Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“After a torrid 12 months, featuring two profit warnings, a change in chief executive, a dividend cut and a 25% slump in the share price, shareholders could have been forgiven for approaching Imperial Brands’ trading update with a degree of trepidation, so they will be delighted by the absence of any new, nasty surprises,” says Russ Mould, AJ Bell Investment Director.

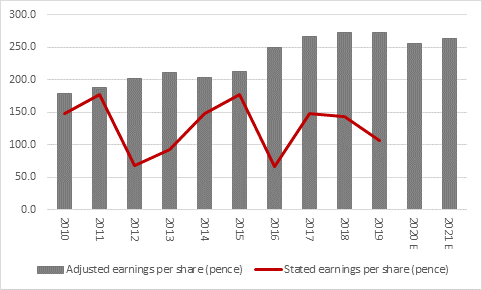

“New boss Stefan Bomhard is now suggesting that tobacco volumes and revenues are coming in ahead of expectations, with sales up 1% and total group revenues broadly flat, before currency movements. Meanwhile while earnings per share (EPS) for the year that ended in September will fall around 6%, on a constant currency basis. A 1% headwind from currency movements implies a total fall in EPS of 7%, slap bang in line with the analysts’ consensus forecast of 255.1p, down 7% from 273.7p a year ago.

Source: Company accounts, Sharecast, analysts’ consensus forecasts

“Some long-awaited stability in EPS estimates may also give greater credence to the company’s dividend policy, which is crucial, given that its mighty yield will form the basis of many a shareholder’s reasoning for holding the stock in the first place.

“Imperial’s temporary leadership team of Dominic Brisby and Joerg Biebernick sanctioned a one-third reduction in the interim dividend back in May, the first time Imperial had cut its shareholder distribution since 1996’s spin off from the Hanson conglomerate.

“The team also flagged a likely full-year dividend of 137.7p, although earnings forecasts have since dribbled lower, taking the consensus dividend per share estimate down to 132.8p a share.

Source: Company accounts, Sharecast, analysts’ consensus forecasts

“That is still enough to imply a 9.6% dividend yield, the second-highest in the FTSE 100.

Source: Sharecast, analysts’ consensus forecasts, Refinitiv data “A forward price/earnings (PE) ratio of barely 5.5 times, coupled with that chunky yield, may look like stand-out ‘deep value’ to some investors. “But to others Imperial will just look like a value trap. The combination of low earnings multiple and high yield certainly suggests that investors remain very sceptical of the tobacco giant’s ability to maintain its profitability and cash flow, and thus dividend-paying potential, over the long term, thanks to regulatory pushback on smoking and increased public health awareness. In addition, tobacco stocks will fail to pass any ethical screens which investors care to run. “Those investors are unlikely to be persuaded that the second half’s improved trading, presumably the result of people being stuck at home during lockdowns and worrying about their jobs or the pandemic, will last. As a result, Imperial trades on a lowly profit multiple and investors are demanding the huge yield as a compensation for the perceived risks associated with holding the stock. “It will take more than one trading statement that does not feature any nasty surprises to convince a sceptical market, especially dividend yields that looked to be around 10% (or higher) on paper eventually proved to be nothing of the sort in reality once pay-outs were cut at firms like Vodafone, Shell, BP, Royal Mail and Centrica.” These articles are for information purposes only and are not a personal recommendation or advice. |

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05