Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“After starting the year with a furious rally, shares in Netflix are now finding it harder to make further gains and they still trade some 13% below last summer’s all-time high, even as the S&P 500 and NASDAQ reach fresh peaks. The second-quarter results will therefore be a good test, especially as earnings per share estimates have leaked lower,” says Russ Mould, AJ Bell Investment Director.

“This may set things up neatly for the quarterly ‘earnings beat’ so beloved by momentum investors but sceptics will continue to express concern about a lofty valuation, even loftier debts and huge commitments to spend on content in what is a highly-competitive marketplace.

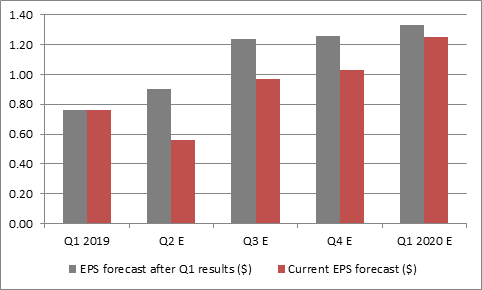

Source: NASDAQ.com, company accounts after actual Q1 results

“Since the release of the Q1 results in April, when Netflix made earnings per share of $0.76, the consensus estimate for Q2 has dropped from $0.90 to $0.56. Analysts have also downgraded their forecasts for future quarters, although not by as much.

“It will therefore be interesting to see how the figures stack up against both the consensus and also the guidance provided by chairman and chief executive officer Reed Hastings alongside the Q1s. At that time Mr Hastings forecast

An acceleration in growth in streaming average revenue per user (ARPU) to +2% from the -2% seen in Q1, thanks to price increases in the US, Brazil, Mexico and some parts of Europe. Excluding currency movements, ARPU was seen rising 7% in the second quarter.

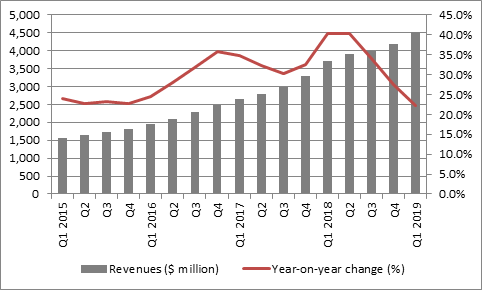

An acceleration in total revenue growth to 26% from the 22% seen in Q1. This implies sales of some $4.9 billion for Q2 and will rest on both price increases and subscriber additions.

Source: Company accounts

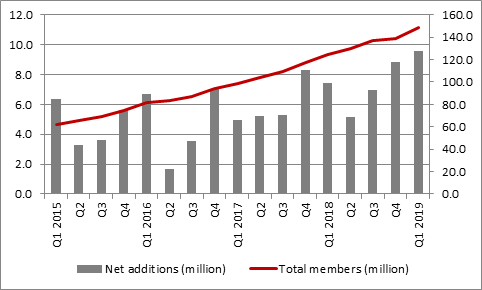

In the first-quarter, Netflix added 9.6 million subscribers on a net basis, a record quarter, to take the total to 148.9 million.

Source: Company accounts

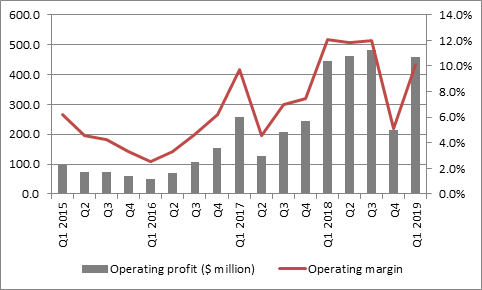

Netflix has a full-year operating margin target of 13%, compared to the 10.2% generated in both 2018 and Q1 2019. Mr Hastings noted that investment in content means margins will move around a lot from quarter to quarter but stated the second half would overall be higher than the first.

Source: Company accounts

A big hike in the tax charge, to 48% in Q2, may provide the main reason behind the substantial profit forecast downgrade, due to what were termed “one-time, discrete events.” This may explain why the share price has proved relatively tolerant of the forecast downgrades seen in the past three months, especially as the group tax charge is seen trending down toward US federal rates over time.

Analysts and investors will then home in on the cash flow and the balance sheet, especially as Netflix raised a further $2 billion in debt in April.

At the end of Q1, the company had a net debt position of $7 billion and had content purchase commitments worth a further $19 billion. Such burdens do lead bears of the stock to worry how these liabilities could be funded if either bubbly debt markets dry up (and Netflix’ debt has a ‘junk’ rating of Ba3 from Moody’s) or its build-and-they-will come model starts to falter for any reason and subscriber and revenue growth slows. Net cash flow was negative again in the first quarter and one thing that the company could do to put the bears to flight is to start to generate cash.

Source: Company accounts

“Even positive cash flow might not stop bears growling about the stock’s valuation. The $366 share price and $165 billion market cap put the shares on a forward price/earnings of more than 100 for 2019, 64 times for 2019 and 38 times for 2021, assuming that earnings per share grows to $3.35, $5.79 and then $9.68 as analysts currently expect, compared to $2.68 in 2018.

“So long as subscriber and earnings momentum remain strong, bulls of the stock may be able to keep bears at bay, as valuation only really starts to matter once disappointment creeps in – although at that point it is normally too late for shareholders to take evasive action, as such a lofty valuation will offer little or no downside protection.

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05