Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

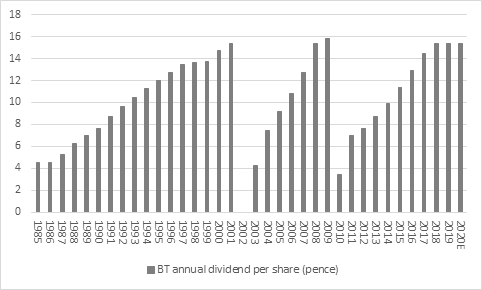

“A cut to its first-half dividend a year ago was a sign that BT was in trouble and the shares have largely given investors nightmares ever since. Today’s announcement from CEO Philip Jansen, who took over from Gavin Patterson in February, that the interim payment is unchanged at 4.62p and that the telco intends to match last year’s total distribution of 15.4p a share may therefore soothe a few nerves and help shareholders sleep more easily in their beds,” says Russ Mould, AJ Bell Investment Director.

“That 15.4p figure equates to a dividend yield of 7.4%, although investors still need to make sure that the payment can be sustained and that BT is not strangling itself so it can avoid a repeat of the dividend cuts of 2002 and 2010.

Source: Company accounts

“A yield of 7.4% means BT is among the ten highest-yielding stocks in the FTSE 100, although earnings cover is thinner than ideal at 1.61 times (two or more would give more comfort and offer shareholders more protection in the event of any unexpected developments.

| Dividend yield (%) 2019E | Dividend cover (x) 2019E | |

|---|---|---|

| Evraz | 16.6% | 1.34 x |

| Imperial Brands | 11.8% | 1.34 x |

| Taylor Wimpey | 10.8% | 1.12 x |

| Persimmon | 10.2% | 1.15 x |

| British American Tobacco | 7.7% | 1.54 x |

| Rio Tinto | 7.6% | 1.66 x |

| Aviva | 7.40% | 1.92 x |

| BT | 7.4% | 1.61 x |

| Barratt Developments | 7.2% | 1.58 x |

| Standard Life Aberdeen | 7.2% | 0.87 x |

| Average | 9.4% | 1.41 x |

Source: Sharecast, consensus analysts’ forecasts, Refinitiv data

“To see if the dividend is truly defensible, investors can also dig deeper and look at cash flow cover for the distribution, which comes to around £1.5 billion a year in actual cash terms. Investors will also want to check that BT is not skimping on capital expenditure. Such a move could support dividends in the near term but threaten them in the long term by potentially weakening the firm’s long-term position in what remains a highly competitive (and tightly regulated) market.

“The good news management has suggested that investment in the business will be roughly unchanged this year at £3.8 billion this year. But this budget means that forecast that ‘normalised cash flow,’ as BT defines it, will fall by almost a fifth in the year to March 2020. That will leave BT investors on edge about the dividend, even if for the moment there is sufficient cash flow to cover the dividend once all key expenses, such as tax, interest on debt and capital investment are met.

| £ million | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020E* |

|---|---|---|---|---|---|---|---|

| Capex | 2,346 | 2,317 | 2,622 | 3,454 | 3,522 | 3,963 | 3,800 |

| ‘Adjusted’ EBITDA | 6,116 | 6,193 | 6,459 | 7,645 | 7,505 | 7,392 | 7,950 |

| ‘Normalised’ cashflow | 2,450 | 2,830 | 3,098 | 2,782 | 2,973 | 2,400 | 2,000 |

Source: Company accounts. *2020 based on mid-point of management guidance. Financial year to March.

“That will leave BT investors on edge about the dividend. At the moment, there is sufficient cash flow to cover the dividend once all key expenses, such as tax, interest on debt and capital investment are met. But the margin for error is getting smaller and if profits do come under severe pressure then the pay-out could come under threat.

| £ million | 2015 | 2016 | 2017 | 2018 | 2019 | H1 2020 |

|---|---|---|---|---|---|---|

| Operating profit | 3,402 | 3,613 | 3,167 | 3,381 | 3,421 | 1,762 |

| Depreciation & amortisation | 2,538 | 2,631 | 3,572 | 3,514 | 3,546 | 2,121 |

| Net working capital | (117) | (3) | (112) | (549) | (90) | (513) |

| Tax | (309) | (256) | (551) | (473) | (431) | (83) |

| Net interest expense | (859) | (712) | (804) | (764) | (756) | (284) |

| Capital expenditure | (2,317) | (2,622) | (3,454) | (3,522) | (3,963) | (2,067) |

| Operating free cash flow | 2,338 | 2,651 | 1,818 | 1,587 | 1,727 | 936 |

| Dividends | 924 | 1,075 | 1,435 | 1,523 | 1,504 | 457 |

| Operating free cash flow minus Dividends | 1,414 | 1,576 | 383 | 64 | 223 | 479 |

Source: Company accounts

“Maintaining the dividend would therefore be a huge step toward perhaps persuading investors that BT could be a cheap stock. At 204p the shares trade on a forward price/earnings ratio of barely eight times and come with a plump yield and the company does feel unloved – its shares trade no higher now than they did in December 1989, although that may be a clue as to just how big a job Mr Jansen has on his hands if he is to revive the company’s profit momentum and share price on a sustainable basis.

Source: Refinitiv data

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05