTC and Raytheon merged in 2020 and the bigger players have been looking to snap up smaller ones, who can add to their technological capabilities, allow them to access niche areas that are growing quickly, bolster supply chains or simply take market share. Ultra itself tried to acquire American submarine-tracking specialist Sparton in 2017.

“Cobham’s initial statement back in June suggested its plan had been to merger its CAES business with Ultra’s Intelligence and Communications unit, only for Ultra to say talks had ended. The FTSE 250 firm also stressed the discussions had centred on a private merger and acquisitions deal and not a full takeover by the Advent-backed Cobham.

“Yet Cobham then countered by saying several deal structures had been explored, including a possible offer. Having rejected one form of business combination Ultra could therefore have encouraged a full-blown approach, although none has been made yet and Cobham has until the end of July to confirm any plans to bid under the Takeover Code’s ‘put up or shut up’ regime.

“There remains the possibility that the UK Government could get involved, especially as accusations gather that Advent is busy breaking up Cobham rather than nurturing it, while the ultimate arbiter of whether a bid for Ultra arrives or not will surely be valuation.

“The major US players – such as General Dynamics, Lockheed Martin, Raytheon and Northrop Grumman – look to trade on between 16- and 22-times forward earnings, based on analysts’ consensus forecasts for 2021.

“Ultra Electronics already trades toward the top of that range, but it does generate higher operating margins than the large US defence combines, comes with a relatively clean balance sheet for good measure and generates a free cash flow yield which is beaten by only BAE Systems in the context of the UK aerospace and defence sector.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30