Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“For the second straight quarter in a row, BP has paid a quarterly dividend of 10.25 cents, up from 10 cents a year ago. That year-on-year increase, coupled with autumn’s slide in the share price, means the shares are offering a dividend yield of almost 6% for 2018 and 2019,” says Russ Mould, AJ Bell investment director.

“The company still has to reassure that its $10.5 billion purchase of BHP Billiton’s shale assets is the right plan, although with cash flow gushing once more and BP’s production profile looking stagnant you can see why chief executive Bob Dudley and the board have taken the plunge.

“In the third quarter of 2017, BP received an average price of $33.23 per barrel of oil equivalent ($47.5 per barrel for oil and $2.89 per 1,000 cubic feet of gas) and this year it bagged $46.14 ($69.7 per barrel for oil and $3.86 per 1,000 cubic feet of gas).

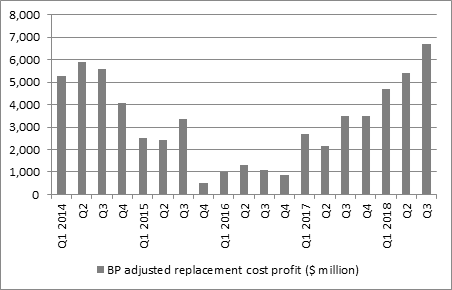

“This helped to take BP’s quarterly profit to $6.7 billion, easily its best mark in the past five years.

Source: BP accounts

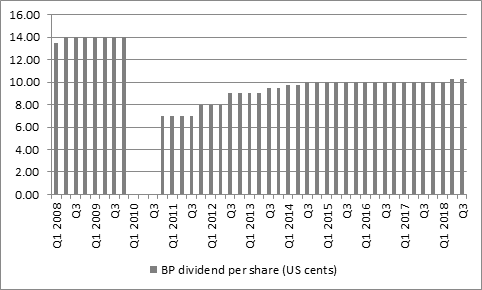

“That has helped BP to declare a dividend of 10.25 US cents a share for the second quarter in a row, a 2.5% increase on a year ago.

“Admittedly, this still leaves the quarterly pay-out way below the 14 US cents a share received by shareholders before the Gulf of Mexico oil spill in 2010 but income seekers will be grateful for the increase, especially as many investors were frightened of a dividend cut when oil slumped below $30 a barrel in early 2016.

Source: BP accounts

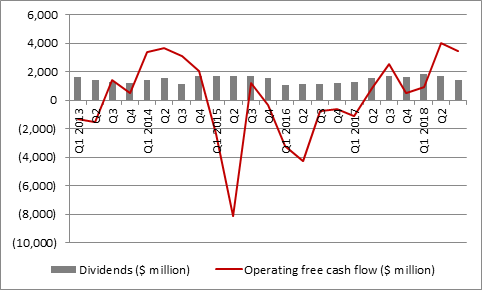

“BP’s willingness – and ability – to increase its dividend reflects the benefits of a higher oil price, but also the company’s own cost-cutting and efficiency programmes, which have enabled the firm to make the most of the rally in crude oil.

“This is also reflected in how cash flow is starting to gush once more, as the oil major keeps a tight rein on capital expenditure in particular. Cash flow finally comfortably covers the dividend payment, even after capital investment and tax payments.

“Operating profit of $6.1 billion added to depreciation of $4.0 billion gives $10.1 billion of cash flow. Working capital soaked up $1.6 billion in cash thanks to an inventory build, while capital investment came to $3.7 billion and tax $1.9 billion, to leave $3.5 billion in the kitty to cover the $1.4 billion quarterly dividend payment.

Source: BP accounts

“It will also be source of relief to investors to see net debt hold steady even as the dividend goes up. The slump in the oil price had forced BP to use disposals, capex cuts and debt to fund its dividend through the lean years of 2015 to 2017.

“However, BP really needs to offer investors a chunky yield to compensate for the risks of owning the stock, which, over time tends to blindly take its lead from the oil price. And since the oil price is pretty much unforecastable, given the number of factors which can affect it, ranging from geopolitics to economics to the weather, a decent yield is required to make up for the potential share price volatility.

“BP also needs to offer that yield because the company isn’t really growing its underlying business. Total hydrocarbon production in the quarter was 2.46 million barrels of oil equivalent a day (mboe/d) compared to 2.462 million in the same period a year ago.

“Higher prices and cost efficiencies then did the rest, so far as the profit and loss account and cash flow are concerned.

“BP is trying to address this tardy production growth profile, which at least partly reflects the era of austerity and capital investment restraint that was enforced after the oil price’s collapse in 2015, through the acquisition of BHP Billiton’s shale assets in the Permian, Eagle Ford and Haynesville basins in the USA. Mr Dudley today forecasts an increase in group hydrocarbon output in the fourth quarter thanks to the swoop for the BHP assets.

“But any major merger and acquisition deal brings risks and investors may still be concerned that BP paid a full price for the assets, for two reasons.

“First, Bob Dudley called the deal a ‘transformational’ one when he announced it in July, a word which tends to be a tacit admission that the asset’s strategic attractions has tempted management to overpay, or at least pay top dollar.

“Second, oil equipment and services giant Schlumberger has produced disappointing earnings this autumn, citing a slowdown in activity in the US Permian basin which was in turn the result of limited pipeline capacity for shipping crude away from the region. In addition, Schlumberger’s management flagged that productivity gains for shale oil appeared to be tapering off in the Permian and Eagle Ford basins, to the potential detriment of return on investment from existing shale wells.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30