Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

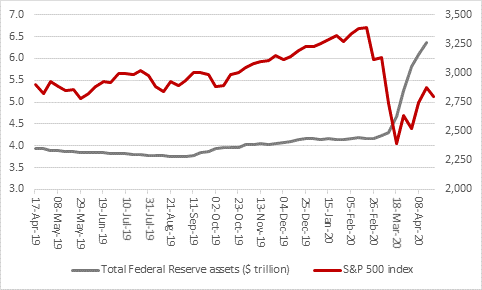

“It might be St George’s Day but at the moment investors are more likely to pay homage to Uncle Sam, because America’s benchmark S&P 500 index is only down by 4% from where it was a year ago,” says Russ Mould, AJ Bell Investment Director.

Source: Refinitiv data

“That leaves all of the other major geographic options available to equity buyers well behind and begs the question of why US stocks are proving so resilient and whether it can last. After all, if you had said to someone a year ago that a global pandemic would strike, large parts of the US economy would be in lockdown and that stocks would only fall 4% from record-highs over the next 12 months you would have probably been told you were off your rocker.

Source: Refinitiv data

“Several factors could be providing support to US stocks.

- US earnings are receiving strong support from leading tech stocks, with the Tech sector forecast to generate 23% of 2020 earnings, according to IBES data from Refinitiv. This may also help to explain why the NASDAQ Composite index is up 5% on where it was a year ago.

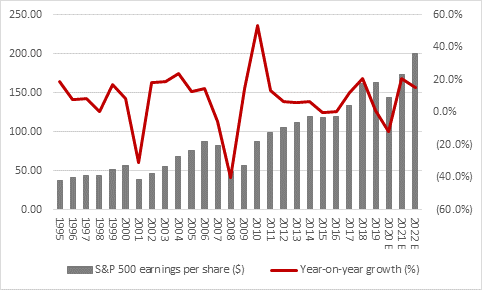

- Analysts are still factoring in a V-shaped recovery in earnings, fired by Financials, Consumer Discretionary, Industrials and Energy stocks in particular, with further growth in tech in late 2020 and 2021 providing additional support. Bottom-up estimates from FactSet suggest US corporate profits will be growing again on a year-on-year basis by Q1 2021.

Source: FactSet

- Hopes for the V-shaped recovery are being fired by talk in America that the lockdown may soon be eased, as well as colossal fiscal and monetary stimulus. Interest rate cuts from the US Federal Reserve and its return to Quantitative Easing, whereby the US central banks has grown the assets on its balance sheet by $2.2 trillion or 53% in just six weeks, also provide financial markets with dollops of cheap liquidity with which they can speculate. This may be the most powerful factor of all in the US stock market’s bounce from the 23 March low and the hardest for sceptics of American equities to fight.

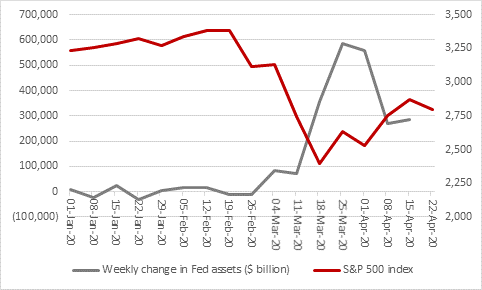

Source: FRED – St. Louis Federal Reserve database, Refinitiv data

“But even here there could be morsels upon which bears can chew.

- The Fed has throttled back its QE programme, adding ‘just’ $284 billion to its asset purchases in the last week for which data is available, compared to $586 billion in late March. Even that easing of stimulus has seen US equities’ recovery lose a little pace and if the rally really is relying on abundant central bank-provided liquidity then that is a brittle set of foundations, as the Fed cannot print forever and ever

Source: FRED – St. Louis Federal Reserve database, Refinitiv data

- It can also be argued that the V-shaped recovery scenario favoured by consensus analysts’ forecasts is too optimistic. The US economic looks set to nosedive in Q2 and it could be unwise to assume that companies and consumers immediately return to their prior investing and spending patterns, given the massive fright they have just had and the possibility that many firms will still fail and some of the 22 million Americans who have filed for unemployment benefits will struggle to find a new job straight away.

The consensus forecast of a mere 12% drop in company earnings, from a record high in 2019, could therefore be left exposed on the downside. It certainly seems hard to believe that the operating environment for companies in 2020 is only 12% worse than it was in 2019, unless the COVID-19 outbreak is contained and erased very, very quickly from here.

A 12% dip in annual earnings would also look very modest compared to the 31% fall in company profits of 2001 and the 40% drop of 2008. Granted, the former downturn focused heavily on an investment bust in the tech industry and the latter was a financial markets crisis, but many other industries were relatively unaffected. The impact of the viral outbreak could be greater this time, because it hits directly at consumers’ incomes and their ability to out and spend in an economy where some 70% of GDP is driven by services and private consumption.

Source: FactSet, Standard & Poor’s, IBES

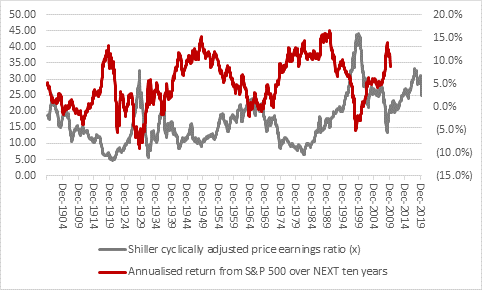

- The final bear argument that states US stocks have held up far too well in the face of the COVID-19 crisis is valuation. On the face of it, the consensus earnings per estimates of $174 and $200 for the S&P 500 put the index on 16 times and 14 times earnings for 2020 and 2021, hardly expensive for a market which is laden with leaders in their chosen industries, notably tech, and where a rapid earnings rebound is expected. But those multiples could prove misleading if earnings disappoint. Moreover, the Shiller cyclically-adjusted price earnings ratio (CAPE) still suggests the US equity market is very expensive relative to its history, using inflation-adjusted earnings from the last 10 years as its basis, rather than variable earnings forecasts.

The S&P500 has only traded at 26 times earnings using CAPE for any length of time and ten-year compound annual returns from the index were negative after both 1929 and 1999.

Source: http://www.econ.yale.edu/~shiller/data.htm

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30