Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“If they are to avoid further punishment, the only course of action for a boxer who is on the ropes is to come out swinging and that is exactly what Sainsbury’s boss Mike Coupe has done with the grocer’s full-year results,” says Russ Mould, AJ Bell Investment Director.

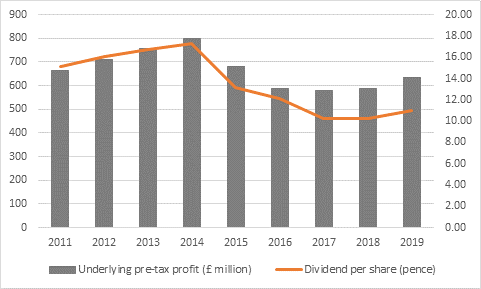

“An increase in underlying pre-tax profit, a dividend hike and a reduction in debt all confound investors’ fears that earnings would be under further pressure and that a fourth reduction in the shareholder distribution was on the cards.

Source: Company accounts

“A plan to further reduce debt by at least £600 million, from last year’s £1.6 billion level, will also help to reassure. Lower debt means lower interest payments (and thus higher earnings). It also means lower risk (and thus potentially a higher earnings multiple for the shares).

“However, Mr Coupe invested £46 million of shareholders’ money in fees on the Asda deal for a reason and not everyone will be convinced that he and his charge are out of trouble just yet.

“Sainsbury is still taking heavy blows from the discounters Aldi and Lidl on one side and online rivals on another, as shown by poor momentum in sales. Retail sales have dipped on a like-for-like basis in each of the last two quarters while total grocery and clothing sales have also begun to stumble.

Retail sales, like-for-like, year-on-year change:

| Q1 2017-18 | Q2 2017-18 | Q3 2017-18 | Q4 2017-18 | Q1 2018-19 | Q2 2018-19 | Q3 2018-19 | Q4 2018-19 | |

|---|---|---|---|---|---|---|---|---|

| Excl. fuel | 2.30% | 0.60% | 1.10% | 0.90% | 0.20% | 1.00% | -1.10% | -0.90% |

| Incl. fuel | 1.60% | 0.90% | 1.20% | 1.80% | 2.60% | 3.40% | 0.30% | -0.50% |

Source: Company accounts

Total sales, year-on-year change:

| Q1 2017-18 | Q2 2017-18 | Q3 2017-18 | Q4 2017-18 | Q1 2018-19 | Q2 2018-19 | Q3 2018-19 | Q4 2018-19 | Grocery | 3.00% | 1.40% | 2.30% | 2.10% | 0.50% | 2.00% | 0.40% | -0.60% |

|---|---|---|---|---|---|---|---|---|

| General Merchandise | 1.00% | -1.60% | -1.40% | -1.20% | 1.70% | 1.20% | -2.30% | 1.50% |

| Clothing | 7.20% | 6.30% | 1.00% | 0.40% | 0.80% | -3.40% | -0.20% | -1.60% |

| Group (excl. fuel) | 2.70% | 0.90% | 1.20% | 1.30% | 0.80% | 1.70% | -0.40% | -0.20% |

Source: Company accounts

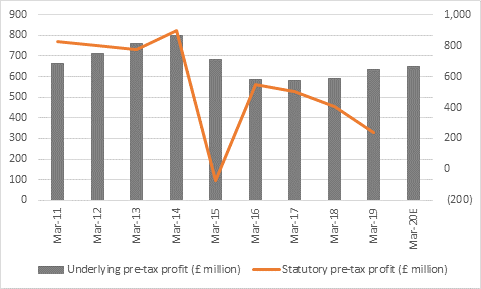

“Some investors will also note how a second consecutive increase in adjusted, or underlying pre-tax profits (Sainsbury’s preferred metric) compares to a third straight drop in statutory measures, which do not strip out allegedly one-off costs and other expenses. In the year to March 2019, these included the Asda advisory fees but also investment in Sainsbury’s Bank, restructuring costs relating to Argos and the core business, property expenses and pension contributions.

“The regular recurrence of all of these items – bar the Asda fees – will make some wonder whether Sainsbury is trying to put a gloss on its numbers by excluding them. After all, keeping costs low is part of any management team’s day job, so it seems odd that the costs are stripped out and presented as unusual items, while keeping the pension fund topped up can hardly be called an extraordinary activity either.

Source: Company accounts

“Cost synergies realised from the Argos deal have been expertly harvested to compensate but these can presumably only go so far, even if lower debt-servicing costs will also help to support profits and if the top line continues to weaken then Sainsbury could yet find profits coming under sustained pressure in what remains a highly-competitive, and fairly mature, marketplace. M&S showed a similar gradual increase in the gap between stated profits and adjusted, before-bad-stuff earnings and it eventually came a terrible cropper as the pressure on sales finally told. The dividend was ultimately cut by the team of Steve Rowe and Archie Norman, who decided that the money would be better spent by investing in the core product and service proposition.

“Nevertheless, these results certainly buy Mr Coupe some time to regroup after the blow dealt to his strategy by the Competition and Markets Authority and shareholders will now be looking forward to the planned capital markets day on 25 September for an update on how he intends to take Sainsbury forward from here.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05