Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

The contrast with a year ago could hardly be bigger. Apple’s first quarter results for 2018-19 followed on from a January profit warning and showed the first year-on-year drop in earnings per share for ten quarters. The results for the first three months of 2019-20 show the first revenue growth from the iPhone in five quarters, renewed sales and earnings momentum across the company as a whole and feature guidance for the second quarter which implies an upgrade to consensus earnings per share forecasts of around 4%.

| Q1 2018-19 | Q2 | Q3 | Q4 | Q1 2019-20 | |

|---|---|---|---|---|---|

| Year-on-year change in revenues | |||||

| iPhone | (14.9%) | (17.3%) | (11.8%) | (9.2%) | 7.6% |

| iPad | 16.9% | 19.3% | 8.4% | 16.9% | (11.2%) |

| iMac | 8.7% | (4.6%) | 10.7% | (4.8%) | (3.5%) |

| Services | 19.1% | 16.2% | 12.6% | 18.0% | 16.9% |

| Wearables | 33.3% | 30.0% | 48.0% | 54.4% | 37.0% |

| Group total | (4.5%) | (5.1%) | 1.0% | 1.8% | 8.9% |

| Year-on-year change in profit | |||||

| Operating profit | (11.1%) | (15.6%) | (8.5%) | (3.1%) | 9.5% |

| Net profit | (0.5%) | (16.4%) | (12.8%) | (3.1%) | 11.4% |

| EPS | 7.5% | (9.5%) | (6.8%) | 4.0% | 19.4% |

Source: Company accounts. Financial year to September.

This will all serve to reassure investors that Apple has rediscovered the sweet spot when it comes to iPhone pricing, functionality and driving the customer upgrade cycle thanks to last September’s iPhone 11 release.

Looking at it purely in share price terms, the iPhone 11 has had the biggest positive impact of any launches of the device since the very first version back in 2007.

| Before launch | After launch | |||||

|---|---|---|---|---|---|---|

| Product | Launched | 6 months | 3 months | 3 months | 6 months | 12 months |

| iPhone 1 | 29-Jun-07 | 43.8% | 30.2% | 25.8% | 63.7% | 39.4% |

| iPhone 3G | 11-Jul-08 | (0.1%) | (5.9%) | 4(3.9%) | 4(7.5%) | 1(9.7%) |

| iPhone 4 | 24-Jun-10 | 28.7% | 17.3% | 8.7% | 20.3% | 21.3% |

| iPhone 5 | 21-Sep-12 | 16.2% | 69.9% | 2(5.8%) | 3(5.3%) | 3(3.2%) |

| iPhone 6 | 19-Sep-14 | 29.1% | 6.7% | 14.1% | 8.1% | 15.8% |

| iPhone 7 | 16-Sep-16 | 8.4% | 17.8% | 0.5% | (7.8%) | 48.8% |

| iPhone X | 03-Nov-17 | 17.3% | 10.9% | (7.0%) | 2.5% | 20.3% |

| iPhone 11 | 20-Sep-19 | 15.7% | 9.2% | 28.3% | 45.9% * | |

| Average | 20.5% | 21.0% | 0.1% | 0.5% | 13.2% | |

Source: Refinifiv data. * Data to 28 January 2020

It will now be interesting to see how Apple’s shares respond. They rose by some 2% in the after-market. It is possible to argue that the positive earnings surprise for Q1 when EPS came in at $4.99 against a consensus number of $4.51, and the upgrade for Q2 is the very minimum required after the phenomenal share price surge of the past 12 months.

The shares are up 105% over the past 12 months and for Apple to repeat that feat between now and late January 2021 the firm would need to add $1.45 trillion in market cap.

It’s pretty hard to see how even the Californian giant could generate the sort of earnings growth or cash returns that could spark such an increase in market cap – but then it added nearly $600 billion in market cap in 2019, so if the Fed lets liquidity run riot and markets really start to melt-up then anything might be possible.

But barring a full-on bubble episode, the forecast earnings growth does not look fast enough to fuel a repeat performance.

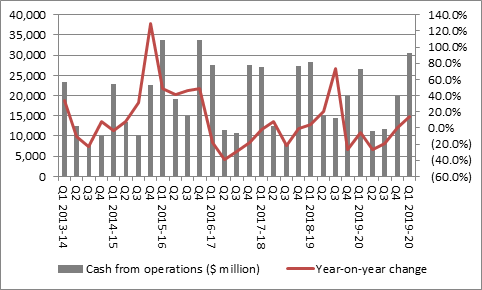

Fans of the stock will still argue that there is scope for upside, not least because the company is still a cash machine. Cash flow from operations in the three months to the end of December exceeded $30 billion for the first time in seventeen quarters.

Source: Company accounts. Financial year to September.

That enabled Apple to fund further cash returns to investors. Share buybacks and dividends came to $24.2 billion in the quarter to take the total handed back to shareholders to $398 billion since September 2013 - a sum greater than the market capitalisation of 492 out of the S&P 500 index’s members.

Source: Company accounts. Financial year to September.

The combination of forecast upgrades (pleasing momentum-seekers) and cash returns (for income-hunters) could give Apple’s shares a further lift, although the ever-growing market cap will make it hard for the company to match past returns, simply owing to the law of large numbers.

In addition, bears will still find a few morsels upon which to chew in the first-quarter results, since arguing about valuation alone does not seem to be getting them very far, given the meteoric rise in Apple’s shares, even if they are now clearly more expensive, trading on a forward price/earnings (PE) ratio in the mid-20s compared to a multiple in the low teens a year ago.

- The gross margin on product sales fell to 34.2% from 34.3% in Q1 2018-19 (and from 36.1% in 2017-18)

- Sales from services undershot analysts’ forecasts by some $400 million to $500 million and the rate of growth did slow

- A good portion of the earnings upside surprise came from higher-than-expected financial income ($349 million against guidance of $200 million) and a lower-than-expected tax charge (14.2% against guidance of 16.5%)

On the basis of the past 12 months, such concerns may not be enough to stop Apple’s share price momentum but there could be three potential dangers that investors need to consider.

- The viral outbreak in China could disrupt Apple’s supply chain and hit demand for its products could take a hit thanks to the travel lockdown over the Lunar New Year holidays. It is too early to tell on either count at the moment, although key sub-supplier Hon Hai Precision, part of Taipei-quoted Foxconn, has today sought to reassure its investors and customers that production targets will be met.

- The launch and roll-out of fifth generation (5G) mobile telecoms services and networks could easily drive the next iPhone upgrade cycle and drive further demand for the device itself, plus apps and wearables. However, US semiconductor specialist Xilinx warned on Tuesday that it had seen disappointing demand from 5G customers, making it the third firm to do so in quick succession, after Swedish telecoms equipment maker Ericsson and another American silicon chip maker, Skyworks. If 5G does roll out more slowly for any reason (and the debate over Huawei’s involvement could conceivably gum up the works) then this could remove one potential catalyst for earnings upgrades and fresh share price momentum at Apple.

- The biggest challenge to the share price could come from something beyond the control of CEO Tim Cook and his colleagues. Apple’s combination of earnings momentum and cash returns looks great in a low-growth, low-interest-rate, low-inflation world where both growth and income are hard to find.

But a cyclical economic recovery, especially one accompanied by a marked uptick in inflation, would mean that earnings growth became less rare and investors would therefore have less reason to pay a fat multiple for it. That would leave Apple’s mid-20s forward PE rating potentially exposed, or mean it could at least act as a cap on the upside, if value names and cyclicals were to become the new focus of investors’ attentions.

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Tue, 30/01/2024 - 15:38

- Thu, 11/01/2024 - 14:26

- Thu, 04/01/2024 - 15:13

- Fri, 17/11/2023 - 08:59

- Thu, 09/11/2023 - 17:09