Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“It may – or it may not – be a coincidence that global stock markets are wobbling just as the US Federal Reserve consistently increases interest rates and withdraws Quantitative Easing. Even if there is some cause and effect here, the central bank professes not to care, given chair Jay Powell’s public assertions that it is not his job to stop investors losing money,” says Russ Mould, AJ Bell Investment Director.

“But a slump in the real world economy could test Mr Powell’s commitment to policy normalisation which is why a sudden slump in house building and building-related stocks is so interesting.

“It is hard to think of an industry that is more sensitive to interest rates than housing and with the 30-year US mortgage rate seemingly about to touch 5% for the first time since 2010, Mr Powell and his colleagues on the Federal Open Markets Committee may well need to keep an eye on this area, since the signs are not good.

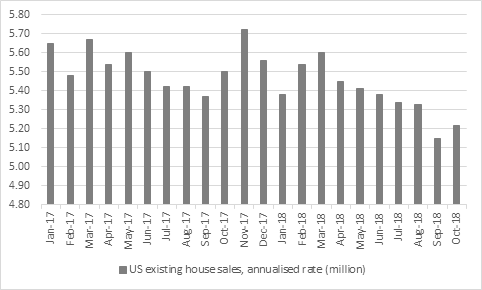

“Wednesday’s monthly existing housing sales number of 5.22 million units, on an annualised basis, represented the first month-on-month increase in seven. But sales are still down by 8.7% from last November’s peak.

Source: FRED – St. Louis Federal Reserve database

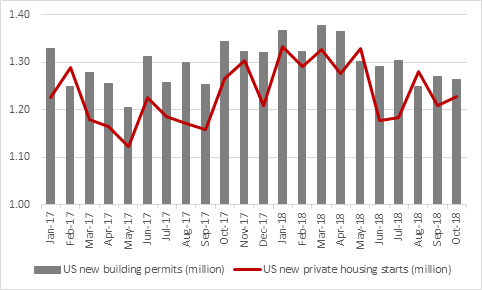

“Tuesday’s new building permits and new building starts data showed a small monthly decline and a slight increase respectively, but both are also down by some 8% from their peaks of March and January 2018.

Source: FRED – St. Louis Federal Reserve database

“These may not seem like big declines but someone has noticed. The S&P Select Home Builders index, which has 36 companies in it, ranging from builders like Lennar and DR Horton to white goods firms like Whirlpool, has collapsed. The index is down by 24% for the year and by 28% from its January high.

Source: Refinitiv data

“Online real estate agents like Zillow are already feeling the squeeze. The company issued a profit warning alongside its quarterly results on 6 November and cuts its sales growth guidance for the year.

Source: Refinitiv data

“Too much more of this and it will be interesting to see if the Fed references housing weakness at all in the minutes of its next meeting in December – especially as President Trump seems sensitive to the stock market slide, let alone any threat of a slowdown in the real economy.

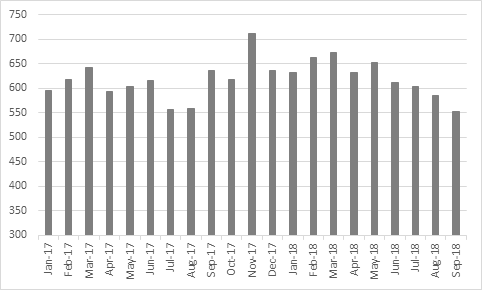

“The new housing sales figures due out on Wednesday 28 November could be highly informative. September’s reading of 553,000 units represented the fourth straight month-on-month drop and left sales some 22% below their November 2017 high.

Source: FRED – St. Louis Federal Reserve database

“Such snippets will be of interest to more than the Fed, too. UK-based hybrid estate agent Purplebricks is trying to crack the US market and Ferguson, the plumbers’ merchant, gets around 90% of its sale from America. The FTSE 100 firm formerly known as Wolseley does not sell just into the residential market but shareholders should check out any statement which accompanies the Annual General Meeting on 29 November, just in case.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30