Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

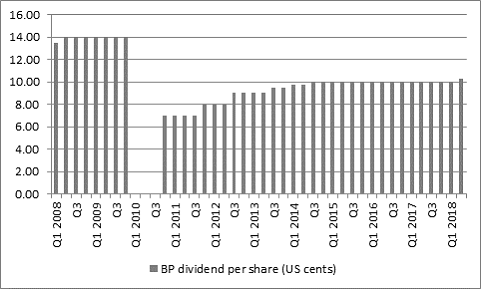

“Gone are the days when BP was offering a dividend yield of 7% to 8% and that is actually a good thing, because it means investors are no longer demanding such a high return to compensate themselves for the risks associated with holding the shares,” says Russ Mould, AJ Bell Investment Director.

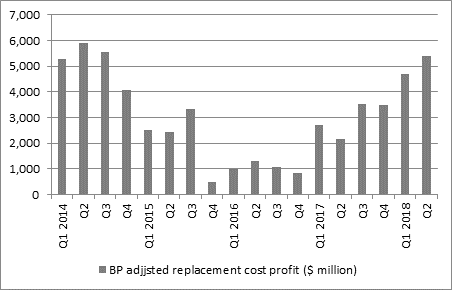

“Fears of a dividend cut three years ago, as oil prices slumped, are now long gone as BP’s best quarterly profit and cash flow performance in since 2014 means chief executive Bob Dudley can now sanction the first quarterly dividend increase in four years.

Source: BP accounts

“BP has nudged its quarterly dividend higher by 2.5% to 10.25 US cents a share. This still leaves the quarterly pay-out way below the 14 US cents a share received by shareholders before the Gulf of Mexico oil spill in 2010.

Source: BP accounts

“BP’s willingness – and ability – to increase its dividend reflects the benefits of a higher oil price, but also the company’s own cost-cutting and efficiency programmes, which have enabled the firm to make the most of the rally in crude oil.

“This is also reflected in how cash flow is starting to gush once more, as the oil major keeps a tight rein on capital expenditure in particular. Cash flow finally comfortably covers the dividend payment, even after capital investment and tax payments.

“Operating profit of $5.6 billion added to depreciation of $3.9 billion gives $9.5 billion of cash flow. Working capital soaked up just $0.6 billion in cash, while capital investment came to $3.5 billion and tax $1.3 million, to leave just $4 billion in the kitty to cover the $1.7 billion quarterly dividend payment.

Source: BP accounts

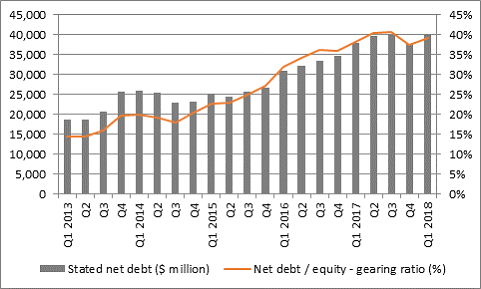

“It will also be source of relief to investors to see net debt come down even as the dividend goes up as the slump in the oil price had forced BP to use disposals, capex cuts and debt to fund its dividend through the lean years of 2015 to 2017.

Source: BP accounts

“The shares offer a chunky yield of 5.4%, well above the returns available on cash or UK Government bonds, and enough to place BP on the fringes of the list of 20 highest-yielding stocks in the FTSE 100.

“This begs the question of why the shares are not perhaps doing better today, given the good news, and there may be two reasons for this.

“The first is the oil price has stopped going up and seems stuck in the mid-$70s-a-barrel range, after OPEC’s decision back in June to increase production and the easing of production and distribution bottlenecks in Libya and Canada – although US sanctions on Iran have oil traders on edge, Venezuelan production continues to crater and any fresh unrest in the Middle East could soon add further support to crude.

“The second is last week’s announcement of the $10.5 billion acquisition of BHP Billiton’s shale assets in the USA. Investors tend to shy away when any chief executive calls an acquisition ‘transformational’, as it tends to be a tacit admission that the asset’s strategic attractions has tempted management to overpay, or at least pay top dollar. Investors will also be fretting that the next stage in BP’s move away from the austerity of 2015 to 2017 will be an increase in capital investment and thus fresh pressure on the near-term cash flows which fund the dividend, even if any fresh drilling work could have a positive impact on long-term returns.”

These articles are for information purposes only and are not a personal recommendation or advice

Related content

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30