Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Investing is all about buying low and selling high, at least if capital appreciation rather than income is the aim of the portfolio builder, but for the past few years buying high and watch things go higher has proved an effective strategy, especially with US equities, as concerns over historically lofty valuations have been brushed aside,” says AJ Bell Investment Director, Russ Mould.

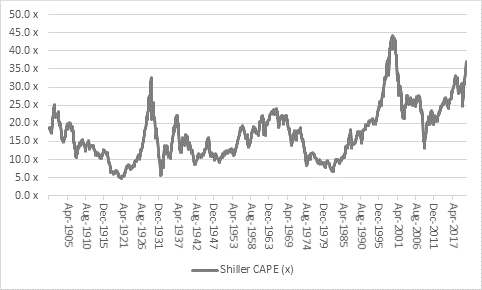

“This continues to pose a dilemma for those investors who believe valuation is the ultimate arbiter of investment return. They will point to Professor Robert Shiller’s cyclically adjusted price earnings ratio (CAPE) and argue US stocks are ridiculously expensive against historic norms, with the result that the joke will ultimately on be on momentum buyers who get cleaned out, rather than valuation disciples who miss out.

Source: http://www.econ.yale.edu/~shiller/data.htm

“The Shiller CAPE, which does not rely on the vagaries of analysts’ forecasts, but a historic rolling ten-year average of corporate profits (on an inflation-adjusted basis), is now suggesting that US stocks are trading on 37 earnings, the second-highest multiple ever. Only during the final stages of the technology boom did US stocks trade on a higher valuation and investors will remember how that episode ended very badly.

“On that occasion, the S&P 500 peaked at 1,527 in March 2000 and bottomed at 777 in October 2002. That 49% fall wiped out three years of bull market gains and it took the index until 2007 to get back to its high (just in time for the next major market accident).

“The only other occasion when then S&P500 traded for any period of time about 30 times forward earnings was in the late 1920s. That was another roaring bull market which quickly turned into a bear market after the 1929 Crash.

“In those episodes, buying high and expecting to watch prices go higher went wrong, and badly so. But valuation is not a timing tool and this is the riddle for CAPE crusaders. Once stocks get expensive, then share prices can keep running as long as investor psychology is bullish and buyers are willing ignore, and even embrace, risk. As Warren Buffett once noted, ‘A pack of lemmings looks like a group of rugged individualists compared with Wall Street when it gets a concept in its teeth.’ The pressure to join in and pile in, and not miss out, becomes huge.

“No-one rings a bell and announces it is time to get out. Everyone thinks they can do just that and emerge from any smash with profits and portfolios unscathed. But if will be interesting to see if sentiment starts to change as some of the hottest sectors come under the cosh and do so for no obvious reason – electric vehicle stocks (even Tesla), SPACs, IPOs, cult tracker funds like ARK Innovations are all taking a beating, with heavy falls from their all-time highs of just a few months ago.

“On the face of it, their narratives have not changed, but their share prices have.

“A big percentage of the falls have followed the collapse of the Archegos hedge fund.

“Perhaps that has made some investors re-think their strategies and rein in some risk.

“Perhaps it has persuaded some prime brokers to rein in their books and offer less leverage to their institutional clients.

“Perhaps the narrative of an inflationary recovery is persuading investors to look for cheap recovery plays that could offer rapid earnings growth now, in the event of a strong post-pandemic economic upturn, rather than keep buying expensive stocks that are promising profits growth a long time in the future.

“Whatever the reason, the shift from growth to recovery stocks that began last summer is accelerating right now. There is no greater influence over sentiment than price movements and this could be an interest test of growth, tech and momentum-led stocks, if not the wider market because buying low and selling high ultimately does provide the best returns. It provides not only upside protection but downside protection, too.

“The higher the price paid, the less the upside and the greater the downside. An analysis of the compound annual growth rates (CAGRs) in the S&P 500 index over the next decade from any point in time against the Shiller CAPE show as much. Any investor who has bought at multiples below 10, or even 15 times, has nearly always locked in positive returns for the next decade. Anyone who has bought at multiples in excess of 25 times has nearly always locked in negative returns for the next decade.

Source: http://www.econ.yale.edu/~shiller/data.htm

“The one exception is the past decade. In this respect it is no wonder that value-adherents are puzzled and momentum buyers are smiling. Perhaps central bank intervention will save the day if markets wobble, just as it did in LTCM in 1998, the tech bust in 2000-03, the Great Financial Crisis in 2007-09, the Greek debt crisis of the early 2010s and the pandemic of 2020. But if inflation does move higher on a sustained basis, the monetary authorities’ scope for providing yet more cheap cash could be limited, and this is why the debate over inflation is so important going forward, for consumers and investors alike.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30