Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Kingfisher’s Turkish joint-venture Koçtaş is a very, very small part of the DIY giant – it contributed just £3 million in profit last year in combination with a 49%-owned French operation – so investors don’t need to worry too much about that, but slack sales at the core Castorama brand in France is a bigger concern altogether,” says Russ Mould, AJ Bell’s Investment Director.

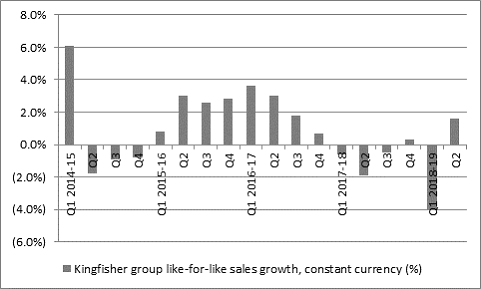

“Despite the huge improvement in the weather from the first quarter of the year to the second, life-for-like sales at the French operations still fell 1% year-on-year on a constant currency basis, the ninth consecutive drop, despite some improvement at the Brico Dépôt operation on the other side of the channel.

Source: Company accounts

“Chief executive Véronique Laury acknowledged disappointing footfall at Castorama but also flagged ongoing disruption from the group-wide One Kingfisher plan, where the firm is looking to unify its product ranges to lower costs, generate economies of scale and provide an improved customer services.

“We are now exactly half-way through the One Kingfisher project and some investors will be concerned that the transformation scheme is still impacting sales, owing to previously-flagged product availability issues, even if sales of unified and unique ranges continue to grow sales and improve margins across the group overall.

“Like-for-like sales growth in constant currency terms in still patchy at group level, despite the improvement in the UK, as Kingfisher eked out growth of just 1.6% year-on-year.

Source: Company accounts

“Despite a welcome upturn in the UK & Ireland, where sales grew 4.5% year-on-year after a nasty 5.4% slump in the first quarter, Kingfisher’s gross margin was still down in the second quarter. Ms. Laury stuck to her forecast of an improvement in gross margin for the year as a whole, but this clearly relies upon a second-half recovery, which in itself rests upon Kingfisher tackling its internal challenges and the French and British economies holding firm.

“A recovery in consumer confidence in both France and the UK would therefore be a huge bonus for the company, which says it is still on track to meet both of the One Kingfisher scheme’s five-year targets despite the absence of any real help from the macroeconomic backdrop.”

These articles are for information purposes only and are not a personal recommendation or advice

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30