Archived article

Please note that tax, investment, pension and ISA rules can change and the information and any views contained in this article may now be inaccurate.

“General Electric announced the merger of its oil and gas operations with Baker Hughes in October 2016, when times were tough for oil services and equipment providers, and closed the transaction in July 2017, right near the sector’s lows. There now has to be a risk that it will undo that deal just as trading conditions start to improve, judging by today’s trading statements from FTSE 250 firms Hunting and Wood Group,” says Russ Mould, AJ Bell Investment Director.

“Judging by the early share price reaction today, neither Hunting nor Wood’s management teams are getting too carried away, but both stocks have already had a good run, thanks at least in part to a recovery in oil prices.

“But Hunting does flag improved activity in both the onshore and offshore markets in the USA, where the Titan operation sells to oil firms who use fracking to exploit the shale oil and gas fields and some promising signs in the Middle East and Asia Pacific.

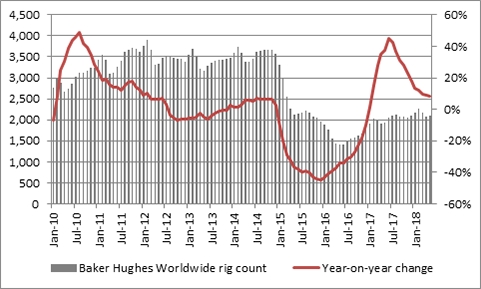

“Wood’s commentary looks to confirm this view, which is backed up by industry data, produced by Baker Hughes, on rig activity both in the USA and worldwide.

Source: www.bakerhughes.com/rig-count

Source: www.bakerhughes.com/rig-count

“The growth rate in active rigs in the US is slowing and it remains subdued worldwide but – from the oil services firms’ point of view – they will be pleased to see no actual decline in activity.

“Even if $75-80 oil is not stoking a frenzy of fresh exploration or production work but the Middle East has stopped getting worse and North Sea work seems to have stabilised, too.

“For Hunting and Wood’s shares prices to gush higher still, it may well require further advances in oil, or even just price stability – by no means impossible, despite Saudi production increases, especially if America gets its way and excludes Iran from global markets – as that could prompt increased levels of work in the North Sea and Middle East in particular, to complement the shale boom in the US.

“There also remains the possibility of further merger and acquisition activity, since Hunting’s strong position in the US fracking market (and sterling-priced shares) could be enough to lure a predator, especially as the oil services and equipment industry continues to consolidate (even if GE is now looking to undo the Baker Hughes deal).

“Wood acquired fellow FTSE 250 firm Amec Foster Wheeler (itself the result of M&A activity) in 2017, when Altrad also bought Cape, while going further back Kentz was snapped up by SNC-Lavalin in 2014.

“Hunting may not look cheap, as it lost money in 2017 on a stated basis and made earnings per share of just $0.08 when exceptional costs are stripped out. But the firm made EPS of more than $1 as recently as 2014. That is the equivalent now of 76p a share, enough to put the stock on a price/earnings ratio of 10 to 11 times, so if a predator is thinking of an approach they might be tempted to get on with it, just in case the oil equipment market – and Hunting’s share price – start to take off again.”

These articles are for information purposes only and are not a personal recommendation or advice.

Related content

- Wed, 24/04/2024 - 10:37

- Thu, 18/04/2024 - 12:13

- Thu, 11/04/2024 - 15:01

- Wed, 03/04/2024 - 10:06

- Tue, 26/03/2024 - 16:05