Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“Investors in Netflix are suffering a rare reverse today as the shares are tumbling amid disappointment over the company’s subscriber addition number for the second quarter of the year. But nerves over the subs figure relay reflect the company’s lofty valuation and how the company is still a long way from generating the sort of cash flow that would justify its $155 billion market capitalisation,” says Russ Mould, AJ Bell Investment Director.

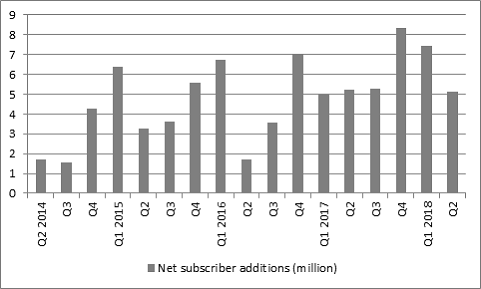

“Netflix added 5.2 million subscribers in the quarter to take the total to 130.1 million worldwide, but that was the lowest increase since Q3 2016. Management added to investors’ nerves by predicting the next three months would grow at a similar run rate, lower than analysts had been expecting, in stark contrast to the blow-out customer additions of Q4 2017 and Q1 2018.

Source: Netflix accounts

“This could be just the law of large numbers taking over although it could also reflect competition from established broadcasters, as well as Amazon, which is making ever-greater strides in the field of content creation and delivery.

“It would be wrong to judge Netflix on the basis of just the one quarter and the mildly disappointing outlook, as least relative to consensus forecasts, and the company’s business model still looks much stronger than that of Spotify for example.

“Both run a subscription model, which can make for loyal (or sticky) customers who also pay upfront, which is good for cash flow. This model is also more predictable than transaction-based fees, or the advertising-based approach.

“However, Netflix pays for and develops content as a fixed cost, so the more subscribers it has, the lower the costs relative to revenues and the higher its profits and cash flow. By contrast, Spotify pays for content based upon the number of song downloads, in the form of royalties, so its costs rise to some degree as revenues grow.

“Netflix is making plenty of money, racking up operating profits if $462 million in the three-month period, a record for a firm and a figure which shows the operational gearing it generates as subscriber numbers grow and the company generates additional sales from created or acquired content which is already a sunk cost.

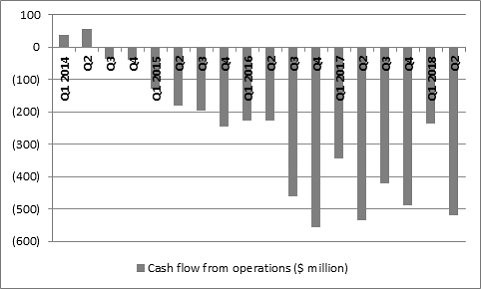

Source: Netflix accounts

“However, the question remains whether Netflix is generating enough profit and cash flow to support its monster market valuation.

“Even though the firm is on track to earn more than $1 billion at the net level in 2018, that compares to a $155 billion market cap, after the post-results stumble – so the shares trade on more 155 times earnings (compared to a multiple for the S&P 500 of 16 times, based on consensus earnings forecasts).

“In addition, the company is still burning cash and piling up debt as it funds the development of its content library and thus customer acquisition.

“Netflix spent $2.8 billion in the second quarter alone on programming and as a result the net cash outflow was $518 million – so even some 21 years after its creation, the firm cannot generate the cash that ultimately pays the bills and sets the basis for its shares’ valuation.

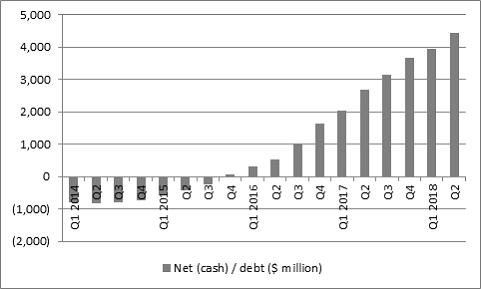

Source: Netflix accounts

“The company is currently making up the shortfall with debt. Net debt has mushroomed from $300 million in March 2016 to $4.5 billion now and that is before billions in committed future spending relating to content streaming deals.

“The firm issued a fifth bond in just three years in April to finance its activities, raising $1.9 billion in fresh debt. The ten-year paper came with a 5.875% yield to reflect the B+ rating given by Standard & Poors – a mark which leaves the bond four notches into what is known as sub-investment grade, high-yield or ‘junk’ territory.

Source: Netflix accounts

“That coupon reflects the dangers perceived by bondholders and this is something that shareholders might like to bear in mind.

“Netflix does have its risks and if subscriber growth does slow down and founder on a sustained basis then profits and cash flow will come under pressure and leave that huge market capitalisation looking potentially very exposed on the downside.”

These articles are for information purposes only and are not a personal recommendation or advice

Related content

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05

- Wed, 20/03/2024 - 16:30

- Fri, 15/03/2024 - 09:33