Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“As the FTSE 100 remains in the grip of a global bout of ‘risk-off’ sentiment, investors can draw some reassurance from how the quantity and quality of UK plc’s earnings seem to be improving,” says Russ Mould, AJ Bell Investment Director.

Quantity of earnings

“Aggregate pre-tax profit forecasts for the FTSE 100 in 2018 continue to rise and now stand at a total of £225.8 billion, some 6% higher than they were a year ago, while estimates for 2019 are also showing positive momentum with a further increase to £242.9 billion.

Source: Digital Look, company accounts, analysts’ consensus dividend forecasts

“With the FTSE 100 index having fallen by 4% while profit estimates have advanced 6% over the past 12 months the benchmark has become cheaper. Based on consensus forecasts the benchmark now trades on just 13.5 times earnings for 2018 and 12.4 times for 2019 (compared the 18 times and 16 times multiples currently afforded to America’s S&P 500).

“Dividend forecasts also continue to rise, rather than fall, so the FTSE 100 now offers a 4.3% yield for 2018 and 4.5% yield for 2019, assuming that analysts’ forecasts prove correct.

“This suggests that the unloved UK equity market – regularly flagged as an ‘underweight’ among fund managers in the surveys such as that carried out by Bank of America Merrill Lynch – could be offering some contrarian value, at a time when value seems hard to find.

“The tricky bit is finding what could act as a catalyst that could persuade investors to reassess the case for UK equities and unlock that value.

“Merger and acquisition activity has yet to convince the doubters, despite a series of bids for FTSE 100 and FTSE 250 firm, including GKN, Sky, Shire and a failed approach for Smurfit Kappa, which suggests that overseas trade buyers see value in the UK even if financial buyers do not.

“It is possible that investors remain concerned over the mix of the FTSE 100’s earnings progress, which remains reliant upon oils, financials (notably banks) and miners in particular, all sectors that cannot be described hand-on-heart as inherently reliable or easy to predict.

| 2018E | ||||

| Percentage of forecast FTSE 100 profits | Percentage of forecast FTSE 100 profits growth | |||

| Financials | 23% | Oil & Gas | 35% | |

| Oil & Gas | 18% | Financials | 21% | |

| Mining | 16% | Health Care | 14% | |

| Consumer Staples | 13% | Consumer Staples | 10% | |

| Consumer Discretionary | 10% | Consumer Discretionary | 8% | |

| Industrial goods & services | 8% | Mining | 7% | |

| Health Care | 7% | Industrial goods & services | 3% | |

| Telecoms | 3% | Utilities | 1% | |

| Utilities | 2% | Technology | 1% | |

| Technology | 0% | Telecoms | 0% | |

| Real estate | 0% | Real estate | 0% | |

Source: Digital Look, analysts’ consensus pre-tax profit forecasts

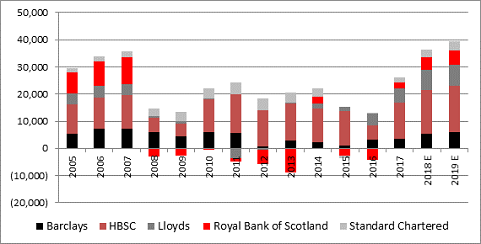

“The banks remain particularly important because analysts are expecting the big five banks to generate profits that match the pre-crisis peak of £36 billion.

Source: Digital Look, company accounts, analysts’ consensus pre-tax profit forecasts

“However, it is in the second half of the year, and especially the fourth quarter, that the banks tend to book the bulk of any bad loans, asset write-downs, regulatory costs and restructuring charges so nothing can be taken for granted just yet.

Quality of earnings

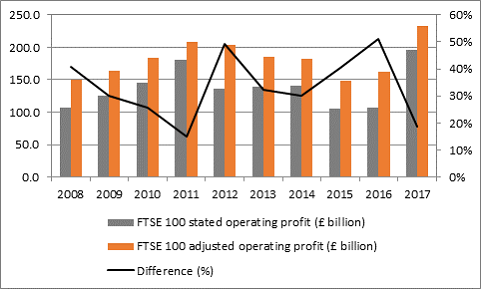

“Encouragingly, the quality of the FTSE 100’s earnings as well as their quantity seems to be improving.

“The gap between statutory earnings and companies’ preferred profit metrics (which can – cynically – be described as ‘earnings before bad stuff, or ‘EBBS’) closed dramatically in 2017 from 2016’s decade high to the lowest level since 2011. This suggests that the underlying quality of FTSE 100 earnings in 2017 improved relative to 2016, even as overall profits rose nicely too.

Source: FTSE 100 companies’ Annual Report and Accounts in aggregate, 2008-2017

There are two, conflicting, possible interpretations for this:

- Companies are simply being more transparent, providing greater clarity to shareholders on the many moving parts which make up their business and enabling investors to get a better view of what is really going on under the bonnet.

- Those companies which had perhaps been intentionally muddying the waters ran out of tricks to pull, relating to acquisitions or restructuring charges, or even felt a lesser need to do so as underlying trading improved.

“The apparent improvement in earnings quality may ease some fears that a deterioration in the standards of reporting and accounting could be a pointer that a market top is imminent.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30