Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

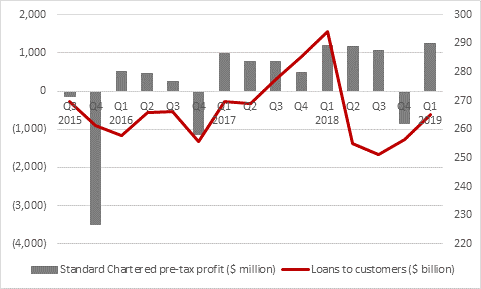

"A 5% year-on-year increase in pre-tax profit at Standard Chartered may not sound like much, but $1.2 billion in earnings easily beat analysts’ forecasts. Add in a 3% increase in the loan book compared to the previous quarter and upbeat commentary from chief executive Bill Winters about ‘sentiment in our markets showing signs of improvement’ and you can see why the shares are up strongly today, in contrast to the lukewarm response from investors to the first-quarter results from Barclays and RBS," says Russ Mould, AJ Bell Investment Director.

Source: Company accounts

"It is also possible the investors are welcoming the announcement of a $1 billion share buyback programme. Such a move suggests the bank is out of the woods when it comes to its difficulties with regulators around the world, shows management’s confidence in the future and could be a sign that the Board thinks Standard Chartered’s shares are undervalued – they do trade at a 23% discount to the net asset value per share figure published for the end of 2018, after all.

| 2019E P/E | 2018 Price/book | 2019E Dividend yield | 2019E Dividend cover | |

|---|---|---|---|---|

| HBSC | 11.4 x | 1.21 x | 6.00% | 1.47 x |

| Lloyds | 8.5 x | 1.20 x | 5.40% | 2.15 x |

| Royal Bank of Scotland | 8.8 x | 0.84 x | 5.00% | 2.28 x |

| Standard Chartered | 13.4 x | 0.77 x | 2.30% | 3.26 x |

| Barclays | 7.5 x | 0.62 x | 4.60% | 2.94 x |

Source: Sharecast, consensus analysts' forecasts, company accounts. Price/earnings and yield based on 2019 consensus. Price/book based on last published book value per share figure (Q4 2018 or Q1 2019)

"This means that the $1 billion buyback plan passes one of two tests used by legendary investor Warren Buffett to judge whether such schemes make sense and truly add value for shareholders.

"In his 2012 Letter to Shareholders, the Sage of Omaha wrote:

'Charlie [Munger] and I favour repurchases when two conditions are met: first, a company has ample funds to take care of the operational liquidity and needs of its business; second, its stock is selling at a material discount to the company's intrinsic business value, conservatively calculated.'

"The big discount to book value may well mean Standard Chartered passes the second test, providing investors do not fear another global recession or debt bust is just around the corner.

"The issue of whether Standard Chartered’s putative share buyback makes sense from a strategic point of view is still a matter for debate.

Source: Company accounts

"But with Standard Chartered facing competition from digital and fintech upstarts it seems unlikely that the bank could not put that $1 billion to good use in its own business. The firm has, as part of a consortium, just won a virtual banking license in Hong Kong, one of only three to be awarded so far and you would have thought that this – and other such ventures – would require investment.

"Shareholders will therefore be hoping that the Standard Chartered board is not falling into the trap of trying to manage the share price when it should be focusing on managing the assets and getting the best risk-adjusted returns out of them for shareholders.

"Many a firm has needlessly squandered valuable cash on buybacks in an effort to persuade tell investors that their shares are cheap, with Marks & Spencer under Marc Bolland and BT under Gavin Patterson two glaring example of this. Both have subsequently cut their dividend to compound investors’ woes.

"Thankfully Standard Chartered is in the process of rebuilding its dividend and it may be about to get more assistance from its end-markets than either BT or M&S did, but it was only six months ago that investors were fretting about global growth. It may only take another such scare – or a genuine downturn – to make shareholders wonder whether Standard Chartered would have been better off holding to the $1 billion it now plans to distribute."

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05