Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“An eleventh consecutive increase in like-for-like sales in the UK, a strong performance from £4 billion acquisition Booker and a 67% increase in the interim dividend are not proving enough for Tesco shareholders, as the (adjusted) operating profit figure has undershot analysts’ forecasts by some 5%,” says Russ Mould, AJ Bell Investment Director.

“A sixth straight drop in like-for-like sales in Asia, where boss Dave Lewis flags Thailand as a particularly difficult market, and a second consecutive year-on-year fall in Central Europe are partly to blame here.

“This may add further fuel to the debate over whether Tesco is still too complex a company, despite all of the work done by Mr Lewis and his team to get the company back to basics after its failed experiments with Dobbies Garden Centre and the Giraffe restaurant chain, among others.

“The Booker deal is clearly designed to drive both sales growth and margins across the group while the launch of the new Jack’s chain is designed to tackle the threat posed by the discounters head on.

“Yet both initiatives will keep management very busy at a time when competing in the UK grocery market with Morrison, Sainsbury and rival online offerings is a full-time job in itself.

“UK profits are up sharply, helped by the presence of Booker for the first time, although the stated figure would be less impressive were Tesco to include the (allegedly) exceptional costs relating to the acquisition, the closure of Tesco Direct and a further £16 million in regulatory costs at Tesco Bank.

| £ million | H1 2017-18 | H1 2018-19 |

| UK + Ireland | 464 | 685 |

| Central Europe | 61 | 59 |

| Asia | 141 | 100 |

| Tesco Bank | 84 | 89 |

| Operating profit before exceptionals and amortisation | 750 | 933 |

| Tesco Direct closure costs | 0 | -57 |

| Restructuring and redundancy costs | -63 | -22 |

| Provision for customer redress | 0 | -7 |

| Release of amounts provided re: FCA obligations | 0 | 15 |

| Property transactions | 65 | 13 |

| Tesco Bank FCA provision | 0 | -16 |

| Profit on sale of Lazada | 124 | 0 |

| Amortisation of acquired intangible assets | 0 | -40 |

| Total exceptional costs and amortisation | 126 | -74 |

| Stated operating profit | 876 | 819 |

| Stated pre-tax profit | 553 | 564 |

| Stated earnings per share (pence) | 5.13 | 4.37 |

Source: Company accounts

“As such the progress in stated profit is much less impressive than the pre-exceptionals figure and the fall in earnings per share will also reflect the higher share count that resulted from the cash-and-shares offers for Booker.

“Patient investors will draw encouragement from how Mr Lewis is sticking to the medium-term goals of £1.5 billion in cost cuts, improved cash flow and an improvement in group operating margin to 3.5% to 4.0% by the financial year to January 2020, as well as further cost benefits from Booker.

“But Tesco has lagged both Morrison and Sainsbury this year, although the latter has yet to win approval from the Competition and Markets Authority for its planned merger with Asda.

| Performance in 2018 to date | |

| Ocado | 127.40% |

| Sainsbury | 31.40% |

| Morrisons | 18.20% |

| Tesco | 7.00% |

| SSP Group | 3.10% |

| Clinigen | -14.90% |

| UDG | -18.10% |

| Greggs | -25.10% |

| McColl’s Retail | -47.00% |

| Crawshaw | -74.40% |

Source: Thomson Reuters Datastream. To 0900 on Wednesday 3 October 2018

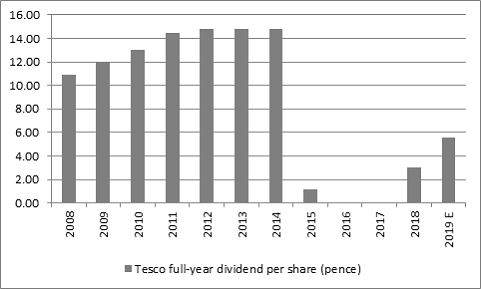

“This may reflect lingering concerns that Tesco could be trying to do too much at once in its determination to return to sustained profit and dividend growth, raising the risks at the same time as it seeks to provide shareholders with further rewards.”

Source: Company accounts, Digital Look, analysts’ consensus forecasts. Financial year to February.

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05